5 Key Documents for Federal Taxes When Selling Your House

Selling your house can be an exhilarating yet stressful experience, primarily due to the financial implications it holds. One of the most crucial aspects of this process is handling federal taxes appropriately. Not only does it impact how much money you take away from the sale, but it also influences your financial planning for the near future. Here, we delve into the 5 key documents you will need when preparing for federal taxes after selling your home.

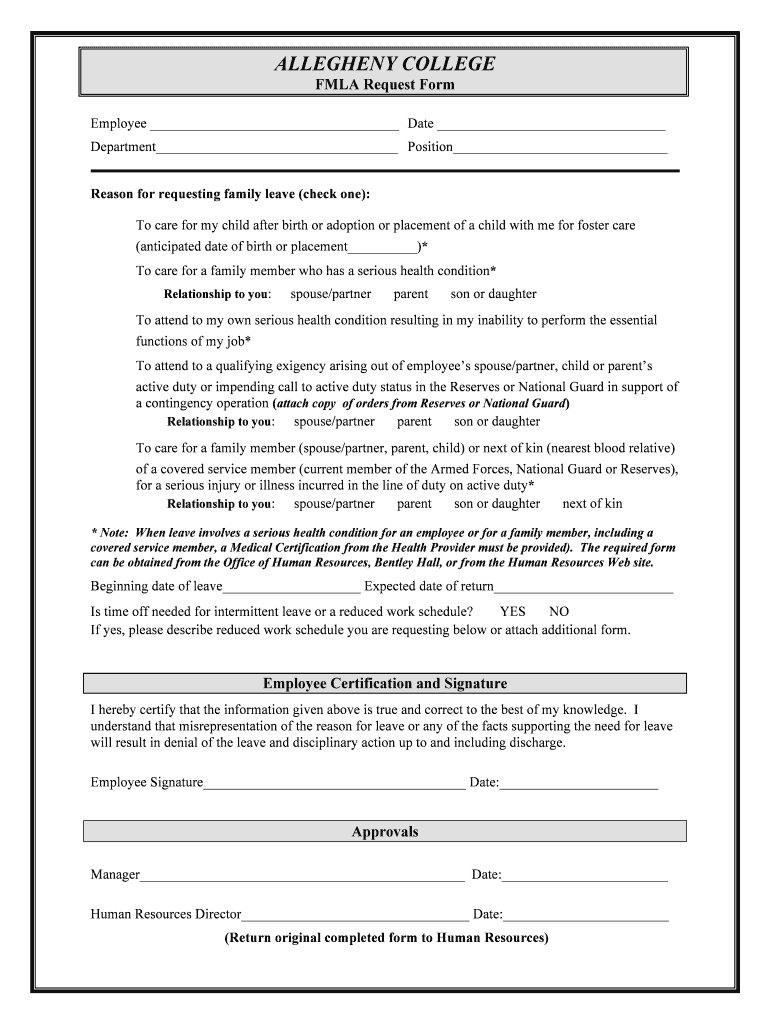

Finding the Cost Basis of Your Property

The first document you’ll need is one that establishes the cost basis of your property. This figure is critical as it’s used to determine if you have a capital gain or loss from the sale.

- Purchase Agreement or Settlement Statement - This document outlines what you paid for the property initially, including any upgrades or significant repairs made shortly after purchase.

- Deed of Trust or Mortgage Documents - These can help if you need to prove how much of the cost was financed through loans.

📝 Note: Original receipts or records of home improvements can also be considered part of the cost basis and might increase your gain exclusion if properly documented.

Proving Your Ownership Duration

To benefit from certain tax exclusions, you must have owned and used the home as your primary residence for at least two out of the last five years. Key documents include:

- Property Deed - The date on the deed will confirm the start of your ownership.

- Utility Bills or Voter Registration - These documents can help prove residency if needed.

Calculating Your Gains

Having documents that detail the selling price and any associated costs is essential for calculating your taxable gains:

- Closing Statement - This provides a comprehensive breakdown of the final sales price, real estate agent commissions, closing fees, etc.

- Escrow Account Statements - These can reflect payments made for taxes, insurance, and PMI if applicable.

Home Improvement and Repair Documentation

If you’ve made any substantial improvements or repairs, keeping records is crucial. These could:

- Add to your cost basis, potentially reducing taxable gain.

- Help in determining gain exclusions for tax purposes.

Record of Losses or Casualty Events

In the unfortunate event that your property was affected by casualty (like natural disasters), having documentation of:

- Insurance claims - Show financial losses and compensations.

- Repair or Replacement Estimates - If you’ve opted not to repair, these can support claims for loss in value.

🚨 Note: If your property was previously claimed as a rental, remember to separate the documentation for the part of the property used as your primary residence from the rental portion.

After exploring these essential documents, one thing is clear: proper documentation is your key to navigating the federal tax landscape when selling your home. Organizing your records and understanding what each document contributes to your tax reporting can make the process smoother and potentially reduce your tax liability.

How long should I keep my tax-related documents?

+

The IRS typically recommends keeping tax documents for at least three years after you file your return. However, if you claim a loss from worthless securities or bad debts, keep records for seven years. For property transactions, keeping records indefinitely is often beneficial.

What if I made improvements but don’t have receipts?

+

If possible, gather any other forms of documentation like canceled checks, credit card statements, or affidavits from contractors. In some cases, photographs and permits can also serve as evidence of the improvements made.

Can I claim a tax deduction for selling my house?

+

Generally, the sale of your primary residence does not result in a tax deduction, but rather, you might be eligible for an exclusion of up to 250,000 (500,000 for married couples filing jointly) from capital gains tax.