5 Essential Steps to Create an Expenses Excel Sheet

In today's fast-paced world, managing personal or business finances efficiently can be quite a task. One of the most straightforward and effective ways to keep your finances in check is by using a well-organized expenses Excel sheet. Whether you're tracking daily expenses, managing a budget, or preparing for tax season, an Excel sheet can be an invaluable tool. Here are five essential steps to create your very own expense tracker:

Step 1: Identify Your Purpose and Categories

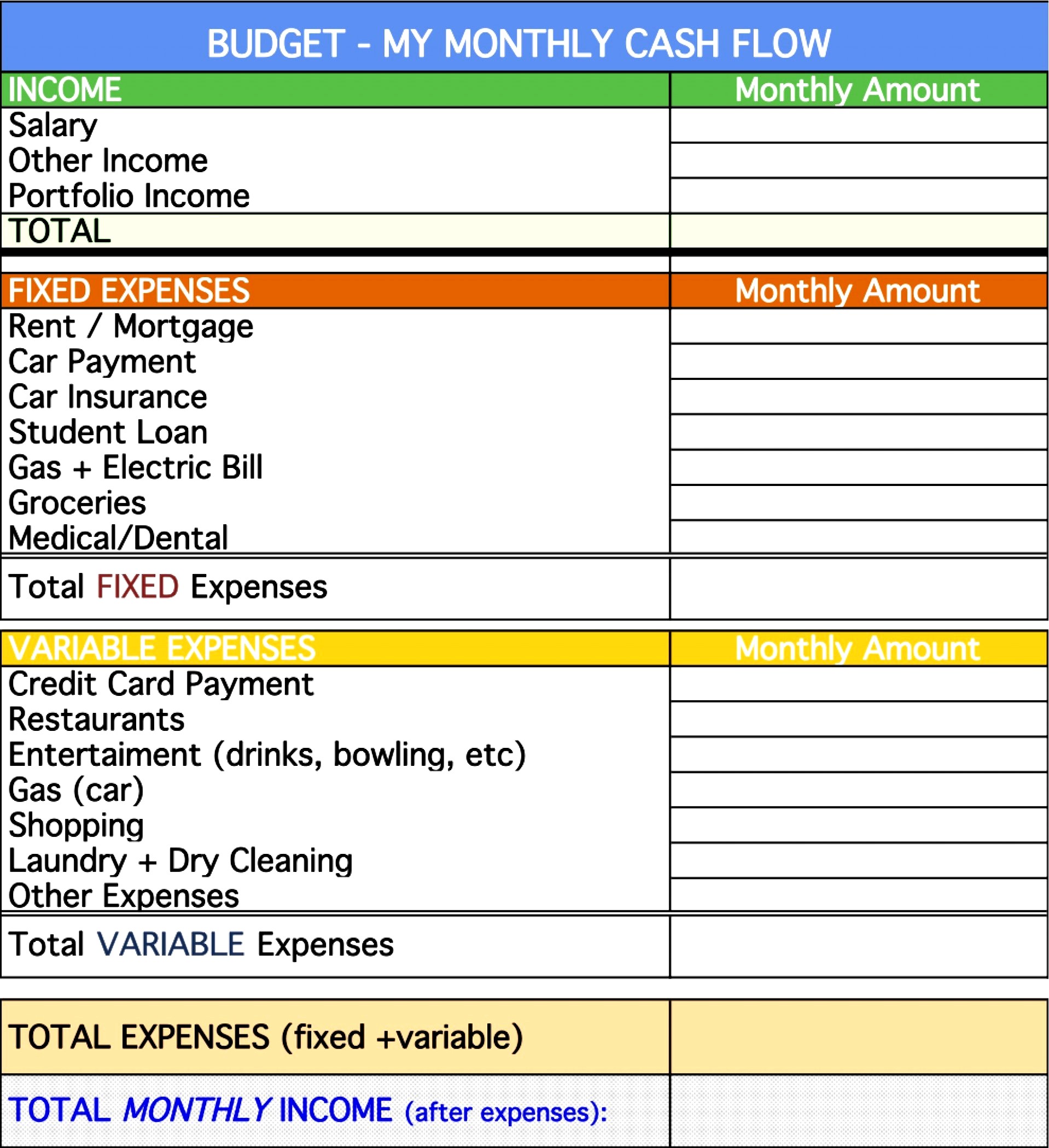

Before diving into Excel, consider what you aim to achieve with your expense tracking. Here’s how to start:

- Define Your Goals: Are you tracking to save for a vacation, manage monthly bills, or analyze spending habits?

