How FSBOs in Colorado Request Buyer's Loan Pre-Qualification

In the world of real estate in Colorado, selling your home yourself or FSBO (For Sale By Owner) offers a unique set of opportunities and challenges. One critical step in the FSBO process is to ensure that potential buyers are not just window shopping but are seriously considering making an offer. This is where requesting a buyer's loan pre-qualification comes into play. Pre-qualification gives you, the seller, a clearer idea of a buyer's financial readiness to purchase your home. Here's how FSBOs in Colorado can effectively manage this process:

Understanding Loan Pre-Qualification

Before diving into the steps, it's vital to understand what loan pre-qualification means:

- Pre-qualification: A preliminary assessment by a lender of how much they might be willing to lend to a buyer, based on a quick review of their financial information.

- Pre-approval: This goes a step further, involving a detailed examination of the buyer's financial history, including credit checks and financial documents review.

Steps to Request Loan Pre-Qualification

1. Educate Yourself on Loan Options

Learn about the different loan types available in Colorado, such as:

- Conventional Loans

- FHA Loans

- VA Loans

- USDA Loans

🏠 Note: Knowing the buyer’s loan type can help you understand potential delays or additional requirements in the buying process.

2. Create a Pre-Qualification Form

You can make a simple form or use an online service to gather:

- Buyer’s name and contact information

- Estimated income

- Current debts

- Employment details

- Any existing mortgage details

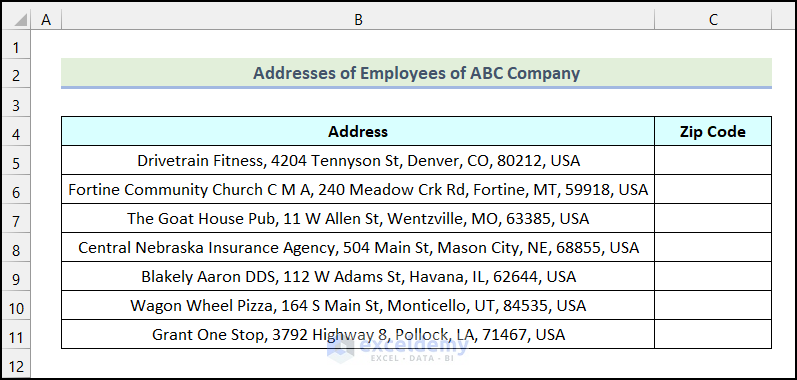

Sample Form:

| Name | Contact | Income | Debt | Employment | Mortgage |

|---|---|---|---|---|---|

| Jane Doe | janedoe@email.com | 75,000</td> <td>15,000 | Tech Inc. | None |

3. Request Pre-Qualification Letters

Ask interested buyers to provide a pre-qualification letter from their lender. Here’s how:

- Provide buyers with a list of recommended lenders in Colorado.

- Give them a deadline to submit the pre-qualification letter.

💡 Note: Setting a deadline ensures buyers take the process seriously, reducing the time wasted on uncommitted potential buyers.

4. Evaluate the Pre-Qualification

Once you receive the pre-qualification letters:

- Check the letter’s date to ensure it’s recent.

- Ensure the loan amount matches or exceeds the asking price of your home.

- Review the terms and conditions, if any, for the loan.

📑 Note: Be wary of pre-approvals that are too vague or lack specific details like loan amount and terms.

5. Use Pre-Qualification as a Tool

Use the pre-qualification status to:

- Prioritize showings for buyers who are pre-qualified.

- Negotiate from a position of strength, knowing the buyer’s financial situation.

- Plan your selling strategy according to the buyer’s financing timeline.

Enhancing Your FSBO Sale with Pre-Qualification

Understanding how pre-qualification can benefit your FSBO sale includes:

- Attracting Serious Buyers: Pre-qualification filters out those who are not ready or able to purchase.

- Efficient Sales Process: It speeds up the sales process by identifying potential buyers upfront who can secure financing.

- Negotiating Power: Knowing a buyer's financial readiness gives you better leverage during price negotiations.

In conclusion, requesting a buyer's loan pre-qualification letter in a FSBO transaction is more than a formality; it's a strategic move. It not only streamlines the selling process but also instills confidence in both the seller and the buyer. The pre-qualification process in Colorado can be as straightforward or detailed as you make it, but the benefits of clarity and commitment from buyers make it an essential step for FSBO sellers.

Is pre-qualification the same as pre-approval?

+

No, while pre-qualification is a quick estimate of loan eligibility, pre-approval involves a more rigorous financial check, offering a firmer commitment from the lender.

Can a buyer still get a loan if they are not pre-qualified?

+

Yes, but it often means a longer process and potentially more uncertainty in the selling process.

What if a buyer’s pre-qualification letter is lower than my home’s price?

+

This doesn’t necessarily mean they can’t buy your home. They might need to come up with a larger down payment, or they can look for a different lender for better terms.