5 Tips to Create an Effective Expense Sheet in Excel

Mastering Your Expenses: 5 Tips to Create an Effective Expense Sheet in Excel

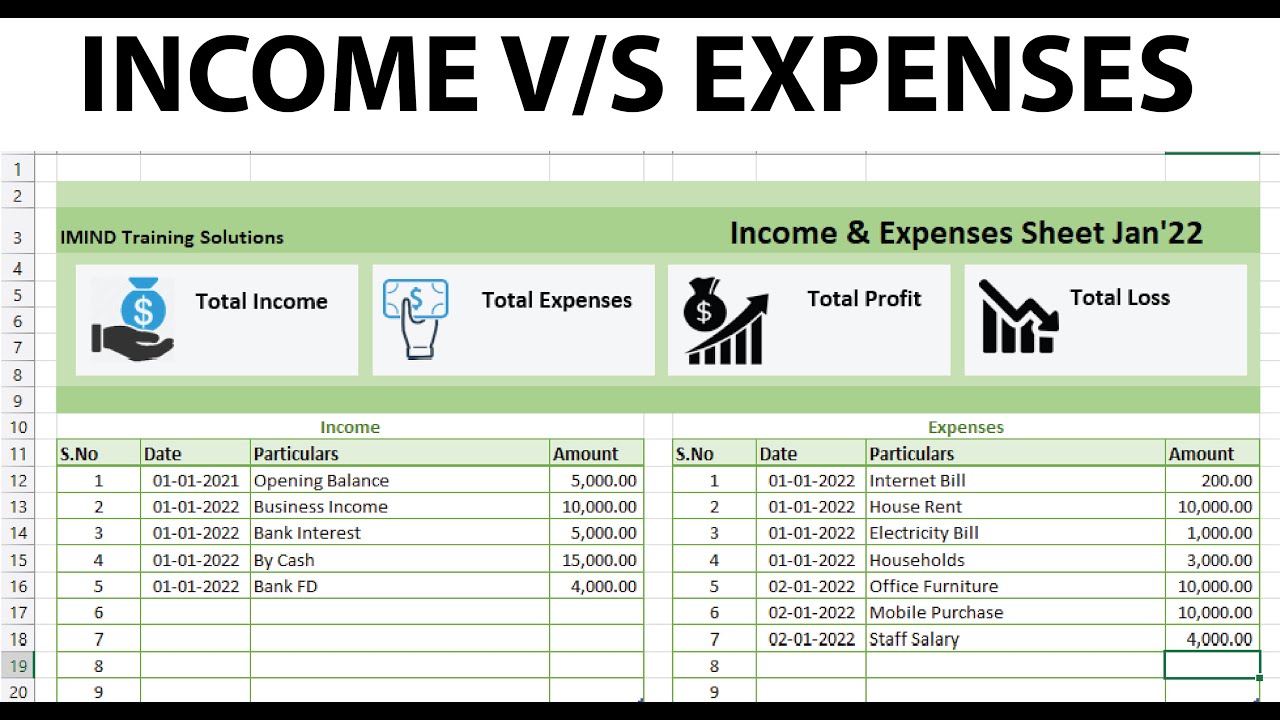

In today's fast-paced business environment, keeping track of your expenses is more important than ever. An effective expense sheet can streamline your financial management processes, ensuring you stay within budget while providing valuable insights into your spending habits. Microsoft Excel, with its powerful data organization and calculation tools, is an excellent choice for crafting such sheets. Here are five essential tips to help you create an effective expense sheet in Excel.

1. Organize Your Data Properly

The foundation of any good expense sheet is a well-structured dataset. Start by defining categories for your expenses:

- Date: When the expense was incurred.

- Category: Group your expenses into logical categories like travel, office supplies, utilities, etc.

- Amount: The cost of the expense.

- Description: A brief explanation of the expense.

- Payment Method: How the expense was paid (cash, credit card, etc.).

- Status: Whether the expense has been approved, paid, or is pending.

Place these column headers at the top of your sheet. You can use Date, Category, Amount, Description, Payment Method, and Status as column names to organize your data intuitively. This structure not only makes it easier to enter and retrieve information but also facilitates sorting and filtering.

2. Utilize Excel Functions for Summaries

Excel's functions like SUM, AVERAGE, COUNTIF, and VLOOKUP can transform your expense tracking:

- SUM: Add this formula to total expenses in specific categories or the entire month. E.g.,

=SUM(B2:B100)will sum all amounts in cell range B2 to B100. - AVERAGE: Calculate average monthly expenses or per-category spending.

- COUNTIF: Count how many expenses fall under a particular category or status.

- VLOOKUP: For more complex sheets, use this to look up an expense from another sheet or database.

💡 Note: Ensure to protect any cells with formulas to prevent accidental overwriting of your calculations.

3. Visualize Your Data with Charts

Excel allows you to present your expense data visually, making it easier to understand trends and anomalies:

- Pie Charts: Show the proportion of expenses in different categories.

- Line or Column Charts: Track expenses over time, revealing trends or seasonal variations.

- Sparklines: Embed small charts inside cells to provide quick overviews without taking up too much space.

Charts not only make your expense sheet more visually appealing but also help in presentations to stakeholders or during budget discussions.

4. Conditional Formatting for Insights

Use conditional formatting to automatically highlight key information:

- Highlight over-budget expenses in red or high-priority status items in another color.

- Set up rules to change the cell background color based on the amount spent, e.g., expenses over $500 could be marked differently.

This technique quickly draws attention to important data points, allowing for instant visual analysis of your expense sheet.

5. Regularly Update and Maintain Your Sheet

An expense sheet is only as good as its up-to-date information:

- Daily Input: Record expenses as they occur to avoid missing out on any transactions.

- Monthly Reconciliation: Review and reconcile your sheet with bank statements or receipts.

- Regular Cleanup: Remove old, irrelevant data and keep the sheet manageable.

Keeping your expense sheet updated not only ensures accuracy but also helps in making timely financial decisions.

In wrapping up, mastering the creation of an effective expense sheet in Excel is pivotal for any individual or business looking to manage their finances efficiently. By organizing your data systematically, employing Excel’s powerful functions, visualizing your data with charts, using conditional formatting for quick insights, and maintaining the sheet regularly, you set a solid foundation for financial health.

These tips will not only streamline your expense tracking but also enhance your understanding of financial flow, empowering you to make data-driven decisions. Embrace these practices, and you’ll be well on your way to financial clarity and success.

Can I link my bank account to automatically update my Excel expense sheet?

+

While Excel doesn’t directly link to bank accounts for real-time updates, you can manually import transactions from your bank statement in CSV format or use third-party financial software like Mint, which can sync with your bank and export data to Excel.

How often should I update my expense sheet?

+

It’s beneficial to update your expense sheet daily or as transactions occur. Monthly reconciliations are recommended to ensure all transactions are accounted for and to adjust your budget accordingly.

What are some common mistakes to avoid when creating an expense sheet in Excel?

+

Common mistakes include: not protecting formula cells, inconsistent data entry, neglecting to regularly back up the sheet, and not setting up categories or filters that reflect your business or personal needs. Be diligent in structuring your data for accuracy and ease of analysis.