Can I Claim PPI Without Paperwork? Discover How!

Pay Protection Insurance (PPI) has been a topic of considerable interest and controversy in the UK, particularly with the massive mis-selling scandal that came to light in the late 2000s. If you've been searching for a way to claim PPI without the hassle of sifting through paperwork, you'll be pleased to know there are indeed methods to proceed with minimal documentation. Here's how you can initiate a claim for PPI compensation while keeping the paperwork to a bare minimum.

Understanding PPI Claims

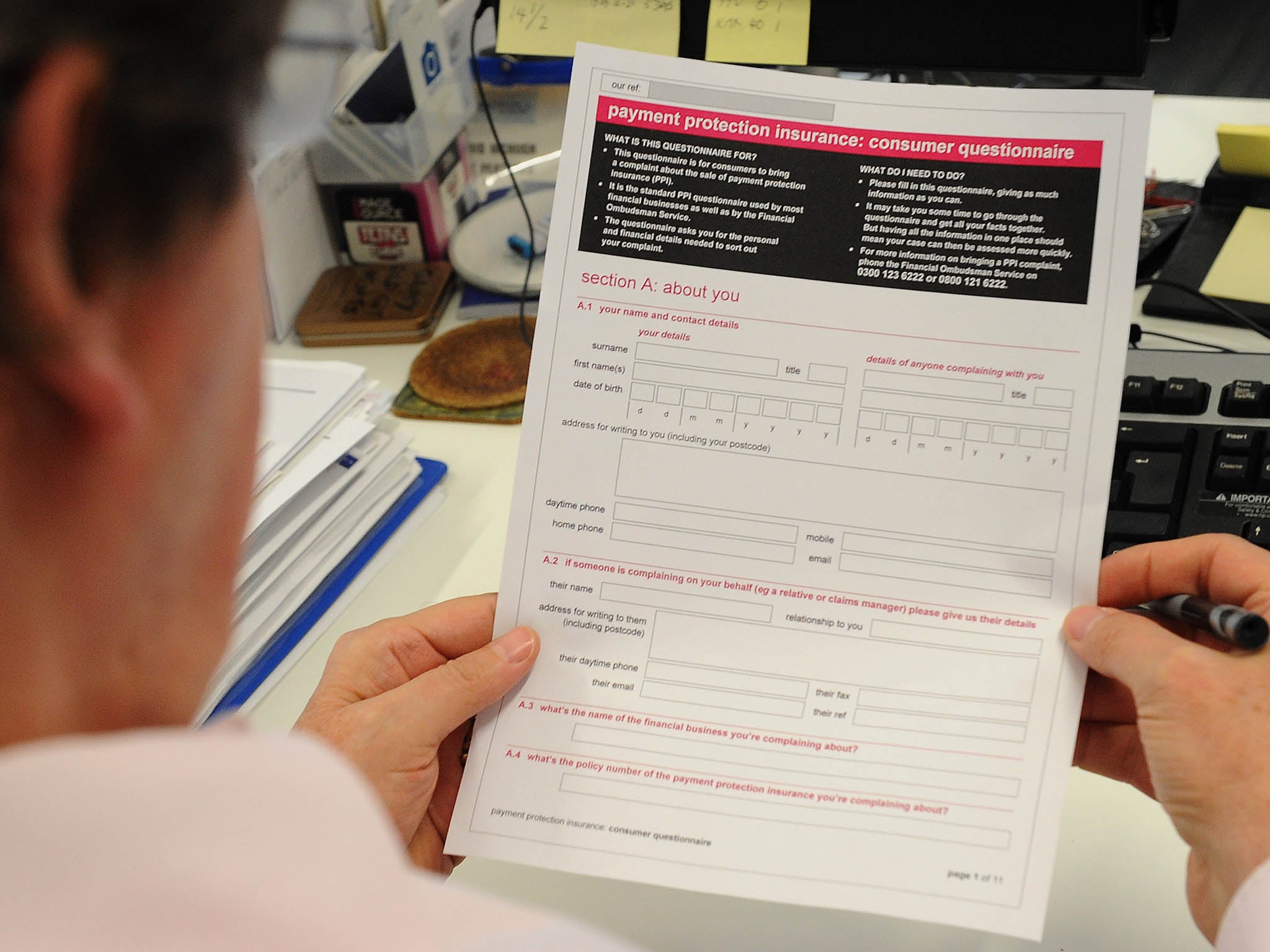

PPI, or Payment Protection Insurance, was a type of insurance policy designed to cover payments on loans, credit cards, or other financial products if the policyholder was unable to make repayments due to various reasons like illness, unemployment, or accident. Unfortunately, many consumers were mis-sold these policies, often without their full understanding or consent. Understanding the basics of PPI is crucial before you embark on claiming:

- Eligibility: You might be eligible if you purchased a loan, credit card, or other financial product with PPI between the late '90s and 2010.

- Mis-Selling Signs: Indicators that you might have been mis-sold PPI include not being informed about the PPI, being told it was mandatory, or the PPI being added without clear explanation or consent.

- Time Limits: Remember, there are time limits for claiming PPI compensation; typically, you have 6 years from the date of mis-selling or 3 years from when you became aware of the mis-sale.