- Create Categories: Group your expenses into categories like Food, Housing, Transportation, Entertainment, etc. This segmentation will help in sorting and understanding your spending patterns.

👨💻 Note: Keep your categories as specific as possible to avoid confusion. For instance, instead of ‘Food,’ consider having subcategories like ‘Groceries,’ ‘Dining Out,’ ‘Coffees,’ etc.

Step 2: Set Up Your Excel Sheet

With your categories ready, let’s build the framework:

- Open Excel: Start a new workbook or use an existing template if you’re new to Excel.

- Create Headers: Use the first row for column titles. Here are some suggested headers:

| Date | Category | Description | Amount |

|---|---|---|---|

| 01/01/2023 | Housing | Rent | 1200</td> </tr> <tr> <td>01/02/2023</td> <td>Groceries</td> <td>Supermarket trip</td> <td>60 |

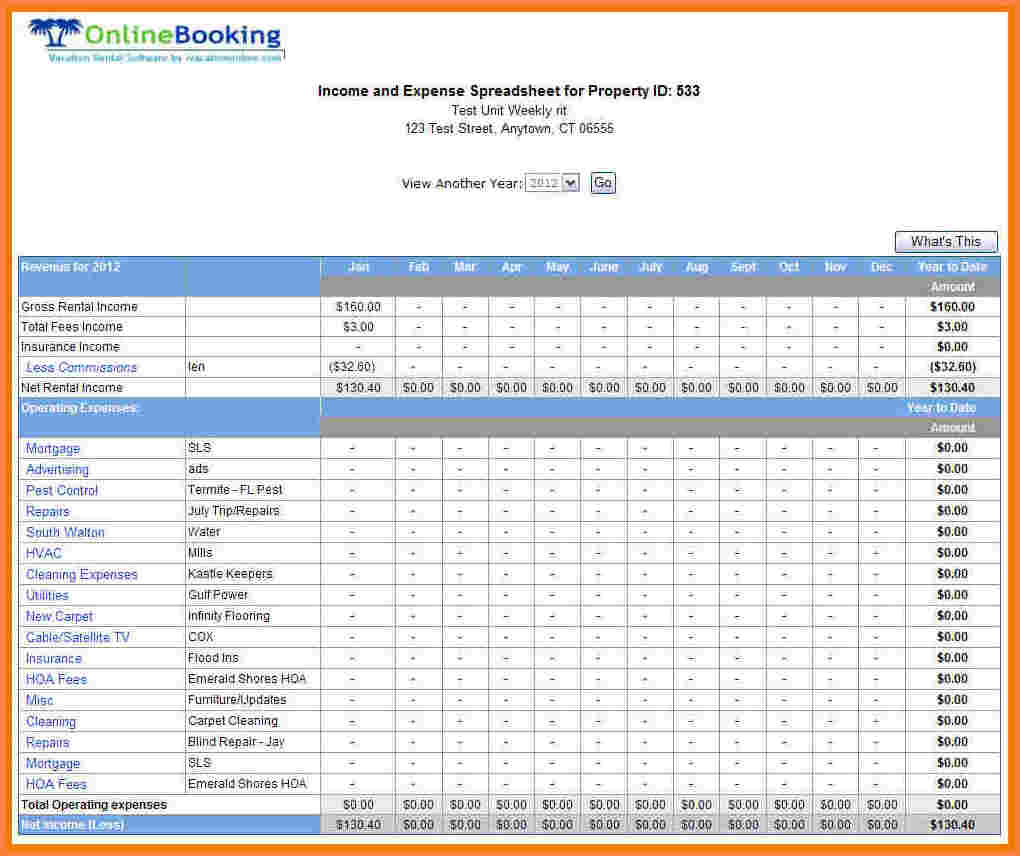

Step 3: Data Entry

Now, you’ll start logging your expenses:

- Date: Enter the date of the transaction.

- Category: Select or type the category from your list.

- Description: Provide a brief description for easier recall later.

- Amount: Log the exact amount spent.

