5 Ways Owners Policy Appears on Paperwork

Understanding the Basics

When delving into the world of insurance, understanding how an owner’s policy manifests on your documents is crucial. An owner’s policy, often referred to as a title insurance policy, protects property owners against unforeseen defects in their property title. This post will explore how an owner’s policy looks on various types of paperwork, ensuring you’re well-informed when managing or reviewing property documents.

1. The Policy Schedule

One of the primary documents where an owner’s policy details appear is in the Policy Schedule. Here’s what you’ll find:

- Covered Risks: Lists the defects, liens, or encumbrances against which the policy provides coverage.

- Policy Amount: Specifies the dollar amount for which the property is insured.

- Effective Date: The date when the policy takes effect.

- Exclusions: Details what isn’t covered, often including known title defects or issues that could have been discovered by a thorough title search.

2. Title Commitment

Before closing on a property, you’ll encounter a title commitment, which is a promise to issue a title insurance policy. Here’s what to expect:

- Title Commitment Cover: Basic information about the policy including the proposed insured, the property, and the amount of coverage.

- Requirements: Items that must be addressed before issuing the policy, such as liens to be paid off or mortgage releases to be recorded.

- Exceptions: Defects or encumbrances that won’t be covered by the policy unless they’re resolved.

3. Deed and Transfer Documents

When you’re transferring property ownership, your owner’s policy might be referenced or even included in the following documents:

- Deed: While not a part of the deed itself, the existence of an owner’s policy might be noted.

- Transfer Tax Affidavit: Sometimes, transfer tax documents will note the existence of title insurance to ensure there’s no double taxation on a transfer that’s already insured.

⚠️ Note: While the owner’s policy might not directly appear on the deed or transfer documents, its implications are crucial for the transaction process.

4. Mortgage and Loan Documents

When you’re securing a mortgage, lenders require title insurance:

- Loan Estimate: Might mention the requirement for title insurance.

- Closing Disclosure: Details the cost of title insurance under ‘Title Fees’ or similar sections.

- Mortgage Loan Agreement: Often includes a clause about the borrower obtaining title insurance.

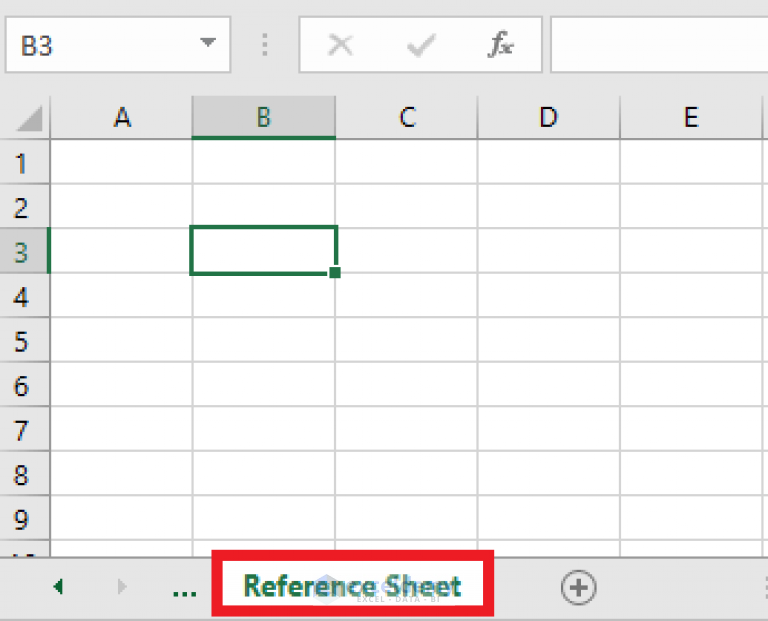

| Document | Description |

|---|---|

| Loan Estimate | Includes a line item for title insurance. |

| Closing Disclosure | Detailed breakdown of title insurance costs. |

| Mortgage Loan Agreement | States the necessity of title insurance. |

5. Legal Documents and Legal Notices

Legal documents can also reference an owner’s policy:

- Legal Notices: In case of disputes or actions against the title, the insurance policy might be referenced as proof of ownership or to clarify legal standing.

- Estate Planning Documents: Sometimes, when dealing with property within an estate, the owner’s policy is referenced to ensure a clean title transfer.

The ways in which an owner's policy appears on your property documents are diverse but share the common goal of ensuring that your title is clear and your ownership is protected. By understanding how these policies manifest on various forms and agreements, property owners can better manage their investments, minimize potential title risks, and ensure a seamless property transfer process. Remember, the details on these documents are your first line of defense in safeguarding your property rights.

What does an owner’s policy cover?

+

An owner’s policy typically covers issues like unknown defects, liens, encumbrances, or title issues that could arise after the property transaction. It ensures that the new owner has a marketable title free of any such problems.

Can I review my title insurance policy?

+

Yes, you can and should review your title insurance policy. It’s provided at the closing of the property purchase, and understanding the terms and conditions can help you know exactly what your coverage entails.

Do all property transactions require title insurance?

+

While it’s not legally required in every jurisdiction, lenders generally mandate it to protect their investment. For buyers, while not mandatory, it’s highly recommended to purchase an owner’s policy to safeguard their interest in the property.