5 Ways to Speed Up Closing After Paperwork Delays

Understanding the Paperwork Delays

Before diving into strategies to speed up closing, it's essential to understand why paperwork delays occur:

- Lack of Coordination: Lack of communication between real estate agents, title companies, and lenders.

- Incomplete Documentation: Documents missing required signatures, notaries, or notarized copies.

- Errors or Omissions: Mistakes in the paperwork that require corrections.

- Unresolved Liens or Title Issues: Hidden liens or title disputes that need to be addressed.

Proactive Communication

Effective communication plays a vital role in speeding up the closing process:

- Establish a communication protocol to keep all parties informed about progress.

- Use digital tools like project management platforms to facilitate real-time updates.

- Maintain open lines with buyers, sellers, and their agents to ensure everyone is on the same page.

📢 Note: In scenarios where delays are due to missing information, prompt communication can drastically reduce wait times.

Checklist Implementation

A comprehensive checklist can mitigate documentation errors:

- Standardized Documents: Use templates to ensure no crucial forms are overlooked.

- Verification Points: Include steps for verifying all necessary signatures and notarizations.

- Compliance with Local Laws: Incorporate local requirements to prevent legal or regulatory delays.

- Automated Reminders: Set reminders for timely document submission.

🔍 Note: Comprehensive checklists not only reduce errors but also facilitate quicker resolutions by pinpointing the exact documentation requirements.

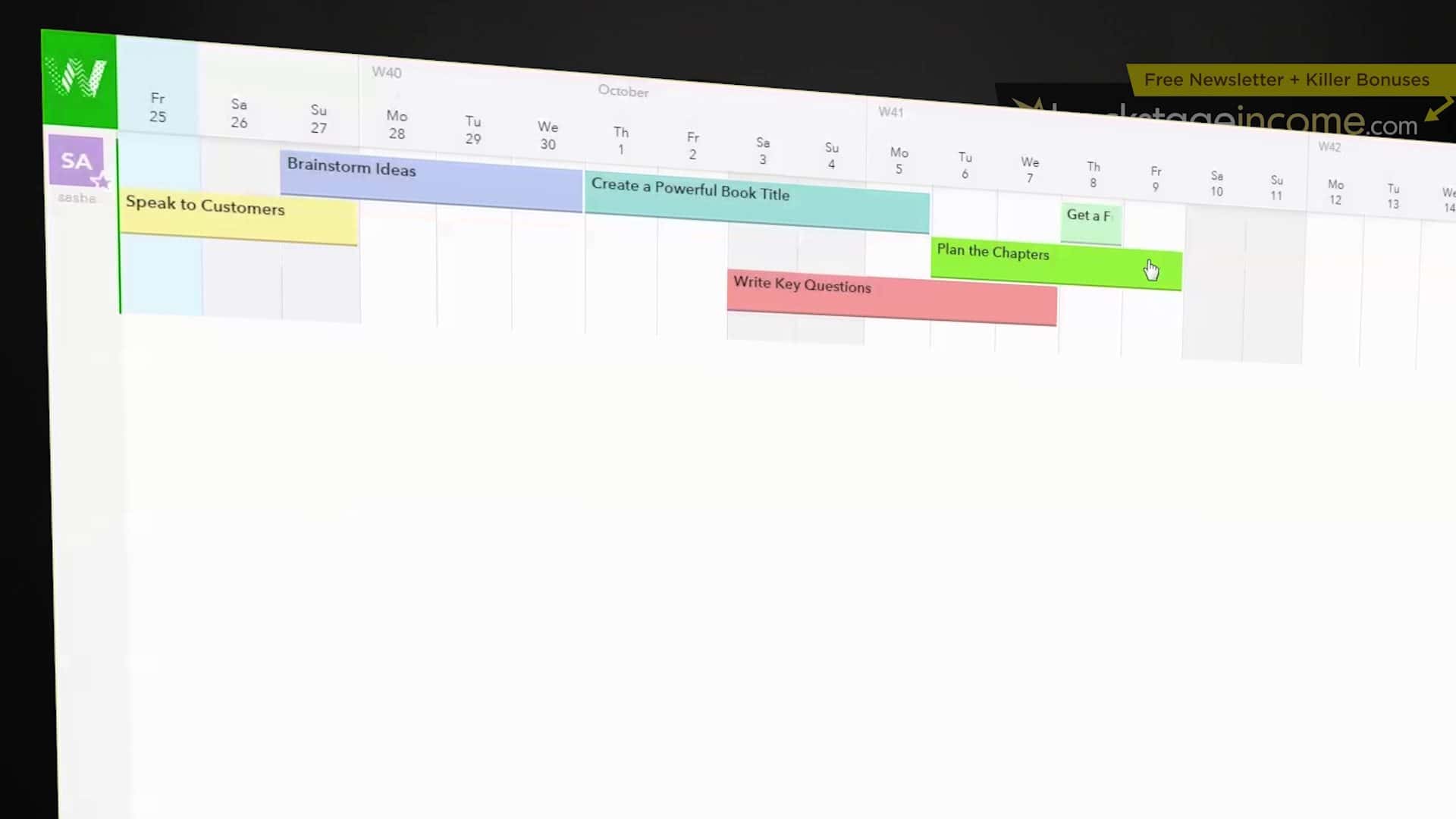

Leverage Technology

Incorporating technology can streamline closing processes:

- eSignatures: Use electronic signature platforms for swift document signing.

- e-Notary Services: Utilize remote notarization services to bypass the need for physical presence.

- Electronic Filing: Submit documents electronically to decrease physical mailing times.

- Virtual Closings: Conduct closing meetings online to eliminate scheduling constraints.

Hire Title Experts

Enlisting title specialists can circumvent title-related delays:

- Early Title Search: Conduct title searches early in the process to identify potential issues.

- Title Insurance: Ensure title insurance coverage to mitigate risks from liens or title disputes.

- Proactive Resolution: Work with experts to resolve any title issues promptly.

| Issue | Expert Service |

|---|---|

| Unresolved Liens | Title Clearance |

| Boundary Disputes | Title Survey |

| Title Defects | Title Examination |

Plan for Contingencies

A well-thought-out contingency plan can safeguard against unexpected delays:

- Escrow or Backup Funding: Arrange for escrow to cover funding gaps.

- Alternative Signatories: Designate alternative signatories in case of emergency.

- Documentation Insurance: Insure key documents to prevent misplacement or damage.

In essence, overcoming paperwork delays in real estate closings requires a mix of proactive communication, meticulous organization, technological integration, professional title services, and well-prepared contingency plans. By implementing these strategies, both buyers and sellers can experience a smoother and quicker closing process, even when faced with documentation hiccups.

What are common reasons for paperwork delays in real estate?

+

Lack of coordination, incomplete documentation, errors or omissions, and unresolved liens or title issues are common culprits.

How can communication improve the closing process?

+

By keeping all parties informed, communication helps in pinpointing and resolving documentation issues swiftly, reducing delays.

What benefits do e-signatures offer in real estate closings?

+

e-Signatures facilitate quicker document signing, eliminate the need for physical presence, and ensure documents are received instantly, which all contribute to faster closings.

How can title experts help with closing delays?

+

Title experts conduct early title searches, provide title insurance to mitigate risks, and help resolve title issues proactively, thus preventing last-minute surprises that could delay closings.

What should be included in a contingency plan for real estate closings?

+

A contingency plan should consider escrow or backup funding, alternative signatories, documentation insurance, and other measures to mitigate unexpected delays or disruptions.