Essential Paperwork Needed for Bankruptcy Filing

Introduction

Filing for bankruptcy can be a daunting and complex process, especially when considering the mountain of paperwork required. However, understanding and preparing the necessary documents is essential for a successful bankruptcy filing, whether you're an individual, a business owner, or representing a corporation. This post will guide you through the maze of paperwork, ensuring you know exactly what is needed to navigate this difficult journey with confidence.

The Importance of Documentation in Bankruptcy

Bankruptcy isn't just about telling the court your financial situation; it's about proving it through documentation. Here's why your paperwork is crucial: - Verification: Your documents verify your financial claims, ensuring that the court can accurately assess your situation. - Compliance: You must comply with the legal requirements, which include providing all necessary documents on time. - Transparency: Detailed documentation promotes transparency, essential for a trustee's review and potential creditor inquiries. - Protection: Proper documentation can shield you from potential legal challenges during and after the bankruptcy process.

Documents Required for Bankruptcy Filing

Personal Information

- Proof of Identity: Such as a driver’s license or passport, to establish your identity. - Social Security Number: Required for your credit report and official records.

Financial Records

- Credit Report: Obtain copies from all three major credit bureaus (Equifax, Experian, TransUnion) to provide a comprehensive view of your debt. - Bank Statements: For at least six months, including all accounts, to show your income and expenditures.

List of Creditors

- Names and addresses of all creditors. - Balance due to each creditor. - Any claims or disputes associated with those debts.

Income Verification

- Pay Stubs: Last 60 days’ worth from all income sources. - Tax Returns: Typically, the last two years, sometimes more depending on the type of bankruptcy. - Profit and Loss Statements: If you’re self-employed or have rental income.

Asset Information

- Property: Details about your home, including mortgage documents, tax assessments, and deeds. - Vehicles: Registration, titles, and loan agreements for all vehicles. - Personal Property: Jewelry, electronics, furniture, with estimated values.

Expense Verification

- Expense Records: Utility bills, rent/mortgage payments, insurance premiums, and other regular expenses. - Debt Payments: Records of payments made on your debts, especially if there have been recent changes.

💡 Note: Be thorough with your documents. Missing documents can delay your bankruptcy process or lead to rejection. Some courts may require additional documents or forms, so always check with your local bankruptcy court for specific requirements.

Business Specific Documents

If you own a business, here are additional documents you’ll need:

- Business Tax Returns: Typically, the last two years.

- Financial Statements: Including balance sheets, income statements, and cash flow statements.

- Lease Agreements: Copies of any business property leases.

- Inventory Lists: If you have physical stock.

- Customer List: If relevant to the business valuation.

Additional Documents for Chapter 13 Filings

- Income Schedules: Demonstrating your ability to make the proposed plan payments. - Plan Proposal: A detailed repayment plan.

Steps to Prepare for Bankruptcy Filing

Before diving into the paperwork, here are steps you should follow:

Educate Yourself: Understand the different types of bankruptcy and their implications. An attorney can provide legal advice tailored to your situation.

Gather Documents Early: Don’t wait until the last minute. Collect all financial documents as soon as you consider bankruptcy.

Review for Accuracy: Go through each document to ensure accuracy. Errors or omissions can complicate or delay your filing.

Organize: Use a system or tool to keep documents organized. Folders, binders, or digital file systems work well.

Pre-Bankruptcy Counseling: Attend a credit counseling session before filing. This is mandatory, and the certificate is required.

Budget Analysis: Understand your income and expenses to prepare for any potential means test or repayment plans.

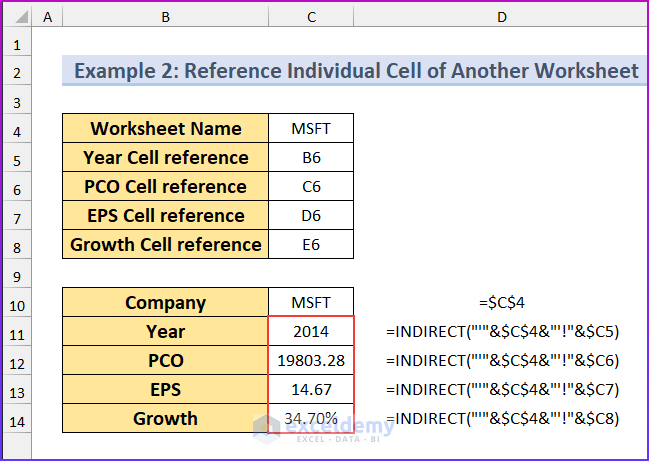

Table: Documents Checklist

| Category | Documents Required |

|---|---|

| Personal Information | Proof of Identity, Social Security Number |

| Financial Records | Credit Report, Bank Statements |

| List of Creditors | Names, Addresses, Balance Due, Disputes |

| Income Verification | Pay Stubs, Tax Returns, Profit & Loss Statements |

| Asset Information | Property Details, Vehicle Titles, Personal Property |

| Expense Verification | Expense Records, Debt Payment Records |

🔑 Note: For business owners, ensure that you separate personal and business documentation for clarity and compliance.

To wrap things up, while the thought of filing for bankruptcy can be overwhelming, being well-prepared with the appropriate documents can streamline the process. From personal identification to income verification and expense records, each piece of paper tells a part of your financial story that helps the court make informed decisions. Remember, the more accurate and comprehensive your documentation, the smoother your bankruptcy filing will be.

Do I need an attorney to file for bankruptcy?

+

While you can file for bankruptcy without an attorney, it’s highly recommended to seek legal advice. Bankruptcy laws are complex, and an attorney can help ensure that you file the correct type of bankruptcy, navigate the legal processes, and possibly save you from costly mistakes.

How long does the bankruptcy process typically take?

+

The duration can vary, but generally, Chapter 7 can take about 3-6 months, while Chapter 13 can take 3-5 years, depending on the length of the repayment plan.

What happens to my debts if I file for bankruptcy?

+In a Chapter 7 bankruptcy, most unsecured debts like credit cards can be discharged. Chapter 13 allows you to reorganize your debts into a payment plan, potentially discharging some debts at the end of the plan. However, not all debts (like student loans or child support) can be discharged through bankruptcy.