🔍 Note: Use the ‘lookup’ function to quickly select from your predefined categories to minimize entry errors.

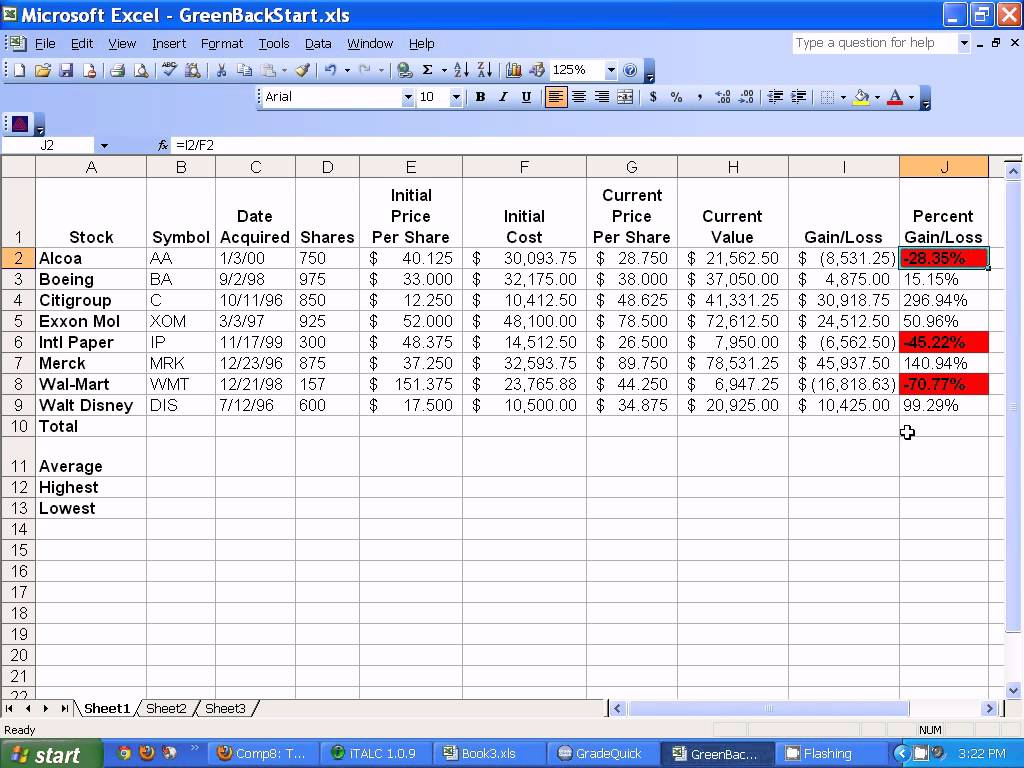

Step 4: Organize and Analyze Your Data

An expense sheet isn’t just for recording; it’s for understanding:

- Summarize Data: Use Excel’s functions like SUMIF to calculate totals by category, month, or other criteria.

- Create Charts: Visualize your expenses through pie charts, bar graphs, or line charts for better comprehension.

- Set Up Filters: Add filters to your table to sort or analyze specific data sets.

Your spreadsheet can show trends, peaks in spending, and even areas where you might save money.

Step 5: Regular Updates and Adjustments

The key to a successful expense sheet is consistency:

- Regularly Update: Enter your expenses daily or weekly to keep the data current.

- Adjust Categories: As your financial life changes, so should your tracking system. Add or modify categories accordingly.

Keeping your expenses Excel sheet updated will ensure that your financial tracking is always accurate and helpful.

💡 Note: Automate repetitive tasks by using Excel macros to save time.

By following these five steps, you've now equipped yourself with a powerful tool for financial management. Not only can you track where your money goes, but you can also make informed decisions based on real data. Whether it's for personal finance management, budgeting, or preparing for tax season, an organized expenses Excel sheet can simplify life immensely.

How often should I update my expenses Excel sheet?

+

Update it as frequently as possible. Daily entries ensure accuracy and up-to-date financial tracking.

Can I use my mobile device to manage my Excel sheet?

+

Yes, with Microsoft Excel apps available for iOS and Android, you can easily update your expense sheet on the go.

What are the benefits of having an expenses Excel sheet?

+

An expenses Excel sheet allows you to track spending, manage budgets, prepare for taxes, and analyze your financial habits to make informed decisions.