Essential Paperwork for Hiring Your First Employee

The process of expanding your business to include new hires is an exciting milestone, but it's also one that comes with significant responsibilities. One of the key aspects of hiring an employee for the first time involves managing various forms of paperwork. This guide will walk you through the essential documents you need to prepare, collect, and understand when you hire your first employee.

Employment Application and Background Checks

Before you even offer a position, you’ll need to start with a few key documents:

- Application Form: This is the standard document that requests all basic information about a candidate. It helps screen applicants and can be a basis for interviews.

- Authorization for Background Check: With the candidate’s permission, this document allows you to perform a background check, which is crucial for verifying employment history, education, and potentially criminal records.

🔍 Note: Always inform candidates that you will perform a background check. Transparency helps in building trust and ensures compliance with legal standards.

Offer Letter

Once you’ve decided on a candidate, an offer letter sets the stage for employment:

- Detail the job title, start date, salary, work schedule, and any other employment terms.

- Include information about benefits or perks they will receive.

- Request their acceptance or rejection of the offer.

Employment Agreement

This document formalizes the terms of employment:

- Specify the employee’s title, duties, compensation, benefits, and working hours.

- Include confidentiality clauses, non-compete agreements, or exclusivity terms if applicable.

| Clause | Description |

|---|---|

| Non-compete Agreement | Prevents the employee from working for competitors for a certain period after leaving the company. |

| Confidentiality | Protects company information by restricting employees from disclosing sensitive information. |

📝 Note: Be aware that non-compete clauses might be illegal or restricted in some jurisdictions. Always consult legal advice.

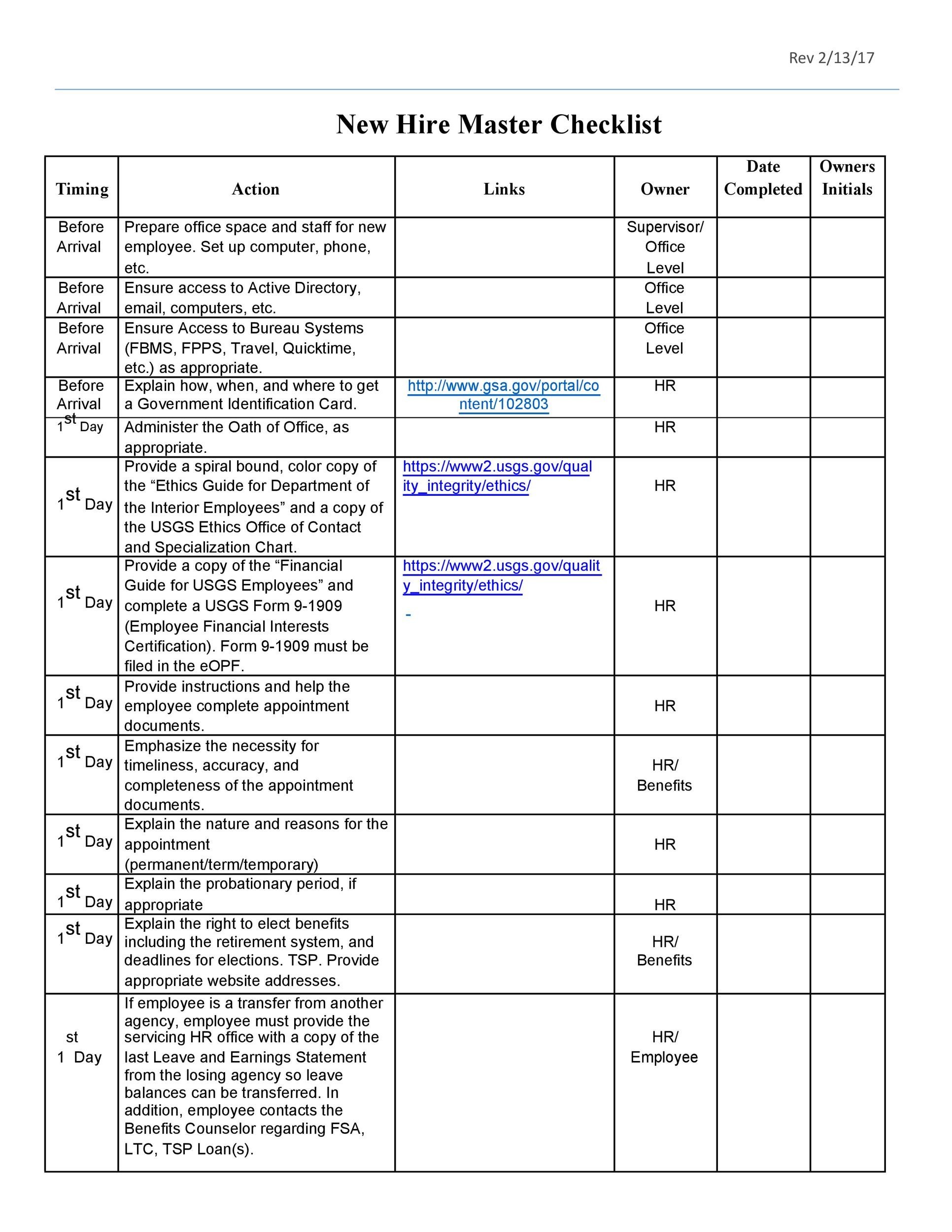

New Hire Paperwork

Once your new employee has accepted the offer, you’ll need to gather a slew of documents:

- W-4 Form: For US employers, this form determines the amount of tax to withhold from the employee’s paycheck.

