Track Gambling Losses Without Paperwork: Simple Tips

Track Gambling Losses Without Paperwork: Simple Tips

The world of gambling, whether it's a casual visit to a local casino, betting on horse races, or an occasional online poker game, can be an exciting pastime. However, with the thrill of potentially winning big comes the responsibility of managing your finances properly. This includes keeping an accurate record of your gambling losses, which can often be as important as tracking your wins for tax purposes, budgeting, and even understanding your gambling behavior. But how can you track your losses effectively without the burden of extensive paperwork?

Why Track Gambling Losses?

Before diving into the how, understanding the why is crucial:

- Tax Deductions: If you itemize deductions on your tax return, gambling losses can offset gambling winnings, potentially reducing your taxable income.

- Budgeting: Knowing your losses helps in setting a realistic gambling budget and preventing overspending.

- Behavioral Insights: Tracking can reveal patterns in your gambling habits, allowing for better control and responsible gambling.

Using Digital Tools to Track Losses

Technology has made tracking gambling losses simpler than ever. Here are several ways you can leverage digital tools:

Mobile Apps

There’s an app for nearly everything these days, including tracking gambling losses:

- Gambling Tracker Apps: Specialized apps like Gambler’s Diary or PokerBank provide interfaces where you can log your gambling sessions, specifying the type of game, amounts wagered, and losses.

- Budgeting Apps: Apps like Mint or YNAB (You Need A Budget) can categorize spending, including gambling expenses, allowing you to track losses within your overall financial picture.

Online Banking

Use your online banking tools to:

- Monitor transactions linked to gambling, either through casino ATMs, online gambling platforms, or cash withdrawals for gambling purposes.

- Set up notifications or alerts for gambling-related transactions to keep track of your gambling activities in real-time.

