5 Essential Papers to Keep After a Loved One's Death

The loss of a loved one is never easy, and alongside the emotional turmoil, there are numerous logistical and legal matters that need to be addressed. One crucial aspect to consider in the aftermath of a death is the collection and organization of important documents. These papers are not only essential for settling the deceased's affairs but also for securing any benefits or rights that may pass on to survivors. Here, we'll delve into five essential papers you should keep after the death of a loved one, ensuring you are well-equipped to navigate through this difficult period.

1. Death Certificate

- Obtaining Copies: One of the most critical documents following a death is the death certificate. You’ll need certified copies of this document. Typically, you can obtain several copies from the funeral home or directly from the county vital records office where the death occurred.

- Uses of Death Certificates: These certificates are used to:

- Settle estates and open probate proceedings

- File insurance claims

- Close accounts and cancel subscriptions

- Transfer ownership of assets

🌟 Note: Keep multiple certified copies as you will need them for various legal processes.

2. Last Will and Testament

- Locating the Will: If your loved one had a will, it’s imperative to find it. Often, it might be stored with an attorney, in a safe deposit box, or at home in a secure place.

- Role of the Executor: The will outlines who the executor of the estate is, their duties, and how the deceased wanted their property distributed. If you are the executor or a close relative, you’ll need this document to proceed with estate administration.

- Probate: If the estate needs to go through probate, the will is the primary document that guides the court.

💡 Note: If there’s no will, the state laws of intestacy will govern how assets are distributed, which might not align with your loved one’s wishes.

