5 Steps to Title Paperwork Before Buying Your House

Buying a house is one of the most significant investments one can make, often involving a complex and intricate process of paperwork. Before you sign the dotted line and hand over a substantial amount of money, it's crucial to ensure every piece of documentation is in perfect order. Here, we delve into the 5 steps you need to take to properly title your paperwork before buying your house, ensuring a smooth and secure transaction.

Step 1: Understanding the Title

The title is essentially the legal way of saying who owns the property. Here are the steps to understand the title:

- Review the Title Report: Once you’ve identified a property of interest, get a title report. This document outlines any encumbrances, liens, or easements attached to the property.

- Look for Defects: Check for any issues with the title. Is there a dispute? Are there any claims against the property?

⚠️ Note: Defects in the title can significantly delay or even nullify the sale process. Addressing them early is crucial.

Step 2: Title Search and Insurance

After reviewing the title, the next step involves due diligence:

- Conduct a Title Search: A professional will research the history of the property to verify the seller’s right to transfer ownership.

- Obtain Title Insurance: Protect yourself with title insurance, which ensures you’re not liable for any prior claims or liens.

| Title Insurance Type | Coverage |

|---|---|

| Owner’s Policy | Protects the buyer’s ownership rights |

| Lender’s Policy | Covers the mortgage lender’s interest in the property |

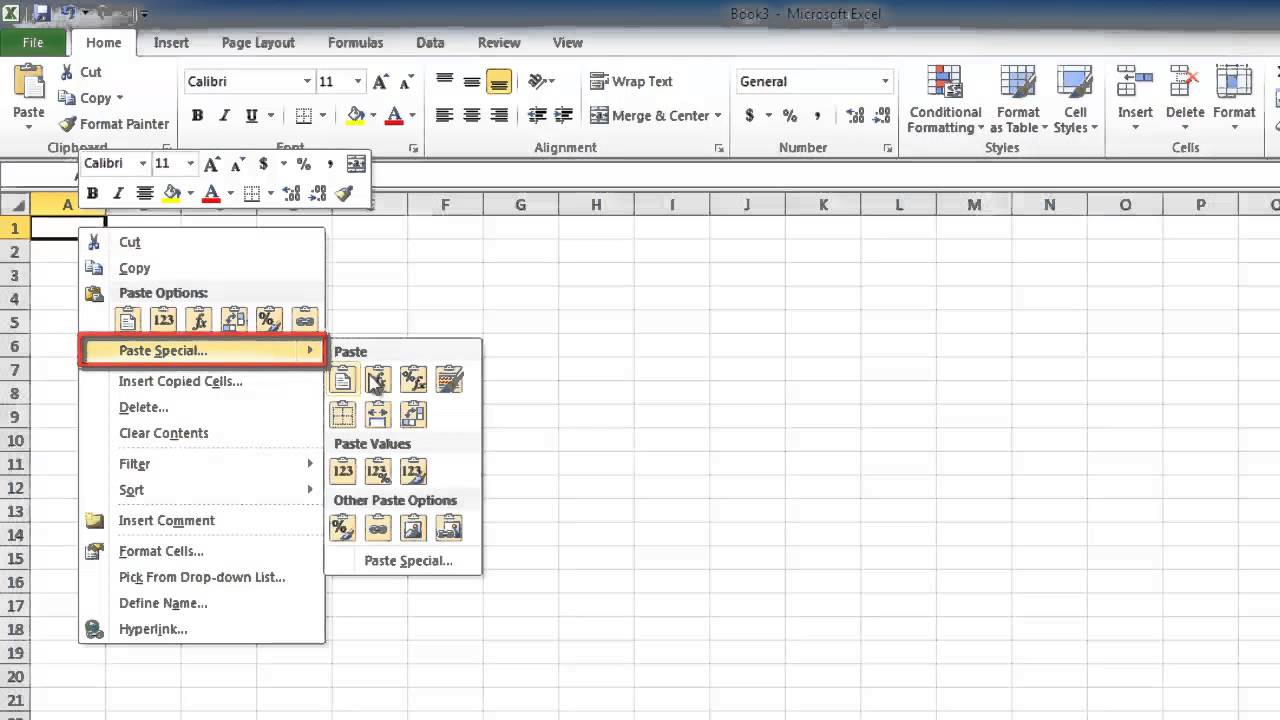

Step 3: Reviewing Mortgage Documents

The mortgage process involves numerous documents that need careful scrutiny:

- Loan Application: Ensure all the details provided are accurate.

