5 Essential Tax Documents You Need for Filing

Introduction to Essential Tax Documents

Every year, millions of individuals and businesses go through the process of tax filing, a task that can be significantly eased with the right preparation and understanding of the essential documents involved. Being well-versed in the key tax documents not only streamlines the process but can also ensure that you claim all deductions and credits you’re entitled to, potentially lowering your tax liability or increasing your refund. In this post, we will explore the five essential tax documents you need for filing your taxes:

- W-2 Forms: For reporting wages from an employer.

- 1099 Forms: For income other than wages, like freelance work or interest income.

- 1098 Forms: For mortgage interest or educational expenses.

- Records of Deductible Expenses: Including receipts for charitable contributions, medical bills, and more.

- Previous Year’s Tax Return: As a helpful reference for comparison and accuracy.

Let’s delve into each of these crucial documents and explain why they are important for your tax return.

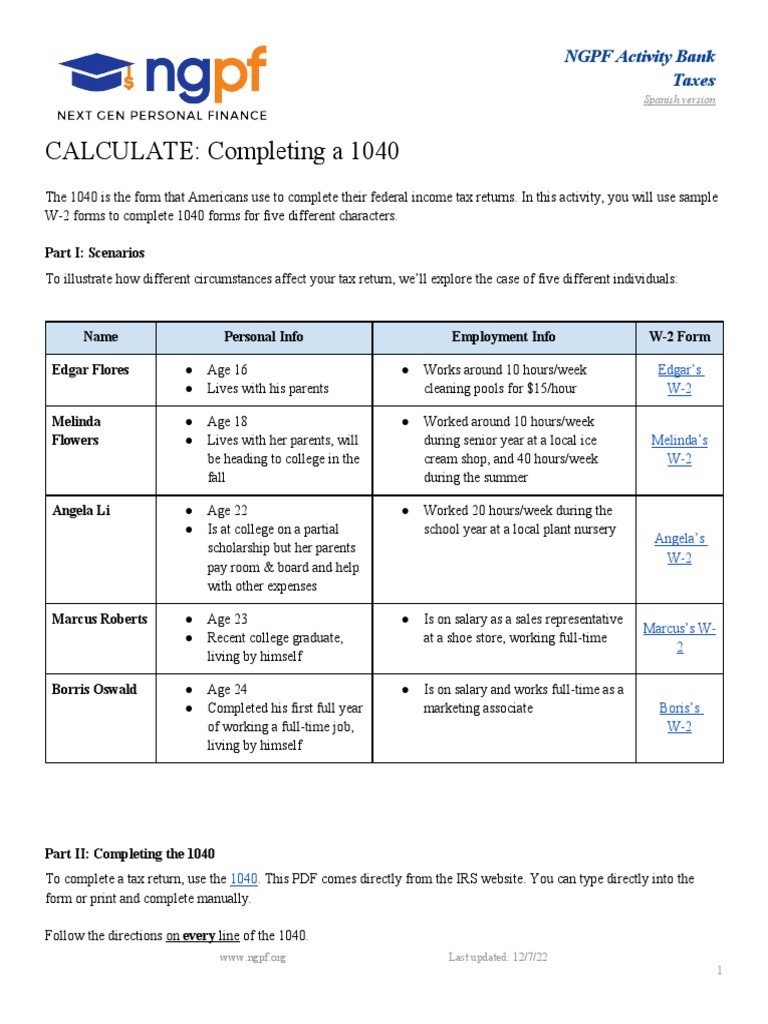

W-2 Form: Understanding and Importance

The W-2 form, issued by employers to employees, is the foundational document for filing taxes. Here’s why it’s vital:

- Earned Income: The W-2 reports your total annual wages, including bonuses, commissions, and any other earnings.

- Withholding: It details how much federal, state, and sometimes local income taxes your employer withheld from your paychecks.

- Social Security and Medicare Contributions: Also known as FICA taxes, these contributions are noted on the form.

🔍 Note: If you receive a W-2 from multiple employers, you'll need to include all of them when filing your taxes.

1099 Forms: A Guide to Non-Wage Income

If you’re not an employee but work as an independent contractor, receive income from investments, or other sources, you’ll deal with various 1099 forms:

- 1099-MISC: For miscellaneous income from freelancing, services, or rental property payments.

- 1099-INT: For interest income from savings accounts, bonds, etc.

- 1099-DIV: For dividend payments.

- 1099-K: For payments from third-party networks like PayPal or Venmo.

| Type | Description |

|---|---|

| 1099-MISC | Miscellaneous income |

| 1099-INT | Interest income |

| 1099-DIV | Dividend payments |

| 1099-K | Payments from online platforms |

Each form represents a different type of income, and it’s essential to report this income correctly to avoid penalties.

1098 Forms: Mortgage and Educational Expenses

The 1098 forms are significant for taxpayers who have paid mortgage interest or incurred educational expenses:

- 1098: For mortgage interest, which can be deducted if you itemize your deductions.

- 1098-E: For student loan interest paid during the year, which is deductible up to $2,500 for eligible taxpayers.

- 1098-T: For tuition payments or scholarships received, which helps determine the educational credits you can claim.

📚 Note: Be sure to check eligibility requirements for deductions and credits related to these expenses.

Records of Deductible Expenses

Here are some key items to document:

- Charitable Contributions: Receipts from donations to qualified organizations.

- Medical Expenses: Receipts or statements showing out-of-pocket medical expenses exceeding 7.5% of your AGI.

- Home Office Expenses: If you qualify, keep detailed records of your office expenses.

- Business Expenses: For self-employed individuals, documenting all business-related costs.

💡 Note: Document these expenses accurately to substantiate your deductions during an audit.

Your Previous Year's Tax Return

Looking at your previous year’s tax return is beneficial for:

- Comparative Analysis: To spot changes in your tax situation.

- Error Prevention: To ensure consistency in the information you provide.

- Documentation: Useful for items like carryover losses, passive activity losses, or charitable contributions.

Final Thoughts on Your Tax Documents

To file your taxes accurately, understanding and organizing these five essential tax documents is crucial. From W-2s to past tax returns, each document plays a pivotal role in your tax filing journey. Here are some key points to take away:

- Preparation is Key: Gather all documents before you start to avoid missing deadlines or potential audits.

- Deductions and Credits: Knowing what documents you need can help you take advantage of all deductions and credits you qualify for.

- Consistency: Ensure your current filings are consistent with past returns to maintain compliance and accuracy.

Remember, tax laws can change, so staying informed or consulting with a tax professional can help ensure you’re always on top of your tax obligations.

What if I don't receive my W-2 by mid-February?

+

If you haven't received your W-2 by mid-February, you should contact your employer. If there's no response, you can contact the IRS for assistance.

Can I file my taxes without a 1099?

+

Yes, you can estimate your income from your records and file your taxes. However, you'll need to amend your return if you receive the 1099 later.

Do I need to keep my tax documents after filing?

+

Absolutely. You should retain tax records for at least 3 years from the date you filed, or up to 7 years if you claimed a loss or deduction, and indefinitely for property transactions.