3. Financial Records

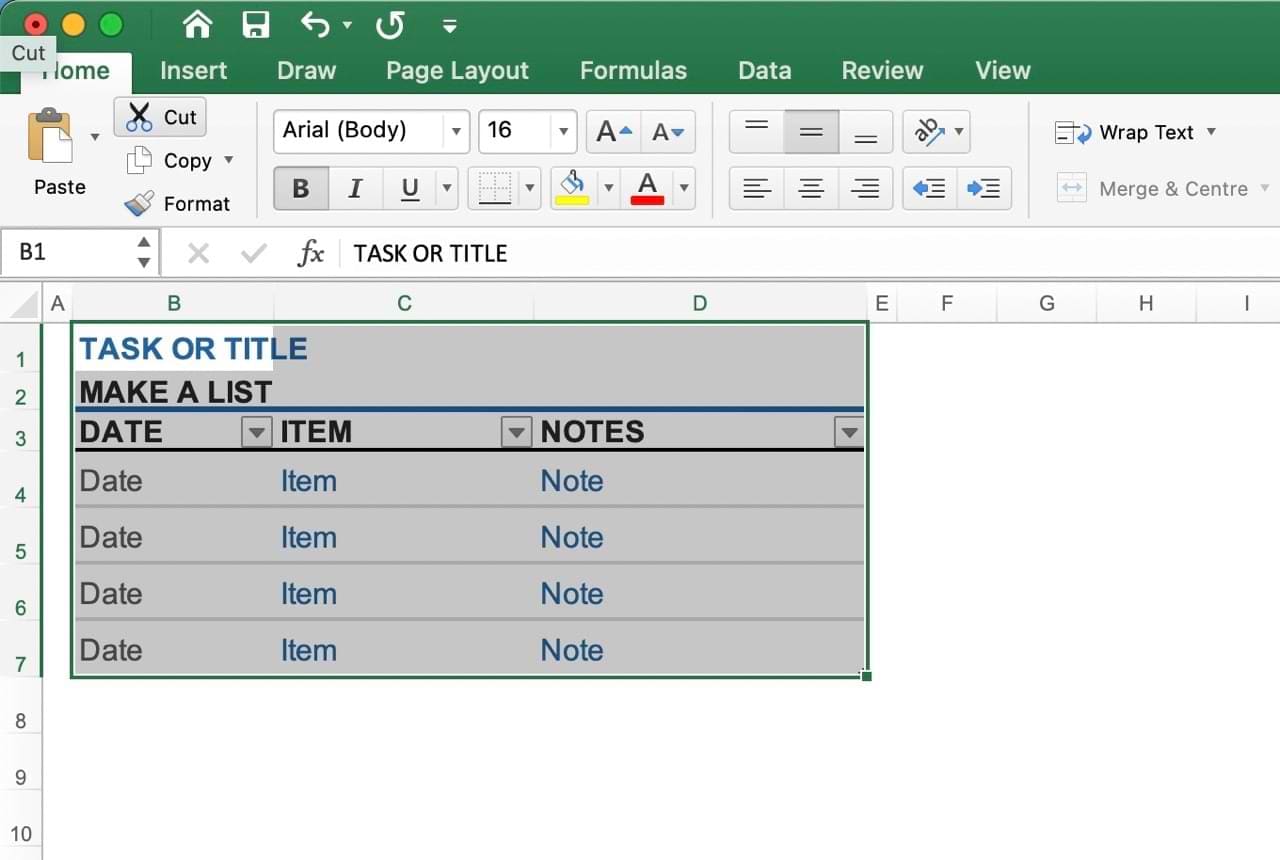

| Document | Purpose |

|---|---|

| Bank Statements | Close or transfer accounts, probate filing |

| Investment Accounts | Transfer ownership, claim beneficiaries |

| Tax Returns | Help with estate tax returns |

| Property Deeds | Change ownership or liquidate assets |

| Retirement Accounts | Understand and claim benefits |

🧾 Note: Organize these records in a file for easy access and reference during the estate settlement process.

4. Insurance Policies

- Types of Policies: Look for life insurance, health, long-term care, auto, and home insurance policies.

- Claiming Benefits: With these documents, you can file claims to receive payouts or benefits, which might be critical for covering funeral expenses or providing financial support to dependents.

📝 Note: Policies might not always be found in one place; check with employers, financial advisors, or insurance brokers for comprehensive coverage.

5. Social Security Documentation

- Survivor Benefits: Spouses, children, and in some cases, dependent parents, may be eligible for survivor benefits from Social Security. The death certificate will be needed to apply for these benefits.

- Retirement Benefits: If your loved one was receiving retirement benefits, you’ll need to notify Social Security to stop these payments and perhaps reroute them to eligible survivors.

🔍 Note: Visit or call your local Social Security office for assistance in navigating these benefits.

As we navigate through the emotional and logistical aftermath of losing a loved one, keeping these documents in order can provide some relief in handling the practicalities of their absence. From closing bank accounts and settling estates to claiming insurance benefits and securing survivor benefits, these papers are your guides in this complex process.

Each of these documents plays a pivotal role in:

- Ensuring legal and financial matters are handled correctly.

- Providing a clear path for survivors to receive what is rightfully theirs.

- Reducing potential disputes among family members regarding the deceased’s estate.

- Facilitating a smooth transition of assets and responsibilities.

Maintaining an organized file of these critical documents can be the key to easing the burden during such a trying time. It’s also a proactive step towards respecting the wishes of your loved one by ensuring their affairs are settled as intended.

What if the death certificate has mistakes?

+

If there are errors on a death certificate, you should contact the vital records office where the death was registered to have the certificate corrected. This often involves submitting documentation or evidence to verify the correct information.

Can you settle a person’s estate without a will?

+

Yes, the estate can still be settled, but the process is governed by state intestacy laws which might not reflect the deceased’s wishes. This can lead to a distribution of assets that might not be what the deceased intended.

How long do I need to keep financial records after someone dies?

+

It’s advisable to keep financial records for at least seven years after the estate is settled for tax purposes, or indefinitely if there are unresolved disputes or legal issues.

What should I do if I cannot find all the insurance policies?

+

Contact the deceased’s employer, financial advisors, insurance brokers, and check old files or financial statements. There are also services that can search for unclaimed life insurance policies using the death certificate and basic information.

Are there any other benefits I might be eligible for after a loved one’s death?

+

Yes, besides Social Security, you might be eligible for other benefits like veteran’s benefits, pension survivor benefits, or private company survivor benefits. Check with relevant institutions or advisors.