- Promissory Note: This document promises to repay the loan, so review the terms, interest rate, and repayment schedule.

- Closing Disclosure: Compare this with the Loan Estimate to make sure there are no unexpected changes in costs or terms.

Step 4: Inspections and Appraisal

Inspections and appraisals are key steps to protect your investment:

- Home Inspection: A professional inspector checks for structural issues, mold, and other potential problems.

- Appraisal: An appraiser assesses the value of the property, which affects your loan amount.

- Environmental Assessment: Sometimes required, especially for older properties or areas with known issues.

🚫 Note: Don’t skip the inspection or appraisal steps. They’re crucial for your peace of mind and securing the value of your investment.

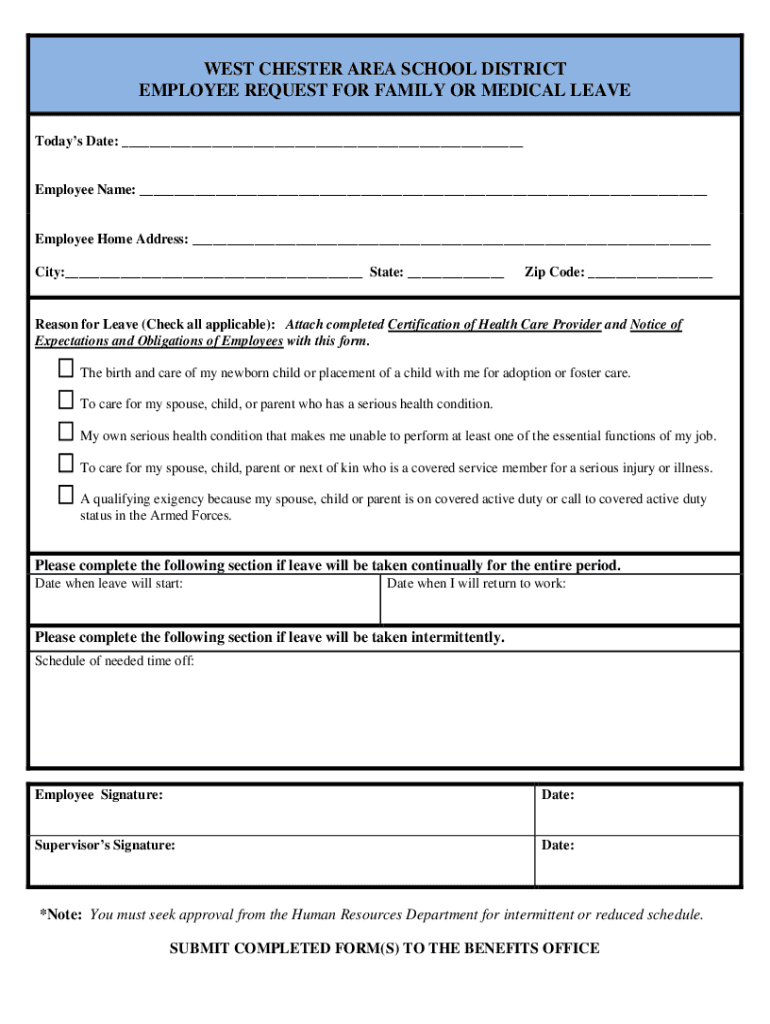

Step 5: Final Walkthrough and Closing

The last step before ownership transfer:

- Final Walkthrough: Make sure everything is as per your last visit and any agreed-upon repairs have been completed.

- Closing: Here you’ll sign numerous documents like the deed, title, and loan papers. Ensure you understand each document:

- Deed of Trust/Mortgage

- Settlement Statement

- Truth-in-Lending Disclosure

- Exchange of Funds: All financial transactions will take place, including the down payment and any closing costs.

By following these steps, you ensure that your journey to homeownership is well-documented, protected, and legally sound. Remember, each document is critical, and understanding them thoroughly prevents future disputes or financial surprises. Taking the time to title your paperwork correctly not only safeguards your investment but also provides you with the confidence and clarity needed during this substantial transaction.

What happens if there’s a title dispute?

+

A title dispute can delay or even prevent the sale. You might need to work with the seller to resolve it or seek a title insurance claim if it’s an insured issue.

Can I skip the title insurance?

+

While it’s possible to skip title insurance, it’s not recommended. It provides critical protection against unforeseen title issues that could jeopardize your ownership.

What should I look for in the mortgage documents?

+

Check for accuracy in terms, interest rate, repayment schedule, and compare the Closing Disclosure with the Loan Estimate for any unexpected changes.