Documents Required for Lease Insurance: A Complete Checklist

In the world of real estate, lease insurance is a fundamental requirement that protects both property owners and tenants from unforeseen financial losses. Whether you're a landlord looking to safeguard your investment or a tenant ensuring peace of mind during your tenancy, understanding the documents required for lease insurance is crucial. This comprehensive checklist will guide you through the essential paperwork, ensuring you are well-prepared for a smooth insurance application process.

Understanding Lease Insurance

Lease insurance, also known as renters insurance, covers losses to personal property, liability claims, and additional living expenses in case of damage to the rented property. Here's what you should know:

- Renters Insurance: Typically for tenants, it covers their personal items against damage or theft.

- Landlord Insurance: Specifically for property owners, it might include loss of rent due to damage or tenant-caused losses.

- Content Coverage: While renters insurance covers personal belongings, landlord insurance might cover the structure and contents owned by the landlord.

Documents Required for Tenant Insurance Application

Identification Documents

- National ID or Passport

- Driver’s License or another form of photo ID

- Social Security Number or National Insurance Number

Proof of Residency

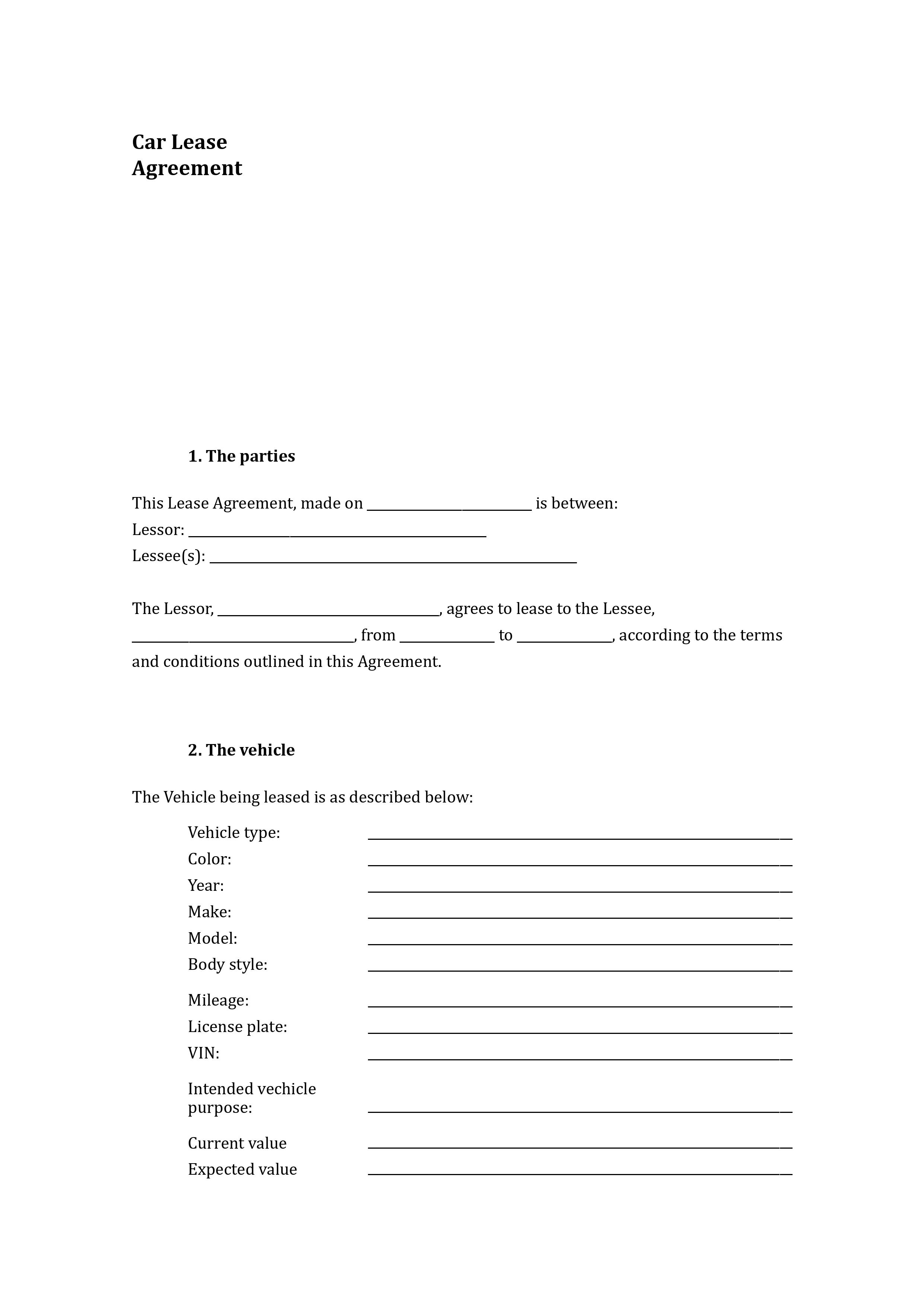

- Lease Agreement

- Utility Bill showing the address

- Rental Receipt or Payment Confirmation

Details of the Property

- Property Address

- Details of any Special Features or Installations

- List of Personal Items to be Insured

Payment Information

- Bank Statements

- Credit Card Details or Alternative Payment Methods

🔑 Note: Ensure all documents are up-to-date and reflect your current residency status.

Documents Required for Landlord Insurance Application

Property Documentation

- Property Deed or Title

- Insurance Policy for Mortgage (if applicable)

- Building Plans or Layouts

Tenant Information

- Current Leases or Rental Agreements

- Tenant Screening Reports or Reference Letters

Financial Documents

- Rental Income Statements

- Expense Records for Property Maintenance

- Mortgage Statements if the property is still under mortgage

⚖️ Note: Having a clear record of your tenant's information can influence the insurance premium and coverage options.

Key Steps for Preparing Your Documents

- Organize: Keep all documents well-organized in a digital or physical folder for easy access.

- Review: Check each document for accuracy, especially dates and contact information.

- Update: Ensure all documents are current, especially those related to the property status.

- Consent: If necessary, obtain consent from your tenants to share their personal information with the insurance provider.

- Backup: Keep electronic copies of all documents for redundancy.

| Document | Where to Obtain | Importance |

|---|---|---|

| Lease Agreement | From Tenant or Landlord | Establishes residency and rental terms |

| Property Deed | Local Registry Office or Purchaser's Records | Proves ownership |

| Utility Bill | Utility Service Provider | Verifies address |

💼 Note: Maintaining an up-to-date and organized set of documents not only facilitates the insurance application process but also aids in quick resolution during claims.

This comprehensive checklist ensures that you have everything in place before approaching an insurance provider. Remember, the smoother your documents are processed, the quicker you can get coverage, providing peace of mind for both tenants and landlords. Always double-check the documents against the insurance company's requirements, as policies can vary. Having the right paperwork not only speeds up the application process but can also ensure you get the best coverage options tailored to your needs.

What if I’m renting without a formal lease agreement?

+

Alternative documents like a letter from the landlord, rent receipts, or utility bills can serve as proof of residency.

Do I need separate insurance for my personal belongings if I’m renting?

+

Yes, renters insurance primarily covers personal property. Your landlord’s insurance does not cover your belongings.

How can I reduce my insurance premiums?

+

Install security systems, maintain good tenant history, or choose higher deductibles. Always review different providers for the best rates.