How To Make A Student Loan Excel Sheet

Managing student loans effectively is a critical skill for any student or graduate. Creating a personalized Student Loan Excel Sheet can streamline your financial planning, helping you to keep track of your debt, repayment schedules, and interest rates. Here, we'll walk through the process of setting up your own Excel sheet for managing student loans.

Why Use Excel for Student Loan Tracking?

Excel is a versatile tool for organizing and analyzing financial data:

- Customization: Tailor the sheet to your unique financial situation.

- Data Visualization: Easily create charts and graphs to visualize loan repayment progress.

- Automation: Use formulas to automatically calculate interest and payments.

- Data Integrity: Ensure accuracy with built-in functions like SUM, AVERAGE, and conditional formatting.

Setting Up Your Excel Sheet

1. Establish Basic Structure

Begin by creating a new workbook in Excel:

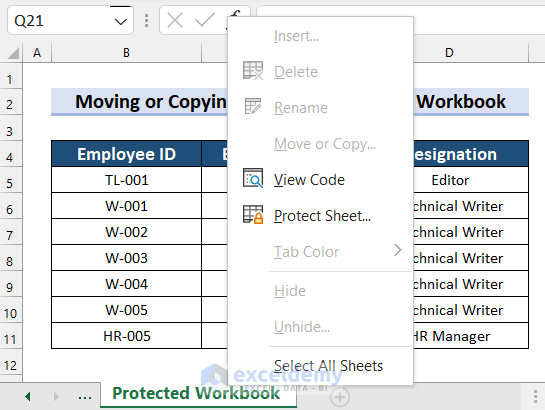

- Create sheets for different purposes:

- An "Overview" sheet for a summary of all loans.

- Separate sheets for each individual loan.

2. Define Loan Parameters

In your "Overview" sheet, enter basic loan details:

| Loan Name | Loan Amount | Interest Rate | Loan Term | Start Date | Monthly Payment |

|---|---|---|---|---|---|

| Federal Subsidized | $15,000 | 3.4% | 10 years | 01-01-2023 | $145.33 |

| Private Loan | $10,000 | 6.8% | 5 years | 01-01-2023 | $197.65 |

🔔 Note: Keep in mind that interest rates and terms can change with market conditions or personal financial situation changes.

3. Inputting Detailed Loan Information

On individual loan sheets, record:

- Current loan balance

- Interest accrued each month

- Payments made each month

- Remaining balance

- Interest rate changes, if applicable

4. Calculating Interest

Use Excel’s financial functions to calculate interest:

- For simple interest, the formula is:

=Principal * Rate * Time - For compound interest, use Excel’s FV function:

=FV(Rate, Nper, Pmt, [Pv], [Type])

5. Automation with Formulas

Automate the calculation of:

- Monthly interest using

=Principal * (Interest Rate / 12) - Payment adjustments for variable rate loans

- Amortization schedule, which can help visualize the breakdown of payments over time

6. Visualizing Data

Create charts to:

- Track the decline in principal over time

- Compare interest rates between different loans

- Show monthly payments and total loan balance

7. Contingency Planning

Incorporate scenarios for:

- Additional payments to reduce total interest

- Changes in income that might affect payments

- Repayment options or consolidation opportunities

By following these steps, you've now set up an effective Excel sheet to manage your student loans. Regular updates and reviewing your plan will keep you on top of your financial obligations.

Key takeaways from creating your student loan Excel sheet include:

- The ability to track and visualize loan information in real-time.

- Automation saves time and reduces errors in loan calculations.

- Scenarios for financial planning help in making informed decisions.

Can I use Google Sheets instead of Excel for my student loan tracker?

+

Yes, Google Sheets provides similar functionality to Excel with the added benefit of cloud storage and collaboration. However, some advanced Excel features might not be available.

What should I do if my interest rate changes?

+

Update your Excel sheet with the new interest rate. Recalculate future payments and adjust your financial planning accordingly.

How can I track multiple loan servicers in one Excel file?

+

Create separate sheets for each loan servicer within the same workbook or consolidate data in a summary sheet with references to other sheets for detailed information.

Can Excel predict when I will be debt-free?

+Yes, with accurate data entry and regular updates, Excel can forecast when your student loans will be fully paid off based on current payment plans.

In the end, creating a student loan Excel sheet is about empowerment through knowledge and strategic financial management. By keeping your financial situation organized and visualized, you can make better decisions towards becoming debt-free sooner and manage your financial future with confidence.