Essential Tax Paperwork: What to Keep and Why

Essential Tax Paperwork: What to Keep and Why

Understanding which tax documents you need to keep and why they are important is crucial for managing your financial health and ensuring compliance with tax laws. Here's a guide to help you navigate the maze of tax paperwork effectively.

Why Keep Tax Documents?

Maintaining accurate records of your tax documents is not just about compliance; it's about:

- Audit Protection: Having the necessary documents can prove your claims if audited by the IRS.

- Deductible Expenses: Keeping records helps in verifying deductions and reducing taxable income.

- Legal Compliance: Ensures you meet legal obligations for both federal and state taxes.

- Financial Planning: Detailed tax records can offer insights for better tax planning in the future.

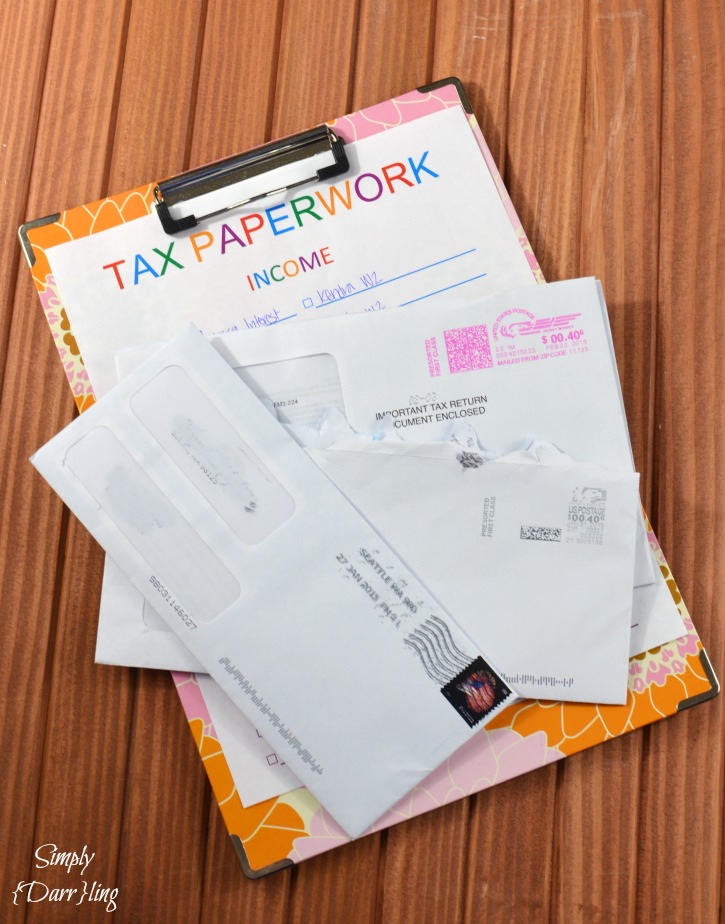

What Tax Documents to Keep

Below are the key documents you should retain:

- W-2 Forms: For wage and salary income, detailing total earnings, taxes withheld, and other deductions.

- 1099 Forms: For income from self-employment, interest, dividends, retirement, and miscellaneous income.

- Records of Deductible Expenses: Keep receipts for business expenses, travel, charitable contributions, etc.

- Investment Records: Brokerage statements, trade confirmations, and records of capital gains/losses.

- Health Expenses: Medical bills, insurance premiums, and receipts for medical equipment or services.

- Home Ownership: Mortgage interest statements, property tax records, and home improvement receipts.

- Education Expenses: Tuition statements, student loan interest, and other education-related costs.

- Gambling Winnings and Losses: Records of casino winnings, horse racing, and other gambling activities.

- Estate and Inheritance Documents: Documents related to inheritances, gifts, or estate planning.

✨ Note: Keep digital copies of your tax documents. Digitizing records reduces clutter and makes it easier to retrieve documents when needed.

How Long to Keep Tax Documents

The duration for retaining tax documents varies:

- 3 Years: General rule for keeping most tax returns and supporting documents.