- I-9 Form: Employees must complete this form to verify their identity and employment eligibility.

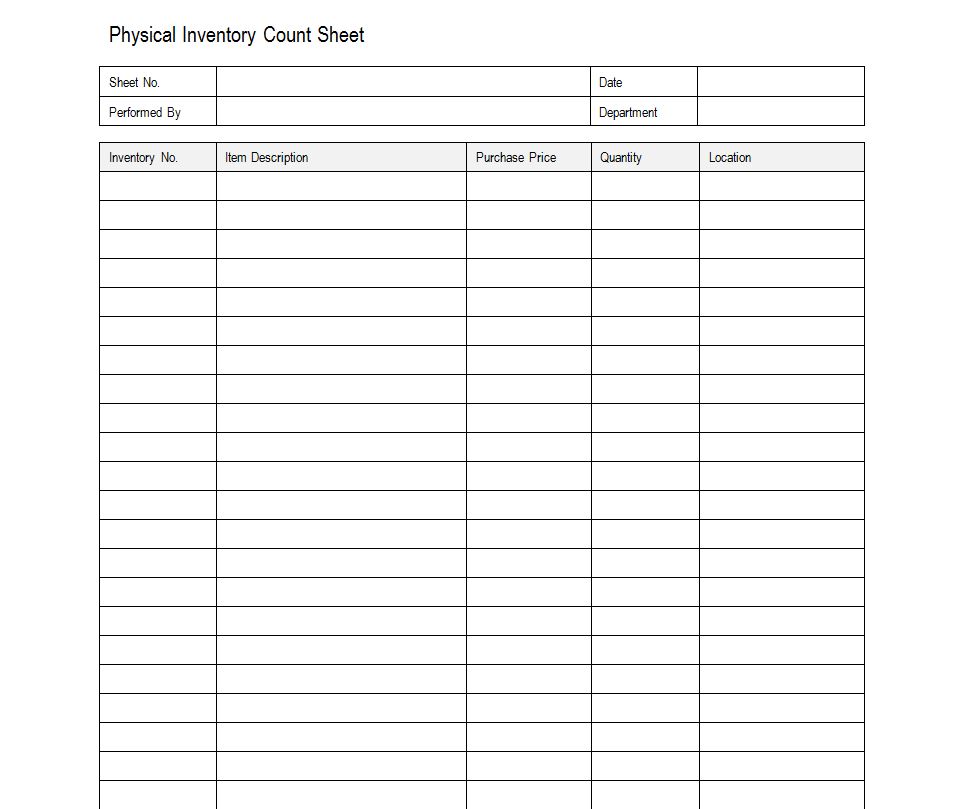

- Employee Information Form: Collects essential data for payroll, emergency contacts, etc.

- Direct Deposit Authorization: Allows the employer to transfer the employee’s salary directly into their bank account.

Benefit Forms

If you offer benefits like health insurance, retirement plans, or stock options, these forms will need to be completed:

- Health insurance forms

- Retirement plan forms

- Stock option or employee ownership plan agreements

💡 Note: Ensure you provide clear instructions for filling out these forms to avoid delays or errors in enrollment.

State-specific Requirements

Many states in the US have additional requirements for new hires:

- Unemployment Insurance: You must report new hires to your state’s employment security commission for unemployment insurance purposes.

- Workers’ Compensation: Ensure the new employee is covered by workers’ compensation insurance, and sometimes you’ll need to provide proof or documentation.

- State Income Tax Withholding: Some states require withholding forms for state income taxes.

Compliance with Labor Laws

Understanding and complying with labor laws is crucial:

- Familiarize yourself with laws regarding minimum wage, overtime, breaks, and work hours.

- Keep records in compliance with the Fair Labor Standards Act (FLSA) and other relevant regulations.

By preparing and understanding these documents and requirements, you pave the way for a smooth onboarding process. Remember, each form, from the application to the benefit forms, plays a crucial role in establishing a legal and transparent relationship with your new employee. Keeping these documents organized and accessible will not only streamline your HR processes but also demonstrate your professionalism and commitment to your employees' well-being.

Can I hire someone without an employment agreement?

+

Yes, you can hire someone without a formal employment agreement. However, having one in place helps to clearly define the terms of employment, protect intellectual property, and can prevent misunderstandings. It’s always recommended to have some form of written agreement even if it’s not overly detailed.

What if an employee doesn’t want to provide a Social Security Number for the I-9?

+

The I-9 form does not require a Social Security Number to verify employment eligibility, but it does require documentation to prove identity and work authorization. If an employee chooses not to provide a SSN for tax purposes, they can still complete the I-9 with other acceptable documents.

How long should I retain HR documents for my employees?

+

According to the FLSA, you must keep payroll records for at least three years. I-9 forms should be retained for at least one year after employment ends or three years after the date of hire, whichever is later. Always check state laws as some might have different retention requirements.