UK Guide: What Paperwork to Keep and Toss

Are you overwhelmed with paperwork, unsure of what to keep and what to shred? In today's digital age, managing personal and business records effectively is more crucial than ever. In the UK, maintaining the right documents not only helps in managing your personal or business affairs but also ensures compliance with legal requirements. This comprehensive guide will help you understand which documents to retain, for how long, and when it's safe to let go.

Why Document Management Matters

Document management isn't just about avoiding clutter:

- Tax Efficiency: Keeping the right paperwork can help in making tax returns easier and maximize your tax deductions.

- Compliance: Various regulations necessitate the retention of certain documents, and failure to comply can lead to fines or legal issues.

- Legal Disputes: Having the necessary documents readily available can protect you in legal disputes or audits.

Personal Documents

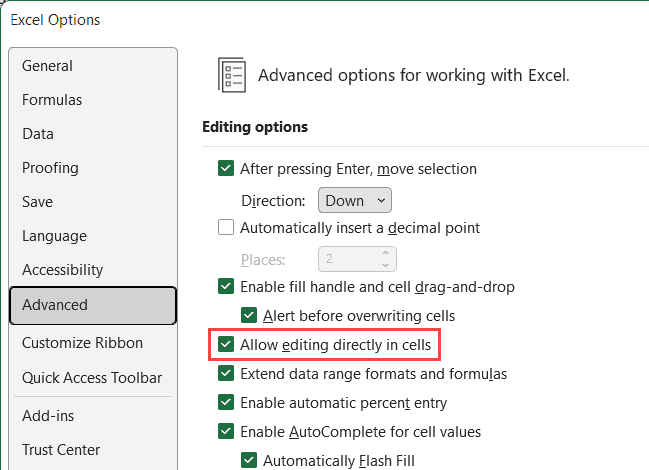

Here's a table outlining key personal documents and their recommended retention periods:

| Document | Retention Period |

|---|---|

| Marriage certificates, Birth Certificates, and Wills | Indefinitely |

| Insurance policies | At least until the policy expires or is replaced |

| Mortgage documents and home purchase agreements | 6 years after the property has been sold or the mortgage has been paid off |

| Pension records | 6 years from the end of the tax year to which they relate |

| Bank and credit card statements | 6 years if they relate to expenses and purchases, 1 year for non-tax-related issues |

| Tax returns | 6 years from the end of the tax year they relate to |

Notes:

📝 Note: Utility bills are generally safe to toss after 1 year, unless they are part of your home office expense deductions.

Business Documents

Managing paperwork for a business involves a different set of rules:

- Accounts Records: Keep sales invoices, purchase orders, and receipts for 6 years from the end of the tax year they relate to.

- Payroll Records: Retain for 3 years after the tax year for PAYE records, and for 6 years for wage records.

- VAT Records: Retain all VAT invoices, records of supplies, and invoices from suppliers for 6 years unless you use an annual accounting scheme.

- Company Secretarial Records: These include the Certificate of Incorporation, Articles of Association, and shareholder registers, which should be kept indefinitely.

Electronic vs. Paper Records

With the digital transformation, many businesses are moving towards electronic records:

- Electronic records must be readily accessible and backed up.

- They should be stored securely to prevent data breaches or loss.

- HMRC accepts digital records for tax purposes, but make sure your system allows for audit trails and retrieval when necessary.

Notes:

💾 Note: Some records, like Certificates of Incorporation, must be kept in physical form as part of legal requirements.

When to Shred Documents

Shredding documents is not just about making space; it's about protecting your personal and business information:

- Shred any documents containing sensitive information like bank details, National Insurance numbers, or passwords once they are no longer needed.

- Ensure that any discarded records are irretrievable by using a cross-cut shredder or hiring a shredding service.

