Essential Paperwork Guide for Contract Employees

In today's dynamic job market, the gig economy has emerged as a significant player, with contract employment becoming increasingly popular. Whether you're freelancing, working on short-term projects, or engaging in temporary roles, understanding the essential paperwork you need as a contract employee is crucial. This guide will walk you through the key documents that are indispensable for managing your career as a contractor.

Why Paperwork Matters for Contract Employees

Before diving into the specifics, it’s essential to understand why paperwork is fundamental for contract workers:

- Legal Protection: Proper documentation ensures your rights as a contractor are safeguarded.

- Financial Management: Managing taxes, expenses, and income is streamlined with the right paperwork.

- Professionalism: Keeping meticulous records establishes trust with clients and agencies.

- Dispute Resolution: In case of disagreements, having well-documented evidence can resolve conflicts swiftly.

Key Documents for Contract Employees

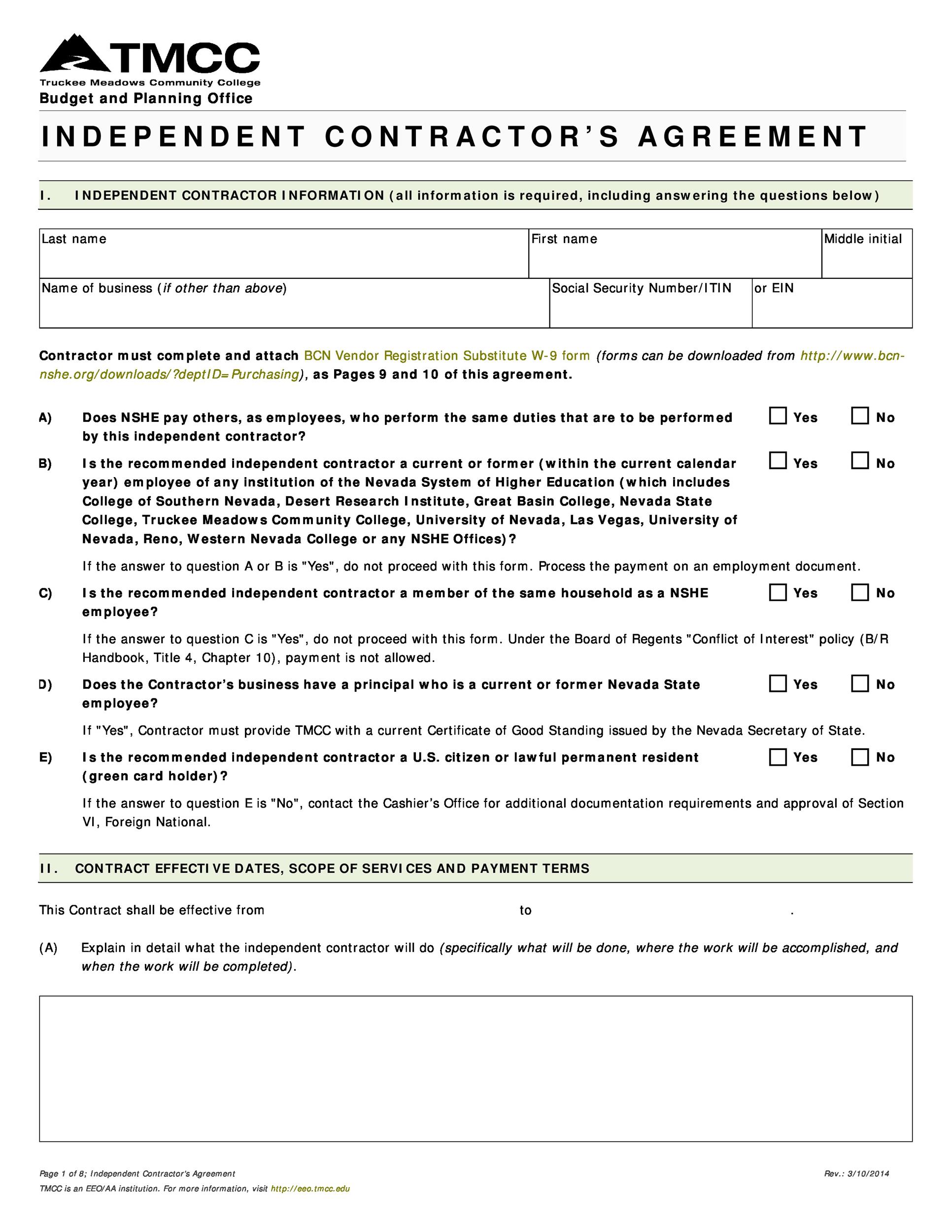

1. Contract Agreement

The cornerstone of any contract employment is the contract agreement itself. This document should outline:

- Scope of work

- Payment terms

- Duration of the contract

- Confidentiality clauses

- Termination conditions

Ensure that everything discussed verbally or in meetings is explicitly included in the contract.

📝 Note: Always read the contract thoroughly. If something is unclear, seek clarification or legal advice before signing.

2. W-9 or Equivalent Form

In the United States, a W-9 form is essential for contract employees to provide to their clients or employers. This form:

- Establishes your tax classification

- Provides your Taxpayer Identification Number (TIN)

- Allows for accurate 1099 issuance for tax purposes

🔒 Note: Keep this information secure but accessible when needed for tax filings or new engagements.

3. Invoices

Professional invoicing is not just about getting paid; it’s about maintaining a record of your transactions:

- Date of issue and due date

- Service description

- Hourly rates or project fees

- Tax information

- Payment details and terms

4. Time Sheets and Expense Reports

Tracking your work hours and expenses helps in:

- Calculating billable hours accurately

- Reimbursing work-related costs

- Providing documentation for tax deductions

5. Project Proposals and Scope Documents

When starting a new contract or project, proposals and scope documents:

- Define the project’s objectives

- Detail deliverables and timelines

- Clarify client expectations

Managing Your Paperwork

Keeping track of your documents can be overwhelming, but effective systems can simplify the process:

- Digital Storage: Use cloud storage services like Dropbox or Google Drive to save digital copies.

- Organize by Project: Create folders for each project, separating contract agreements, invoices, and other documents.

- Physical Copies: Keep signed originals in a secure place for important contracts.

In navigating the modern work landscape, understanding and maintaining proper paperwork is essential for contract employees. Each document serves a purpose in your professional life, from legal protection to tax management. By organizing and safeguarding these documents, you ensure smooth operations, compliance, and the ability to capitalize on future opportunities.

What should I do if a client refuses to provide a contract?

+

If a client refuses to provide a contract, it’s advisable to draft one yourself or seek an understanding of terms through emails or written communication. Without a contract, you risk being unprotected legally and financially.

How often should I review and update my paperwork?

+

At the start of each project, review all documents to ensure they are current. Additionally, have a yearly check to update your tax information, invoices, and to review existing contracts for amendments or renewals.

Can contract employees use document management tools?

+

Absolutely! Using tools like Trello, Asana, or specialized legal software can streamline document management, ensuring you have all necessary paperwork organized and accessible.

What if there’s a discrepancy between agreed terms and what’s in the contract?

+

In case of discrepancies, seek clarification immediately before signing. If a contract has been signed with errors, amendments can be made to address the issues with the client’s agreement.

How long should I keep my contract paperwork?

+

As a rule of thumb, keep your contract paperwork for at least seven years for tax and legal reasons, especially if it has tax implications or legal significance.