Create Your Monthly Budget with Excel Easily

In today's fast-paced world, managing your finances effectively is more important than ever. An organized budget not only helps in keeping your financial health in check but also provides peace of mind. Microsoft Excel, a powerful tool already available on most computers, can transform your budgeting process into an easy and efficient task. Let's delve into how you can create your monthly budget using Excel, ensuring clarity in your financial planning.

Setting Up Your Excel Budget Sheet

Starting a budget in Excel can be straightforward if you follow these steps:

- Open Excel: Launch Microsoft Excel on your computer. You can use a blank workbook or download budget templates if available.

- Create Tabs: Use tabs to categorize different aspects of your financial life:

- Income

- Expenses

- Savings

- Investments (if applicable)

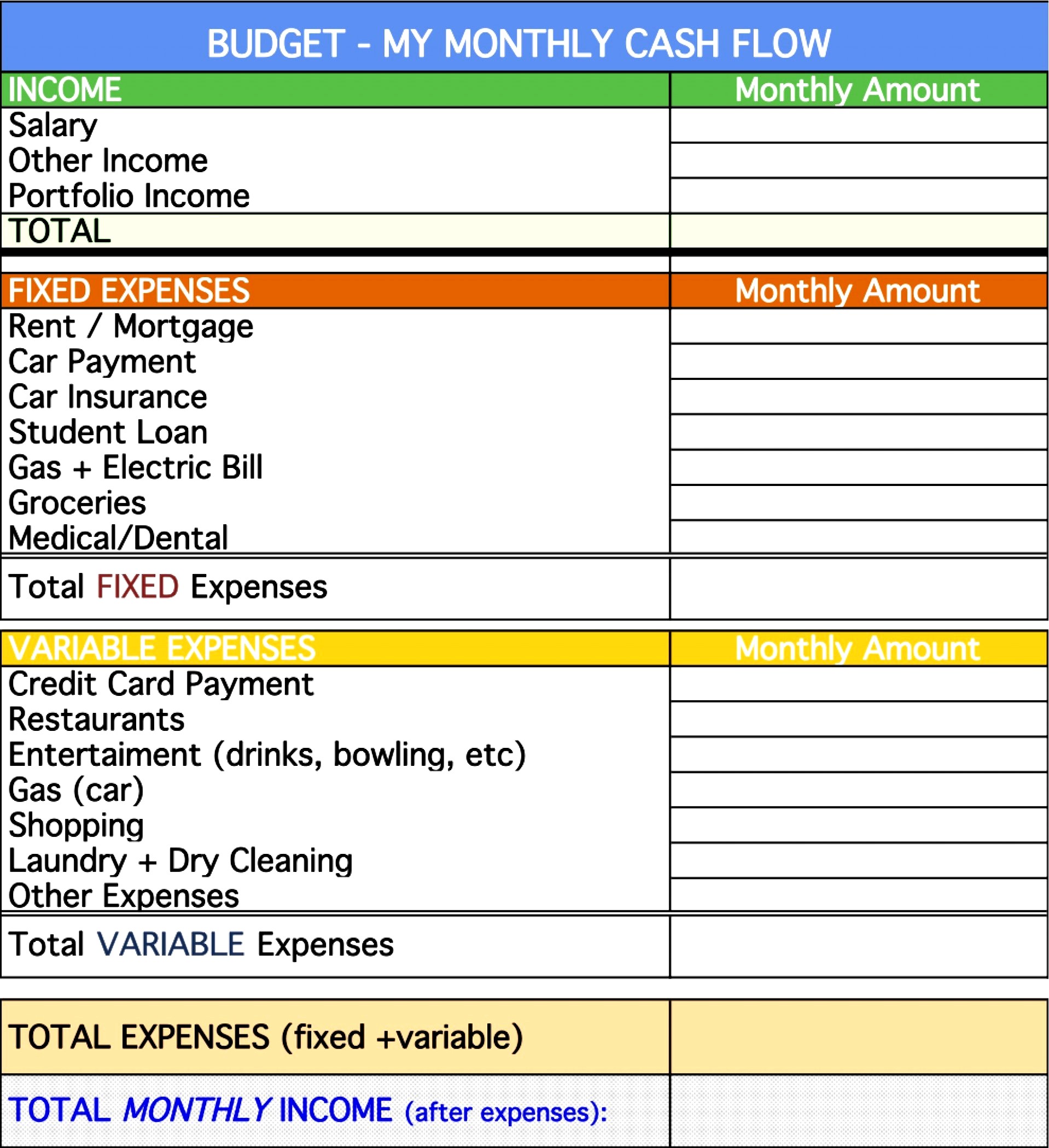

- Set Up Categories: Under each tab, list the different sources of income or types of expenses. For example:

- Income: Salary, Freelance Work, Interest

- Expenses: Rent, Utilities, Groceries, Entertainment

Entering Your Data

Once your structure is set up, it’s time to input your financial data:

- Income: Enter all your monthly income sources in the respective column. Be as detailed as possible to avoid any oversights.

- Expenses: List all your expenses by category. Make sure to include both fixed (like rent) and variable costs (like entertainment).

Formatting for Clarity

To make your budget sheet easy to read:

- Use bold for headers.

- Apply colors or italic font for total rows.

- Adjust row heights and column widths for better visibility.

Calculations and Formulas

Excel’s power lies in its ability to automate calculations. Here’s how you can set up some essential formulas:

- Sum Formulas: Use the SUM function to total up your income and expenses for each category. For example:

=SUM(B2:B10)to sum up all income in cells B2 to B10.

- Difference: Calculate the difference between income and expenses:

=B2 - B11where B2 is total income and B11 is total expenses.

- Percentage of Total Expenses: Use the formula

=B2/B11to find out what percentage each expense is of your total expenses.

💡 Note: Keep in mind that absolute cell references (using $) are crucial when you plan to copy formulas.

Creating Graphs for Visual Analysis

Visual aids like graphs can provide a quick overview of your financial situation:

- Pie Chart for Expenses: Select your expense categories and totals, go to ‘Insert’ > ‘Pie Chart’ to create a visual representation of where your money goes.

- Line or Bar Graph for Income and Expenses: Use line or bar graphs to track changes in income and expenses over time.

Tracking and Updating Your Budget

Regular updates are key to maintaining an effective budget:

- Set reminders to update your budget at least once a month.

- Include a column for planned versus actual expenses to track variances.

- Adjust your budget as needed based on financial changes or surprises.

🔎 Note: Consider setting up an automatic update feature with macros if you're comfortable with VBA, to streamline your updates.

The creation of a monthly budget in Excel not only organizes your finances but also empowers you to make informed financial decisions. With a clear view of your income, expenses, savings, and investments, you can adjust your financial habits to better align with your goals. Remember, a budget isn't static; it evolves as your life circumstances change. Embrace this adaptability as a way to continually refine and improve your financial well-being.

Can I use Excel for budgeting if I’m not good with numbers?

+

Absolutely! Excel provides user-friendly functions like SUM, which simplifies calculations. Once you enter your data, Excel does the math for you. Plus, there are many templates online designed for beginners to help you get started.

What should I do if my expenses exceed my income?

+

If your expenses are consistently higher than your income, you need to review your budget. Look for areas to cut back, such as reducing discretionary spending. Alternatively, you might need to increase your income through additional work or better investments.

How often should I update my Excel budget?

+

Ideally, you should update your budget monthly. However, if your financial situation is volatile, weekly or even daily updates might be necessary to keep track of your cash flow.