5 Ways to Ensure Timely COBRA Paperwork Delivery

Dealing with COBRA paperwork and the timely delivery of crucial documents can be overwhelming, especially during times of change such as job loss or switching health insurance plans. Ensuring that the deadlines are met and the paperwork is correctly handled is essential for a seamless transition in healthcare coverage. Here are five effective strategies to ensure that your COBRA paperwork is delivered on time, keeping your health insurance intact.

1. Understand COBRA Notification Requirements

- Get Acquainted: Familiarize yourself with the federal regulations on COBRA notification. Generally, you have 60 days from the date of employment or a change in coverage status to elect COBRA.

- Employer Communication: Your employer is legally required to provide you with a COBRA notice within 44 days of your employment termination or a qualifying event.

- Record Keeping: Maintain accurate records of the date you receive the COBRA notification for future reference.

📝 Note: Missing the 60-day deadline to elect COBRA coverage can result in forfeiting your right to continue your health insurance.

2. Use Reliable Delivery Methods

To avoid any postal delays, consider these options:

- Email Delivery: Ask your employer or HR department if they can send the COBRA election notice and forms via email. This method ensures a quick delivery and a verifiable timestamp.

- Overnight Courier: If electronic delivery is not possible, opt for overnight or express courier services to guarantee faster delivery of physical documents.

- Use Tracking: Always request tracking numbers for mailed documents to monitor their progress and avoid any potential issues with late or undelivered mail.

3. Keep Track of Important Dates

Maintain an organized schedule with these key dates:

- Notification Date: When you received the COBRA notification from your employer.

- Election Deadline: The date by which you must elect to continue with COBRA (usually 60 days after notification).

- Premium Payment Deadlines: Ensure you know when your first premium payment is due after electing COBRA.

🕑 Note: Creating a calendar with these dates or setting reminders can help ensure you don’t miss any critical deadlines.

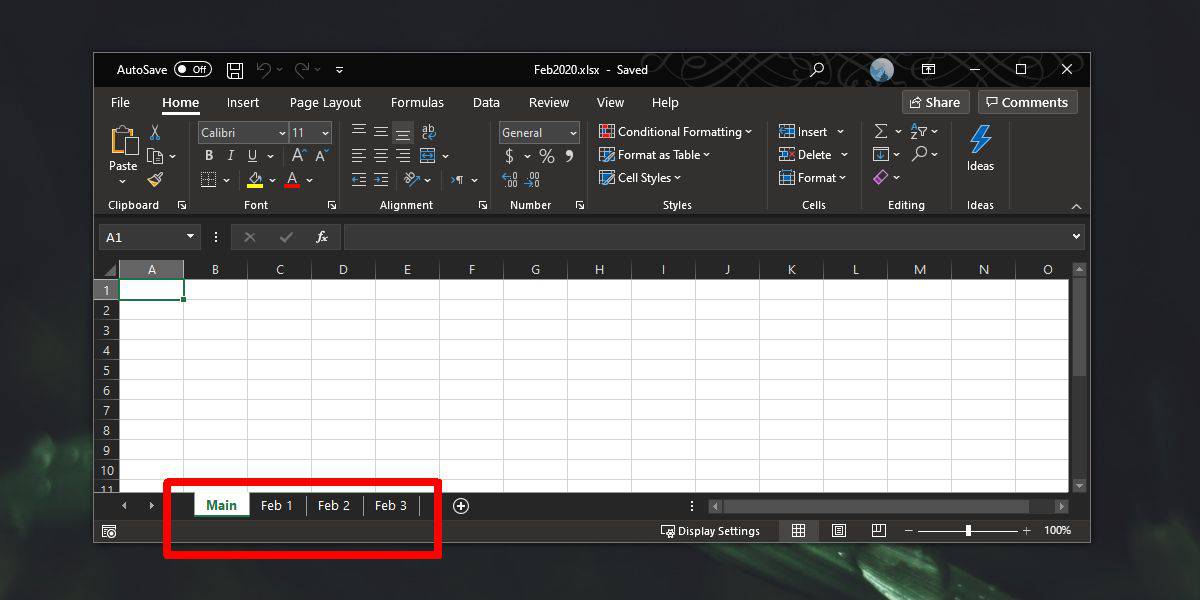

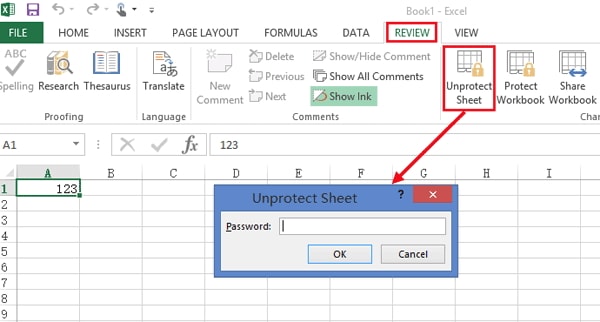

4. Leverage Technology for Organization

Use technology to keep your COBRA paperwork organized:

- Digital Storage: Scan and store COBRA documents in cloud storage for easy access and organization.

- Online Calendars: Set up events with reminders in your online calendar for all key COBRA deadlines.

- Automated Reminders: Use automated reminders in productivity apps to stay on top of your responsibilities.

🔍 Note: By digitizing your documents, you can efficiently search for, share, and back up essential paperwork, reducing the risk of physical document loss or damage.

5. Communicate with HR or COBRA Administrator

If you encounter any issues or need clarity:

- Clarify Information: Don’t hesitate to reach out for clarification on any COBRA paperwork, deadlines, or payments.

- Get Confirmation: Confirm receipt and understanding of instructions or submitted forms.

- Alternative Contact Methods: Establish multiple communication channels with the HR department or COBRA administrator to ensure you always have a way to reach them.

The careful management of COBRA paperwork can seem like a daunting task, but by following these steps, you can significantly reduce stress and secure your health insurance coverage during a transition period. Understanding the notification process, using reliable delivery methods, tracking important dates, utilizing technology for organization, and maintaining clear communication with your HR or COBRA administrator are all key elements to ensuring that your COBRA paperwork is handled efficiently and effectively. Remember, maintaining your healthcare continuity is vital, and a proactive approach to managing COBRA paperwork can make all the difference in your journey toward continued health coverage.

What is COBRA coverage?

+

COBRA, which stands for the Consolidated Omnibus Budget Reconciliation Act, allows employees to temporarily continue their employer-sponsored group health benefits under certain circumstances such as job loss, reduction in hours, or other qualifying events.

How much does COBRA insurance typically cost?

+

The cost of COBRA can vary, but generally, you pay the full premium for the plan, plus a small administrative fee, which can be up to 102% of the group rate. Premiums can be quite high since you’re responsible for the portion your employer usually covers.

What happens if I miss the deadline for electing COBRA coverage?

+

If you miss the 60-day window to elect COBRA, you typically lose the right to continue with your employer’s group health plan. However, you might have other options like joining a spouse’s plan, buying individual health insurance, or looking into Medicaid/Medicare if you qualify.