5 Documents You Need for a Car Loan

In the journey towards owning a new car, obtaining a car loan plays a pivotal role. Not only does it make the purchase more manageable, but it also allows you to spread the cost over time. However, to secure a car loan, you must come prepared with specific documents that lenders require to process your application. Let's delve into the five crucial documents you need for a car loan application to make the process seamless and increase your approval chances.

1. Proof of Income

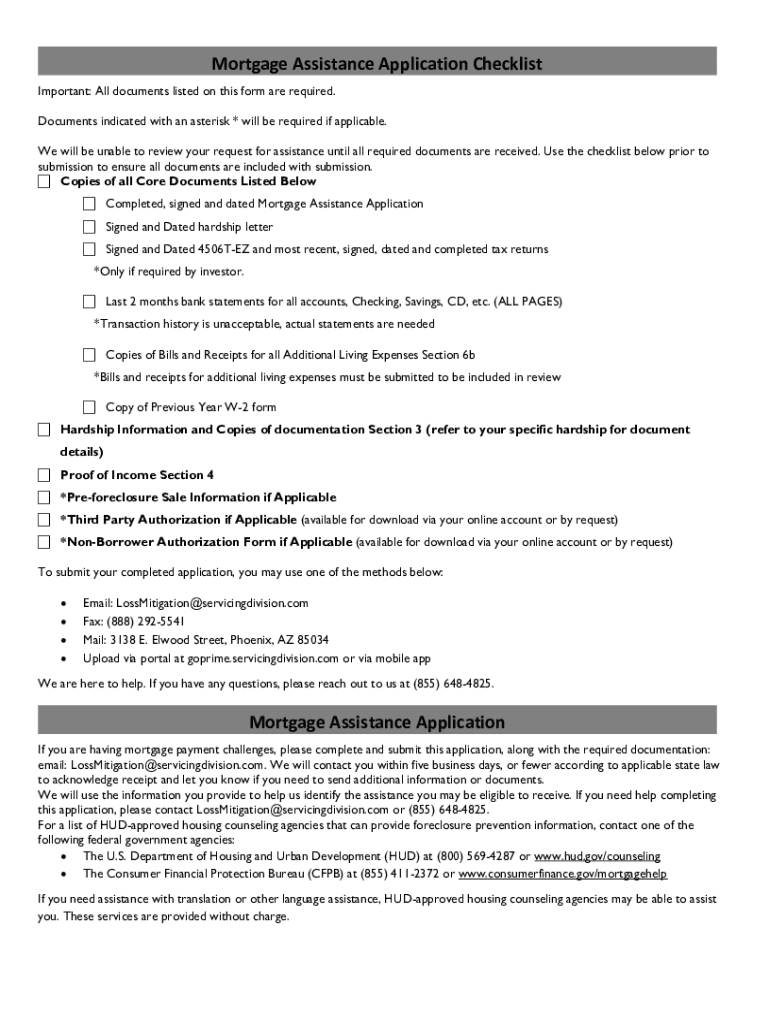

Lenders need to assess your ability to repay the loan, and your income is a significant indicator. Here’s what you might need:

- Recent Pay Stubs: Typically, lenders request pay stubs from the last 30 days to verify your income.

- Tax Returns: If you’re self-employed or your income fluctuates, lenders might ask for the last two years of tax returns to get a comprehensive view of your earnings.

- Bank Statements: Proof of steady cash flow through your bank account can also serve as income verification.

💼 Note: Ensure all income documents are clear, and any discrepancies are explained, as lenders pay close attention to your financial stability.

2. Identification Documents

Your identity and eligibility for a car loan will be confirmed with the following:

- Driver’s License: This is essential since you’ll need it to drive the car you’re financing. A valid license in your name helps establish your identity and driving eligibility.

- Passport or Social Security Card: These documents serve as additional proof of identity.

3. Employment Verification

Besides proving your income, lenders often want to confirm your job stability:

- Employment Letter: A letter from your employer stating your position, length of employment, and salary can suffice.

- Recent W-2 Forms: These can provide historical employment data for lenders to assess your job consistency.

🌟 Note: If you’ve recently changed jobs, providing documentation from both your current and previous employer might be beneficial.

4. Credit History Documents

Lenders use your credit history to evaluate your risk as a borrower:

- Credit Reports: While lenders pull your credit report, bringing one from a credit reporting agency might speed up the process.

- Credit Score: Although lenders calculate this, knowing your own credit score can help in negotiations or understanding loan terms.

| Credit Score Range | Loan Interest Rates |

|---|---|

| 720-850 (Excellent) | Lowest interest rates |

| 690-719 (Good) | Competitive rates |

| 630-689 (Fair) | Higher interest rates |

| Below 630 (Poor) | Highest interest rates or loan denial |

5. Down Payment Proof and Additional Assets

Some lenders require a down payment, and documentation of this payment along with any additional assets is important:

- Bank Statement or Savings Account: To show you have the down payment amount.

- Asset Documentation: If you’re using collateral or showing liquid assets, documentation like titles or bank statements can be required.

💰 Note: A larger down payment can often lead to better loan terms and lower monthly payments.

Wrapping up, preparing for a car loan involves gathering the right documents to prove your eligibility, income stability, and ability to repay the loan. From your proof of income to your credit history, each document plays a critical role in convincing lenders that you're a safe bet. Ensuring these documents are well-organized, up-to-date, and complete can streamline the car loan process, potentially securing you better terms and faster approval. With these documents in hand, you'll be one step closer to driving away in your new car!

What if I don't have all the required documents?

+

If you're missing any required documents, you might want to contact the lender beforehand to inquire about alternatives or additional documentation that could substitute for what you're missing. Delaying your application while you gather necessary documents might be a better option than submitting an incomplete one.

Does my credit score really matter for a car loan?

+

Yes, your credit score is a significant factor in securing a car loan. A higher score can lead to lower interest rates and better loan terms, while a lower score might result in higher rates or loan denial.

Can I use gift money as a down payment?

+

Some lenders allow gift money for down payments but require documentation proving the source of the funds, like a gift letter from the giver stating it's a gift and not a loan, along with any related bank statements.