Steps to Claim PPI Without Paperwork

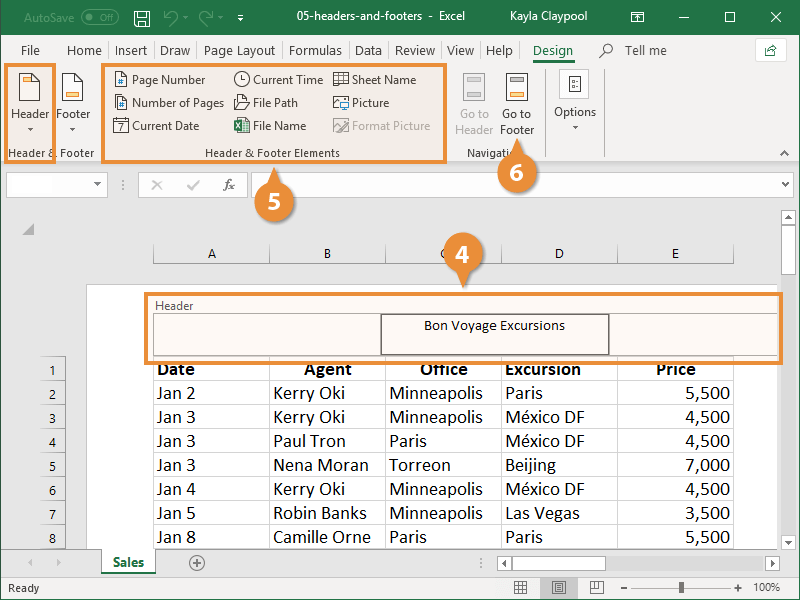

1. Online Claim Submission

Many financial institutions now facilitate online claim processes, which can be incredibly straightforward:

- Visit the bank or financial provider's website and look for the section dedicated to PPI claims.

- Fill out an online form where you'll enter basic details about your policy, such as your policy number if known, and the type of finance product you held.

- This usually involves minimal paperwork, often just electronic submission.

🔍 Note: Online forms usually require some basic information, but if you're unsure about any details, many firms allow for partial information to be submitted with the promise of verification later.

2. Use Existing Records

If you have a past record of any communication with your financial provider, even if it's just an email or a bank statement, these can act as 'proof' of your dealings:

- Check old bank statements or online banking records for PPI premiums or policy numbers.

- If you have an old email confirmation or letter about PPI, this can serve as indirect evidence.

3. Third-Party Claim Services

Some specialized claims management companies can handle the process for you:

- These companies often work on a no-win, no-fee basis.

- They will require minimal information from you, such as your name, contact details, and what financial product you believe you had PPI on.

- They'll take care of the paperwork and correspondence with the banks.

⚠️ Note: Be cautious when selecting a claims management company, as some might charge a substantial fee if you're successful. Always review their terms of service carefully.

4. Call Your Bank Directly

Another way to bypass paperwork is through direct communication:

- Call your bank's customer service line to inquire about your PPI status.

- They might be able to verify your claim over the phone with minimal documentation or even send you pre-filled forms if they have your details on record.

5. Seek Legal Assistance

If you believe there might be complexities or disputes involved, consider legal support:

- Speak with a solicitor specializing in financial mis-selling cases.

- They can guide you through the process with minimal document collection on your part.

Outcome and Follow-Up

Once you've initiated your claim through one of the above methods, what happens next?

- Acknowledgment: Your bank will acknowledge your claim, often within 28 days.

- Verification: The provider might contact you for additional information or clarification, but they'll primarily rely on their records.

- Decision: The decision on your claim usually comes within 8 weeks. If it's upheld, compensation will be calculated and paid out.

- Appeal: If you're unsatisfied with the outcome, you can escalate the matter to the Financial Ombudsman Service.

Once you've initiated your claim through one of the above methods, what happens next? Your claim is not a guaranteed win, but these strategies can significantly reduce the amount of paperwork needed. Remember, the compensation can be substantial, often including interest, so it's worth exploring your options if you suspect you were mis-sold PPI.

Can I claim PPI if I no longer have my bank statements?

+

Yes, you can still make a claim. Banks and financial institutions typically keep records for a long time, and many claims are processed successfully without the need for physical bank statements. Your provider can verify the PPI policy using their own records.

What if I am unsure if I had PPI at all?

+

Contact your bank or lender directly or check online. Many institutions will provide you with information or confirmation of PPI policies upon request, helping you determine if you’re eligible for a claim.

Is there a deadline for making PPI claims?

+

Yes, there are time limits. Generally, you have 6 years from the date of mis-selling, or 3 years from when you became aware of the mis-selling to make a claim. However, specific time limits might apply, so it’s best to act promptly.

How will I know if my PPI claim was successful?

+

Your bank or lender will communicate the decision within 8 weeks after your claim is acknowledged. If successful, they’ll outline how much you’ll receive, including interest, and provide a timeline for payment.

What if my claim is rejected?

+

If your claim is rejected, you can either appeal directly with your bank, ask for a detailed explanation of the decision, or escalate the matter to the Financial Ombudsman Service (FOS) for an independent review.