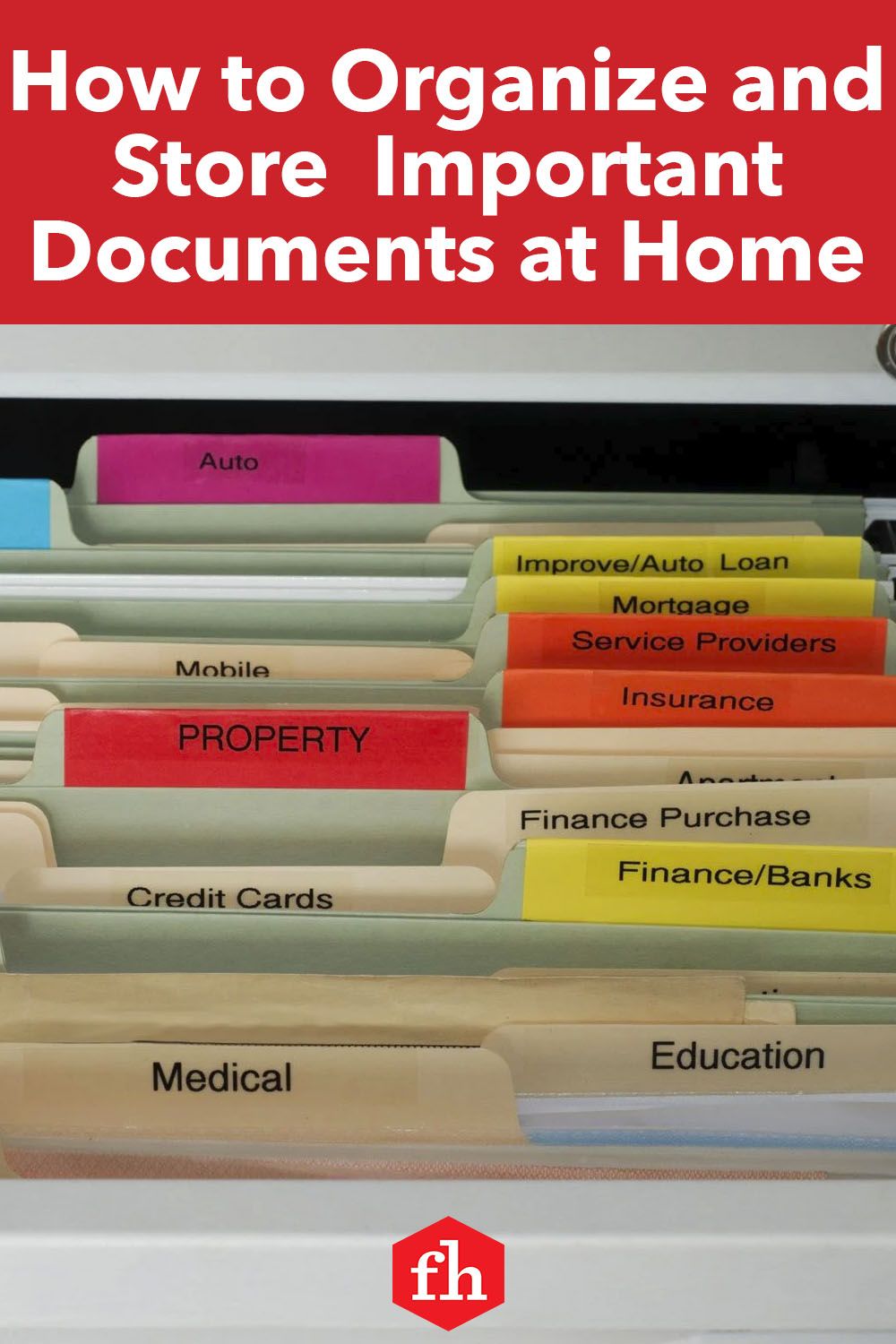

Best Practices for Document Management

Here are some tips to streamline your document management:

- Organize: Use filing cabinets, digital folders, or cloud storage to keep documents categorized.

- Retention Schedule: Create a schedule for reviewing and disposing of documents.

- Data Protection: Understand the GDPR and other relevant data protection laws for handling personal data.

- Regular Audits: Periodically audit your records to ensure compliance and that only necessary documents are being kept.

The proper management of paperwork not only helps keep your financial and legal affairs in order but also contributes to peace of mind, knowing that you have everything you need in case of an audit or legal action. Remember, in our increasingly digital world, secure storage and easy retrieval of documents are as important as ever. By following the guidelines provided in this guide, you can avoid the pitfalls of document mismanagement and ensure that you're complying with UK regulations. Whether it's keeping vital personal records or managing business documents, the key is to know what to keep, when to keep it, and when it's safe to let go.

How long should I keep my tax returns?

+

The general rule is to keep tax returns and supporting documents for 6 years from the end of the tax year to which they relate.

Do I need to keep utility bills forever?

+

No, unless they are related to home office expense deductions or other tax-related purposes, you can safely dispose of utility bills after 1 year.

What if I have an audit or need to reference old documents?

+

If you’re concerned about losing important information, scan and store documents electronically with regular backups. Ensure secure storage to protect sensitive data.