Mortgage Paperwork: What You Need to Know

Buying a home is an exciting milestone, but navigating through the maze of mortgage paperwork can sometimes dampen the spirits of even the most eager homebuyers. Whether you're a first-time buyer or seasoned in the housing market, understanding the paperwork involved can help streamline the process and reduce stress. This comprehensive guide will walk you through the essential mortgage documents, what each entails, and how to prepare for your mortgage application journey.

The Basics of Mortgage Paperwork

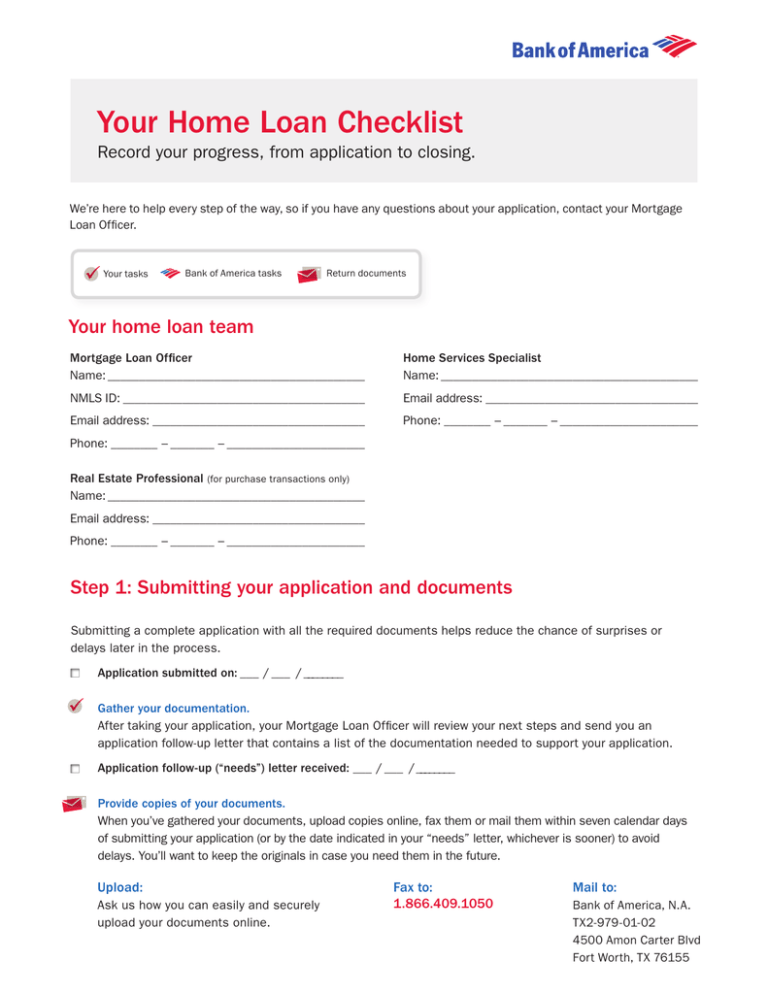

Mortgage paperwork is not just a formality; it's a critical part of the home buying process. Here are the fundamental documents you'll encounter:

- Loan Estimate: Within three business days of your application, lenders provide this form detailing the proposed terms of your loan. It includes estimated interest rates, monthly payments, closing costs, and more.

- Closing Disclosure: This document is given at least three business days before closing and outlines the final terms of your loan, detailing any changes from the Loan Estimate.

- Application Document: Also known as the 1003 form or Uniform Residential Loan Application, this document captures your personal, employment, and financial details.

Essential Documents for Your Mortgage Application

Before your lender can consider you for a mortgage, they'll need several pieces of documentation to assess your creditworthiness:

- Proof of Income: Typically, lenders require recent pay stubs, W-2 forms, and tax returns for the past two years to verify your income stability and capability to repay the loan.

- Bank Statements: Lenders will look at the last 2-3 months of statements from all your financial accounts to verify your assets.

- Credit Report: Your credit score is pivotal in determining loan eligibility. Lenders will pull your credit report to assess your credit history.

💡 Note: Ensuring all documents are in order from the outset can significantly speed up the underwriting process.

Understanding the Underwriting Process

The underwriting process is where the real scrutiny happens. Here, lenders assess:

- Risk Assessment: They evaluate your risk of defaulting on the loan, considering your credit, income, debt-to-income ratio, and assets.

- Appraisal: An independent appraisal to determine the home's market value ensures the property is worth the loan amount.

- Title Search: This confirms that there are no liens or issues with the property title, which could complicate your ownership.

💡 Note: Keep in mind that delays in underwriting can come from missing or unclear documents, so having everything prepared can expedite this stage.

Additional Paperwork for Different Mortgage Types

Depending on the type of mortgage you're applying for, additional documents might be required:

- FHA Loans: Additional paperwork might include proof of employment, a homebuyer education certificate, and possibly gift funds documentation.

- VA Loans: Veterans Affairs loans require a Certificate of Eligibility along with proof of income and possibly a Certificate of Reasonable Value (CRV) for the property.

- Conventional Loans: Might require larger down payments or PMI if your down payment is less than 20%, leading to additional insurance and fee disclosures.

| Mortgage Type | Additional Documents |

|---|---|

| FHA | Homebuyer Education Certificate, Gift Letter |

| VA | COE, CRV |

| Conventional | Private Mortgage Insurance (PMI) documentation |

Dealing with Paperwork: Tips for Efficiency

Here are some strategies to manage the plethora of mortgage paperwork effectively:

- Organize Your Documents: Keep everything in one place and use digital tools to help manage and track paperwork.

- Stay in Communication: Keep open lines with your lender. Any changes in your financial status or employment should be communicated immediately.

- Read Carefully: Don't just sign documents. Understand what you're agreeing to, and ask questions if something is unclear.

💡 Note: A proactive approach to documentation can prevent last-minute surprises that might delay your closing.

In the whirlwind of buying a home, mortgage paperwork might seem like an overwhelming task, but with a solid understanding of what’s required and the right preparation, the process becomes much more manageable. You now have a clearer picture of what mortgage documents to expect, how to prepare for underwriting, and the special considerations for different mortgage types. Your due diligence in handling these documents can lead to a smoother, less stressful home-buying journey, enabling you to focus on the excitement of becoming a homeowner rather than the stress of paperwork.

What is the difference between a Loan Estimate and a Closing Disclosure?

+

The Loan Estimate provides an initial estimate of loan terms, costs, and details soon after you apply. The Closing Disclosure, on the other hand, reflects the final terms and actual costs after negotiations and changes have been made, ensuring you’re fully aware of the financial commitment before closing.

How long does the underwriting process typically take?

+

The underwriting process can range from a few days to several weeks, depending on the complexity of your case, the completeness of your application, and the efficiency of your lender’s underwriting team.

Can I still get a mortgage if I have less than perfect credit?

+

Yes, while having a higher credit score can lead to better loan terms, there are options for those with lower scores. FHA loans, in particular, are more lenient with credit requirements. However, expect higher interest rates and possibly higher down payments or PMI costs.

What happens if there’s a discrepancy in my paperwork?

+

If there’s a discrepancy, the lender will likely request clarification or additional documents. This can cause delays, so it’s crucial to double-check your information for accuracy before submission.

Do I need a real estate attorney to help with mortgage paperwork?

+

While not always required, having a real estate attorney can be beneficial, especially in complex transactions or when navigating state-specific laws. They can provide legal advice, review contracts, and represent you during closing.