- 6 Years: If you fail to report income that should have been reported, keep records for this duration.

- Indefinitely: Documents related to capital assets like homes, investments, or businesses.

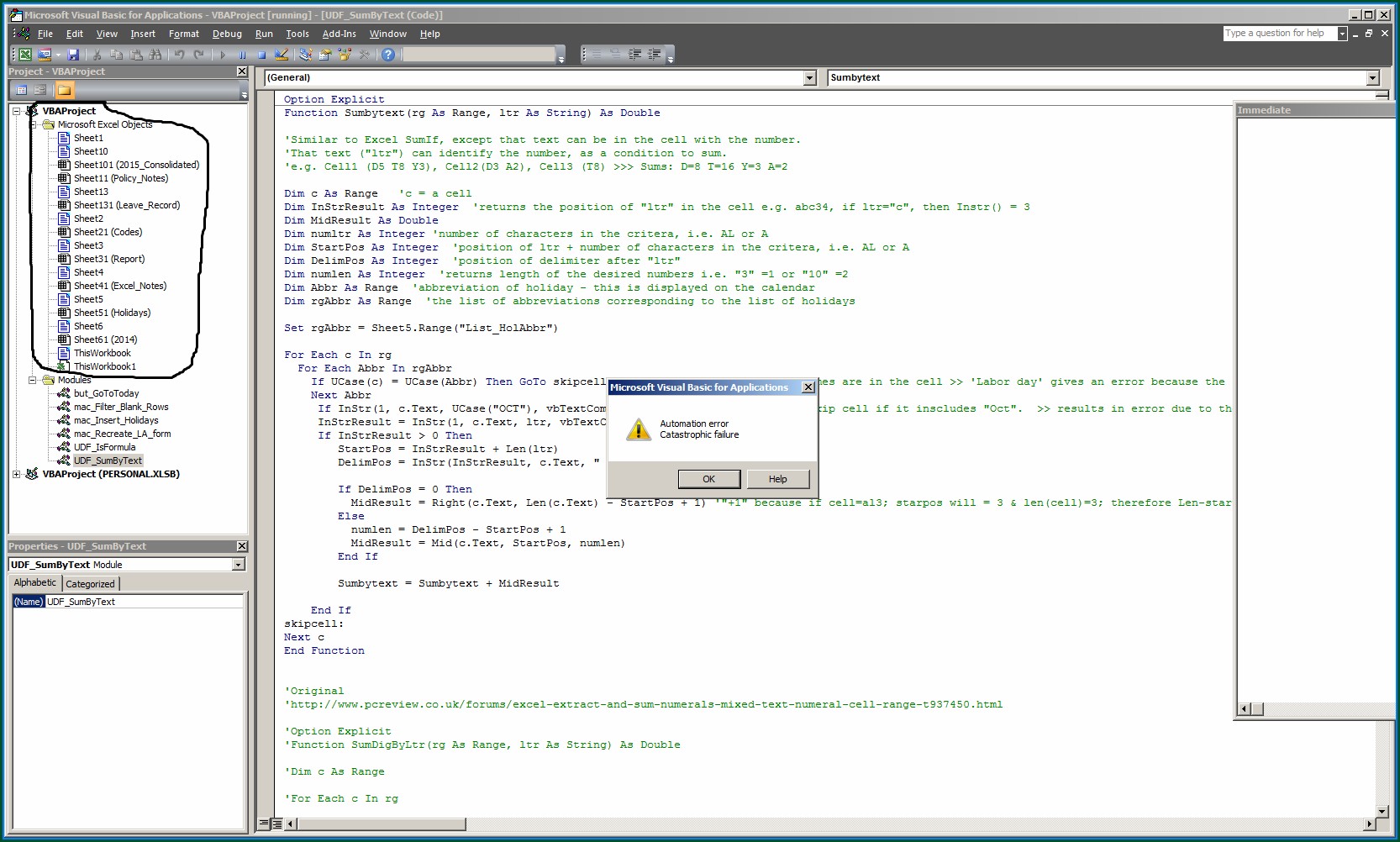

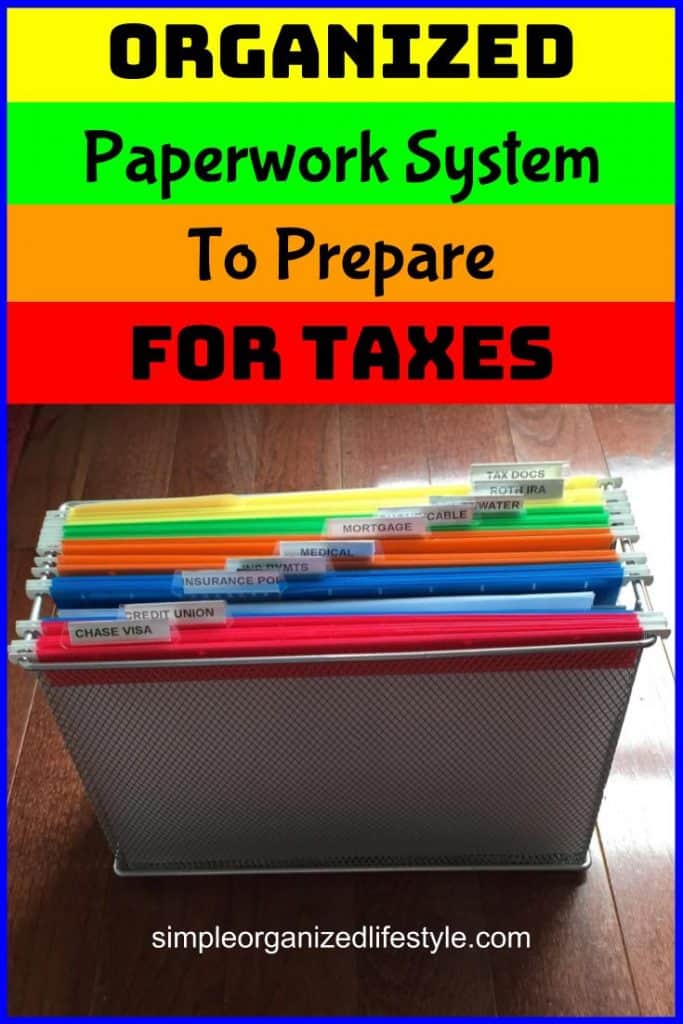

Best Practices for Keeping Tax Documents

To maximize the benefits from retaining tax documents:

- Organize Early: Maintain an organized filing system from the start of the tax year.

- Back Up: Keep both digital and physical backups to protect against loss or damage.

- Regular Updates: Update your records regularly to ensure they're complete and accurate.

- Secure Storage: Store tax documents in a secure, locked location or a cloud storage service with strong security measures.

- Shredding: Dispose of outdated documents properly by shredding them to prevent identity theft.

The key to a smooth tax filing process and protection against unforeseen audits lies in maintaining well-organized and comprehensive tax records. By following these guidelines, you ensure financial security and peace of mind during tax season and beyond. Proper record keeping not only aids in potential audits but also facilitates better financial planning, allowing you to make informed decisions about your tax liabilities and deductions in the future.

What should I do if I lose my tax documents?

+

If you lose your tax documents, contact the issuer of the documents like your employer, financial institution, or insurance provider. Alternatively, if you have digital backups, you can retrieve the documents from there.

Can I deduct my home office expenses if I’m self-employed?

+

Yes, you can deduct home office expenses if you use part of your home regularly and exclusively for business purposes. Ensure to keep detailed records of your home office use and related expenses.

What happens if I don’t keep proper records?

+

Improper recordkeeping might result in difficulties during audits, disallowed deductions, fines, or penalties. It also makes financial planning and tax preparation more challenging.

How do I store my tax documents securely?

+

Use a combination of physical and digital storage methods. Physically, keep documents in a locked safe or fireproof cabinet. Digitally, use encrypted cloud storage with strong passwords and two-factor authentication.