Navigating Window Tax Paperwork: What You Need to Know

Ever since the introduction of the Window Tax, many homeowners and property managers have felt the squeeze of this unique form of taxation. While often viewed as a curious historical quirk, the tax continues to impact property owners today. In this comprehensive guide, we'll dive deep into the essentials of navigating window tax paperwork, ensuring you understand the implications, processes, and how you can manage this tax effectively.

Understanding Window Tax

The Window Tax was first introduced in England in 1696 as a form of property tax. Initially, it was levied on the number of windows in a house, with the aim to tax wealth, but it had the unintended consequence of affecting natural light and ventilation in homes. Over time, various reforms and changes have made it more than just a historical relic.

The Window Tax was first introduced in England in 1696 as a form of property tax. Initially, it was levied on the number of windows in a house, with the aim to tax wealth, but it had the unintended consequence of affecting natural light and ventilation in homes. Over time, various reforms and changes have made it more than just a historical relic.

How Window Tax Works Today

Today, the window tax has evolved:

- Assessments: Properties are assessed based on window count and other metrics.

- Liability: The tax liability can fall on property owners or tenants, depending on the location and agreement.

- Exemptions: Certain types of properties or windows might be exempted based on legislation or renovations.

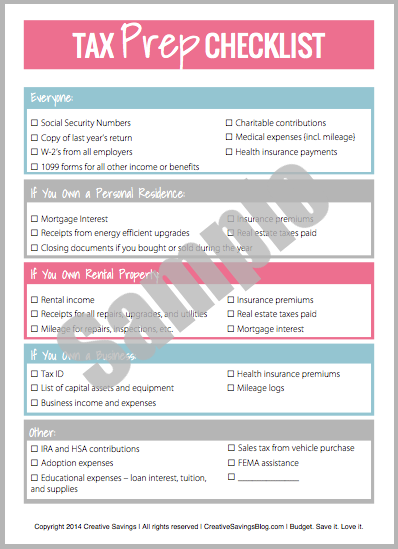

Collecting Your Documents

Before delving into the paperwork, ensure you have:

- Property title deeds or lease agreements

- Latest property valuation or tax assessment

- Any exemptions or modifications notices

📝 Note: Ensuring you have all documents in order can significantly expedite the process of filing your window tax returns.

Filing Your Window Tax Returns

Filing your window tax returns might seem daunting, but with these steps, you can manage:

- Identify the Tax Jurisdiction: Determine which entity (local, state, or federal) is responsible for collecting the window tax.

- Fill Out the Necessary Forms: Obtain the relevant forms, usually available from tax authorities or online platforms.

- Calculate Your Tax: Use the number of windows, along with any valuation and exemptions, to calculate your tax due.

- Submit Your Return: Either file online or mail your forms, making sure to keep copies for your records.

| Property Type | Number of Windows | Base Tax Rate | Exemptions |

|---|---|---|---|

| Residential | Up to 10 | £50 per window | Energy efficiency upgrades |

| Commercial | Unlimited | £100 per window | Historic building status |

Tax Strategies and Reliefs

Here are some strategies to manage or reduce your window tax:

- Invest in Energy Efficient Windows: Some jurisdictions offer tax relief for properties that improve energy efficiency.

- Legal Consultation: Sometimes, hiring a tax advisor can lead to significant savings through exemptions and legal loopholes.

💡 Note: Even minor modifications like sealing windows can influence your tax bracket, so ensure any changes are officially recorded.

Common Mistakes to Avoid

When dealing with window tax paperwork, watch out for:

- Incorrect Window Count: Counting windows incorrectly can lead to either underpayment or overpayment.

- Failing to Update Information: Any modifications to your property should be reported to avoid discrepancies in your tax assessments.

Future Trends and Implications

The window tax landscape is continually evolving:

- Technology Integration: New software is being developed to simplify the process of filing returns.

- Environmental Considerations: Increased focus on green initiatives might influence tax policies in the coming years.

As we navigate through the nuances of window tax, understanding its history and current implications is key. It’s not just about windows; it’s about property management, taxation laws, and adapting to changes in how we live and manage our homes. By staying informed, properly documenting your property changes, and strategizing your tax filings, you can effectively manage this unique tax. Being proactive can save time, money, and ensure compliance with ever-changing tax regulations, enhancing your property's value while reducing the financial burden.

What is the history behind the Window Tax?

+

The Window Tax was introduced in England in 1696 by King William III as a means to generate revenue without increasing income tax. It taxed houses based on the number of windows, leading to unintended consequences like bricking up windows to avoid the tax.

How can I calculate my window tax liability?

+

Window tax is calculated based on the number of windows, the property’s assessed value, and any applicable exemptions. Contact your local tax office or check online resources for specific formulas and rates.

Are there exemptions to the Window Tax?

+

Yes, exemptions can include energy-efficient windows, historical or heritage buildings, and specific renovations or modifications that might not be considered “windows” for tax purposes. Review the tax regulations in your area for more details.