Should You Save Old IRA Paperwork? Here's the Answer

The question of whether you should save old IRA paperwork might seem simple at first, but the complexities of retirement accounts, tax implications, and the need for accurate records make it an important topic. Here, we will delve into why holding onto these documents could be beneficial or, in some cases, even necessary.

Why Save Your IRA Paperwork?

- Tax Records - Your IRA contributions, distributions, and conversions impact your taxes. The IRS requires you to keep records for at least three years from the date you file your return, but if you’ve underreported income by more than 25%, the time frame extends indefinitely.

📌 Note: Keeping your records organized and up-to-date can help in the event of an audit.

- Beneficiary Designations - If something happens to you, the last known beneficiary designations on file with the financial institution will govern how your IRA assets are distributed. Make sure you have the most recent copies of these documents.

- Investment History - Understanding your investment history can help with estate planning, future investment strategies, or even resolving disputes if they arise. Additionally, having documentation of transactions can help you assess the performance of your investments over time.

- Proof of Ownership - IRA statements serve as proof that the account is yours, which might be needed in legal proceedings or for resolving identity theft issues.

Organizing Your IRA Documents

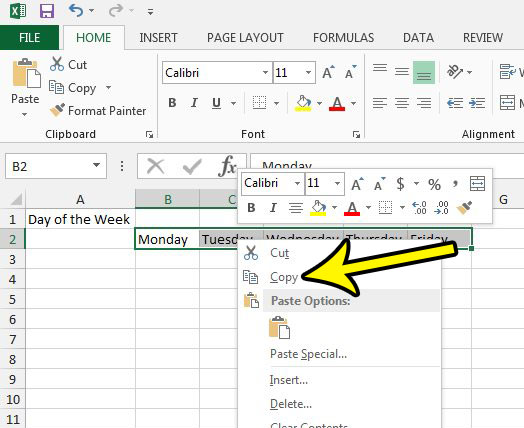

Proper organization is key when dealing with financial paperwork. Here are some tips:

- Create a Digital Archive - Scan and save documents in a secure, password-protected cloud storage or external hard drive.

- Physical Storage - Keep important physical copies in a fireproof, waterproof safe or safe deposit box.

- Labeling - Label all documents with the date, type, and account number. This helps with quick retrieval when needed.

What Documents Should You Keep?

| Document Type | Retention Period | Why Retain? |

|---|---|---|

| IRA Account Statements | Forever | Proof of account existence, contributions, withdrawals |

| Contribution Confirmation | 7 Years | Proof of contributions for tax purposes |

| RMD Notices | Forever | Record of Required Minimum Distributions |

| Beneficiary Designation Forms | Forever | To confirm beneficiaries after your death |

Storing Physical Documents

While digitizing your records is smart, having physical copies can also be crucial. Here are some tips:

- Fireproof Safe - Store documents in a fireproof safe for protection against disasters.

- Safe Deposit Box - Consider a bank safe deposit box, which offers an additional layer of security.

- Organizer Systems - Use binders or file folders to keep documents sorted and easily accessible.

When Can You Throw Documents Away?

Not all documents need to be kept indefinitely:

- Shred Old Statements - Once you have digitally archived your IRA statements, shred any paper statements older than 7 years.

- Keep Records of Special Transactions - Transactions like Roth IRA conversions should be kept indefinitely.

The decision to save or discard IRA paperwork involves balancing between maintaining necessary records and the convenience of decluttering. Keeping records of IRA contributions, withdrawals, RMD notices, and beneficiary designations is essential for tax purposes, estate planning, and proving account ownership. Organizing these documents digitally and physically can save time and stress when you need to access them. Remember, while you can shred certain old documents, crucial ones should be retained indefinitely. As we wrap up this discussion, it's clear that the decision to save old IRA paperwork isn't just about space management; it's about safeguarding your financial future and ensuring your heirs can handle your estate with ease.

How long should I keep my IRA account statements?

+

Ideally, you should keep IRA account statements forever, as they serve as proof of account ownership and can be crucial in case of audits or disputes over contributions or withdrawals.

Can I store all my IRA documents digitally?

+

Yes, you can store your IRA documents digitally for easy access and to reduce clutter. However, it’s advisable to keep physical copies of some key documents in a secure place, like a safe or safe deposit box, as a backup.

What happens if I lose important IRA paperwork?

+

If you lose important IRA paperwork, contact your financial institution to obtain copies or request replacements. However, this process can be time-consuming and potentially problematic, especially if there’s a dispute or an audit. Having an organized archive helps mitigate such risks.