When Must Employers Send COBRA Paperwork?

When Must Employers Send COBRA Paperwork?

If you're an employer, understanding the Consolidated Omnibus Budget Reconciliation Act (COBRA) is crucial for complying with federal law regarding the provision of extended health insurance benefits to employees who lose their job-related health insurance coverage. COBRA allows employees to continue their group health insurance for a limited period under specific conditions. Here, we'll delve into the when and how of sending COBRA paperwork to ensure you're fully compliant with legal requirements.

Understanding COBRA

COBRA was enacted to provide former employees, retirees, spouses, former spouses, and dependent children with the opportunity to continue their health insurance when they would otherwise lose coverage due to certain events called “qualifying events.” The coverage continuation rights under COBRA apply to both fully insured and self-funded health plans.

The Timeline for COBRA Notifications

There are several critical deadlines that employers must adhere to when it comes to COBRA paperwork:

- General Notice: This must be sent to each new employee (and their spouse) within 90 days of plan enrollment.

- Qualifying Event Notification: Within 30 days of a qualifying event (such as termination of employment or reduction in hours), the employer or plan administrator must provide the qualified beneficiary with an election notice.

- COBRA Election Notice: This is sent within 14 days after the event notification. It outlines the options for continuing coverage, including deadlines and payment information.

🛑 Note: Employers should keep track of these dates and ensure proper documentation, as failure to meet these deadlines can lead to penalties.

Qualifying Events

Here is a list of qualifying events under COBRA:

| Qualifying Event | Who Can Qualify | Maximum Coverage Period |

|---|---|---|

| Termination of employment | Employee, spouse, dependents | 18 months |

| Reduction in hours | Employee, spouse, dependents | 18 months |

| Death of covered employee | Spouse, dependents | 36 months |

| Divorce or legal separation | Spouse | 36 months |

| Eligibility for Medicare | Spouse, dependents | 36 months |

| Dependent child losing dependent status | Dependent child | 36 months |

Steps to Take When Sending COBRA Paperwork

Here are the steps to follow when it’s time to send out COBRA paperwork:

- Identify the qualifying event: Determine which event triggers the need for COBRA continuation coverage.

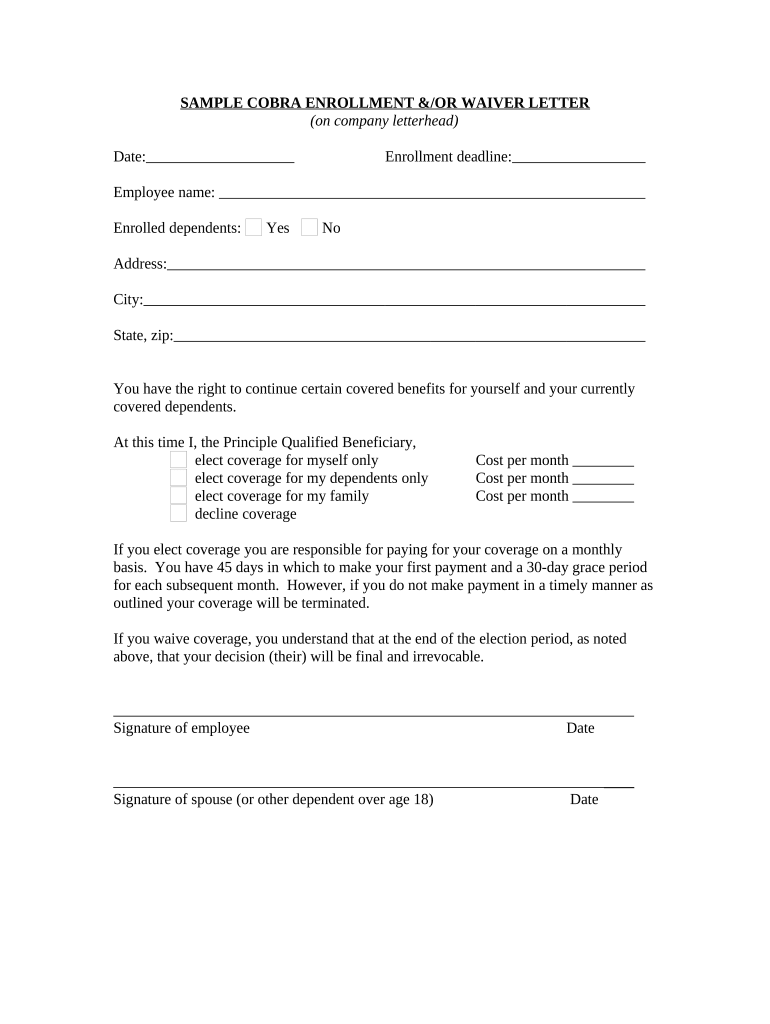

- Notify the employee or beneficiary: Provide the individual with the election notice, including how to continue coverage, the cost, and the deadline for electing COBRA.

- Document the notification: Keep records of when the notification was sent, how it was sent, and to whom.

- Wait for a response: The individual has 60 days to decide whether to continue their health coverage.

- Process the election: If the beneficiary elects to continue coverage, process the payment and ensure that coverage remains uninterrupted.

📝 Note: It's essential to handle COBRA paperwork with confidentiality and accuracy to avoid legal issues or loss of coverage for the beneficiary.

Enforcement and Penalties

Failing to adhere to COBRA requirements can lead to severe penalties:

- Monetary fines by the Department of Labor for non-compliance.

- Potentially substantial civil penalties if an individual can prove they were harmed by the failure to provide COBRA notices.

- Reputation damage, which can affect an employer’s ability to attract and retain talent.

Conclusion

Ensuring that COBRA paperwork is sent out timely and correctly is not just a legal obligation for employers; it’s also a matter of caring for the health and well-being of former employees during transitional times. By understanding and adhering to the deadlines and procedures, employers can avoid legal repercussions and demonstrate their commitment to employee welfare. Keep in mind that while this guide provides an overview, consulting with a HR professional or legal advisor for specific circumstances or any changes in legislation can ensure your compliance and provide peace of mind.

What happens if an employee does not respond to the COBRA election notice?

+

If the employee does not elect COBRA within the 60-day window, they will lose their health coverage. Employers are not obligated to extend coverage beyond this deadline.

Can an employee’s COBRA coverage be extended beyond the maximum periods listed?

+

Under certain circumstances, such as a second qualifying event during the initial 18-month coverage period, COBRA coverage can be extended. For instance, if an employee’s spouse becomes eligible for Medicare, dependents might extend coverage up to a total of 36 months.

What are the tax implications for employees choosing COBRA continuation coverage?

+

The cost of COBRA premiums is typically paid by the individual, but it can be included as a pre-tax deduction if offered through an employer’s Section 125 Cafeteria Plan. Additionally, COBRA premiums paid by an individual might qualify for a tax credit under certain circumstances.