Essential Paperwork Needed After Death in Michigan

Introduction to Handling Post-Death Paperwork in Michigan

When a loved one passes away, managing their affairs can be an emotionally challenging task. In Michigan, there are several legal steps and paperwork that survivors need to handle promptly to honor the deceased's wishes and settle their estate. This post aims to guide you through the essential paperwork needed after someone's death in Michigan, making the process a bit more manageable during a time of grief.

Initial Steps and Notifications

Before diving into paperwork, it's crucial to understand the immediate actions:

- Notify Family and Friends: Inform close relatives and friends about the death.

- Obtain Death Certificate: Multiple certified copies will be needed for various legal processes.

- Contact Professionals: This includes the funeral home, doctors, lawyers, and any relevant financial or legal advisors.

Required Legal Documents

Death Certificate

A death certificate is a legal document that certifies the cause, time, and place of death. Here’s how to proceed:

- Request multiple copies from the funeral home or directly from the county clerk’s office in Michigan.

- Expect to pay a fee for each copy, as these are necessary for closing financial accounts, claiming life insurance, and settling estate matters.

Will or Trust

If the deceased left a will or trust, it will dictate how assets are distributed:

- Locate the original will or trust document, which might be with their attorney, at home, or in a safe deposit box.

- Notify the executor of the will or successor trustee to begin the probate or trust administration process.

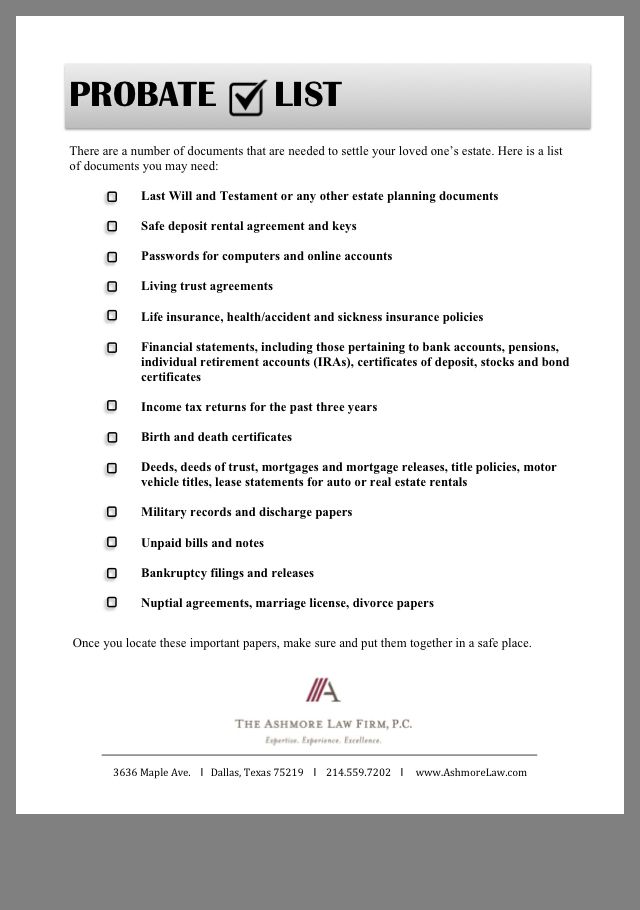

Probate Court Documents

Without a will, or if the estate involves certain assets, probate might be necessary:

- File a petition for probate with Michigan Probate Court if the estate is taxable or there are disputes.

- Fill out and submit forms like the Petition for Probate, Proof of Will, and Letters Testamentary.

📝 Note: If the estate is small (less than $22,000 in total assets, excluding vehicles and real estate), a Small Estate Affidavit can be used to avoid formal probate proceedings.

Life Insurance Policy Documents

Life insurance proceeds can offer financial support to the beneficiaries:

- Gather all life insurance policies. These documents are crucial for filing claims.

- Complete and submit claim forms along with a certified copy of the death certificate.

Bank and Financial Accounts

To manage bank accounts:

- Present the death certificate to the bank to begin the process of closing or transferring joint accounts.

- Request statements from all financial institutions to understand the assets involved.

Property Deeds

If real property is involved:

- File a death certificate with the county recorder’s office to transfer ownership.

- Understand and comply with Michigan’s Homestead and dower laws if applicable.

Key Considerations

Here are some important aspects to consider when dealing with post-death paperwork:

- Estate Tax Returns: If the estate’s value is substantial, file federal and Michigan estate tax returns.

- Creditor Claims: Notify creditors and settle debts to avoid legal complications.

- Inheritance Tax: While Michigan has repealed its inheritance tax, other states might still apply.

Final Thoughts

Navigating the paperwork after a death in Michigan can be intricate and requires attention to detail. By understanding the required documents and processes, you can help ensure your loved one’s wishes are honored and their estate is settled appropriately. Remember, while this guide provides a general overview, seeking legal or estate planning advice tailored to your situation can offer further clarity.

What documents are necessary to close a bank account of a deceased person?

+

You will need a certified copy of the death certificate, the will if available, and documents proving your authority like Letters Testamentary or a Small Estate Affidavit, along with your identification.

How many death certificates should I request?

+

It's advisable to obtain at least 10 certified copies. Each financial institution or entity might require one for their records.

What if the deceased owned property in multiple states?

+

You might need to file for ancillary probate in each state where the deceased held property to legally transfer ownership.

Can I manage the estate myself or do I need a lawyer?

+

While you can manage an estate yourself, especially in small or straightforward estates, legal representation can be beneficial for navigating complex legalities or disputes.

What if there is no will?

+If there's no will, Michigan's intestacy laws govern asset distribution, which might not align with the deceased's wishes. A formal probate process will be necessary.