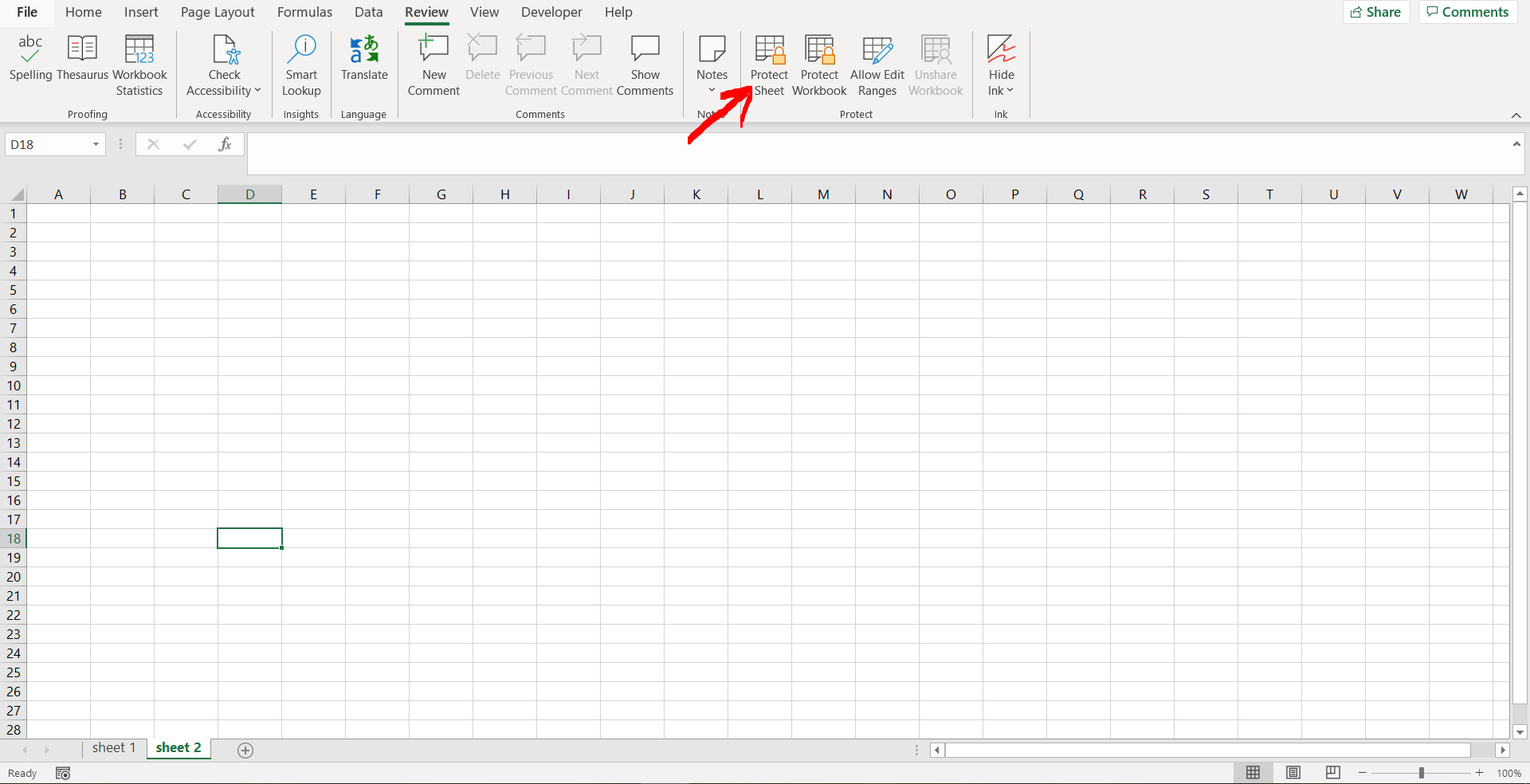

Spreadsheets

If you prefer a more hands-on approach:

- Set up a spreadsheet on platforms like Google Sheets or Microsoft Excel.

- Create columns for Date, Casino/Event, Game, Wager, Loss, and Notes.

Here’s a simple example of how to organize your gambling losses in a table:

| Date | Casino/Event | Game | Wager | Loss | Notes |

|---|---|---|---|---|---|

| 01/05/2023 | Luxor Las Vegas | Blackjack | 200</td> <td>100 | Double down on 11 | |

| 01/10/2023 | Online Poker | Texas Hold’em | 50</td> <td>40 | Playing on PokerStars |

📝 Note: Remember to back up your spreadsheets regularly to ensure you don’t lose your tracking data.

Email Records

If you engage in online gambling, your transactions often result in email receipts or confirmations:

- Set up a dedicated gambling email folder and sort your emails there.

- Use email search functions to compile all gambling-related emails to sum up losses quickly.

Tips for Effective Loss Tracking

Beyond the tools, here are some tips for making your tracking efficient:

- Consistent Logging: Make it a habit to log each gambling session immediately after you finish. This ensures accuracy and prevents forgotten sessions.

- Create Visual Reminders: Set reminders on your devices or use visual cues in your physical environment to prompt you to update your tracking.

- Categorize Sessions: Label sessions by game type or venue to better analyze where losses are most frequent or significant.

Summing Up

Tracking gambling losses doesn’t have to involve a mountain of paperwork. By utilizing digital tools, staying organized, and maintaining consistency, you can effectively keep tabs on your losses. This practice not only aids in tax preparation but also contributes to better financial management and responsible gambling. Remember, the goal isn’t just to avoid losing but to understand your gambling behavior better, manage your money wisely, and perhaps most importantly, enjoy your gambling experiences safely and responsibly.

Can I deduct my gambling losses from my taxes?

+

Yes, you can deduct gambling losses if you itemize your deductions on your tax return. However, you can only deduct losses up to the amount of your gambling winnings, and you must have records to support your claims.

What if I don’t remember every loss?

+

Focus on tracking from now on. Future consistency is more valuable than backlogged records. If you need to reconstruct past losses, do your best to gather evidence from your bank statements, casino records, or any available receipts.

Are there any legal requirements for tracking gambling losses?

+

While there’s no legal requirement to track gambling losses, keeping detailed records is advised for tax purposes and personal financial management. Some jurisdictions might require records to claim deductions on gambling winnings.

How can tracking my gambling losses help with budgeting?

+

By understanding your losses, you can better allocate your gambling budget. It helps prevent over-spending, and you can set realistic expectations for future gambling sessions.

What if I play games where losses aren’t easily quantifiable?

+

For games like poker where buy-ins and cash-outs can be tracked, record the difference. For games where tracking losses might be less straightforward, keep notes on approximate session times, stakes, and outcomes to estimate losses.