How Long to Keep Tax Paperwork: Essential Guide

Keeping track of your tax paperwork can be overwhelming, especially with the array of documents involved. However, understanding how long to keep tax paperwork and why is crucial for compliance with the IRS, future financial planning, and protecting yourself from potential audits. In this essential guide, we will break down the key elements of tax documentation retention, helping you manage your paperwork effectively.

The Importance of Keeping Tax Documents

The retention of tax records serves several key purposes:

- Compliance: The IRS has specific regulations regarding how long taxpayers must keep their records.

- Reference: Keeping documents allows you to reference past tax returns and financial dealings when needed.

- Protection: Records are vital in case of an audit; having them can prove your income, deductions, and credits.

How Long Should You Keep Tax Documents?

Here is a comprehensive guide on how long different types of tax documents should be retained:

| Document Type | Retention Period |

|---|---|

| Tax Returns | At least 3 years, preferably indefinitely |

| Receipts, Invoices, Proof of Income | 3 to 7 years |

| Property Records | At least 3 years after selling the property |

| Bank Statements, Brokerage Statements | 3 to 7 years |

| Retirement Account Statements | Indefinitely |

| Documents for Gifts | At least 3 years from the filing deadline of your tax return |

🚨 Note: If you are involved in fraudulent activity, underreport income by over 25%, or if you do not file a return, the IRS recommends keeping your tax records for at least 6 years.

Specific Situations Requiring Longer Record Retention

- Bad Debts: Retain records for 7 years to support deductions on bad debts.

- Employment Taxes: Employers must retain records for at least 4 years from the due date of the tax or payment of the tax, whichever is later.

- Real Estate Transactions: Records related to selling or buying property should be kept at least 3 years after the disposition of the property.

- Estate Planning: If you are handling an estate, keep records related to valuation, distribution, and other estate tax issues permanently.

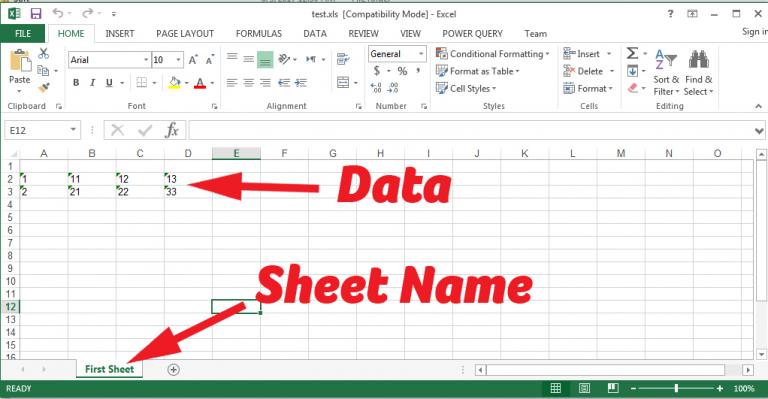

Digital vs. Physical Storage

The rise of digital storage solutions has transformed how we manage our tax paperwork:

- Digital Storage: Cloud services, external hard drives, or a personal computer can store digital copies of documents. Regular backups are recommended.

- Physical Storage: While less efficient, some taxpayers still prefer paper files for certain documents. Be mindful of storage conditions to prevent degradation.

- Hybrid Approach: Combine digital backups with physical copies for critical documents. Use secure, encrypted storage methods.

🗂 Note: Ensure that your digital storage solutions comply with data privacy laws like GDPR or HIPAA if they involve sensitive information.

Proper Disposal of Tax Documents

When it’s time to dispose of outdated tax records, ensure:

- Shredding: Shred documents with personal or financial information to prevent identity theft.

- E-waste Recycling: Dispose of electronic devices securely, ensuring data is completely erased or destroyed.

- Reuse: Consider repurposing physical documents, ensuring they are no longer identifiable.

Final Thoughts

In this guide, we have outlined how long to keep tax paperwork, the importance of maintaining these records, and the various methods to store and dispose of them. Proper management of your tax documentation not only ensures compliance but also offers peace of mind during audits and simplifies future financial planning.

What if I lose my tax paperwork?

+

Notify the IRS immediately. They can provide transcripts of past returns, but having backups in digital form can expedite the process.

Can I keep digital copies instead of paper?

+

Yes, the IRS accepts digital records provided they are accessible, readable, and complete. However, ensure the storage method is secure.

What should I do if my storage is compromised?

+

Change passwords, report to your storage provider, and monitor your financial accounts for any unusual activity. Consider having backups stored separately.