Create a Simple Balance Sheet in Excel - Beginner's Guide

The balance sheet is an essential financial document that provides a snapshot of a company's financial health at a given point in time. It breaks down what a company owns (assets), owes (liabilities), and the ownership interest (equity). For beginners, creating a simple balance sheet in Excel can be a straightforward way to grasp these concepts. Here’s how you can do it:

What You Need

Before we dive into the creation process:

- An updated version of Microsoft Excel

- Basic understanding of financial terms like assets, liabilities, and equity

- Access to the company’s financial data

Step-by-Step Creation Guide

1. Opening Excel and Setting Up the Worksheet

Start by opening Microsoft Excel:

- Go to the ‘Start’ menu or open the Excel application directly.

- Create a new workbook.

- Save your workbook with an appropriate name like “Company Balance Sheet.”

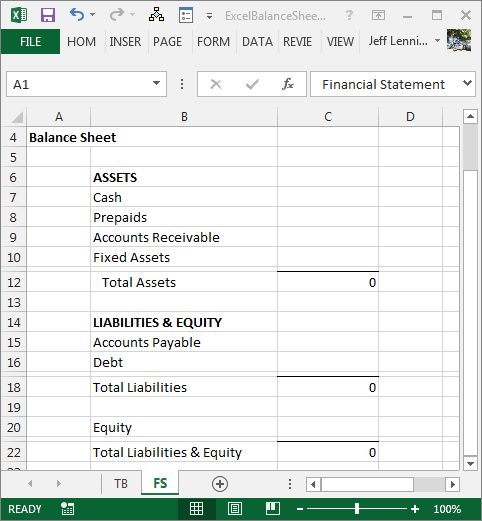

2. Setting Up the Structure

Your balance sheet should have sections for:

- Assets

- Liabilities

- Equity

To organize this:

- Use column A for labels.

- Use column B for values.

3. Entering Asset Data

Begin with assets:

- In cell A1, write “Assets”

- Below, list the following:

- Current Assets (like cash, inventory, receivables)

- Long-term Assets (like property, equipment)

- Total Assets

4. Entering Liabilities and Equity

Proceed to liabilities and equity:

- In cell A9, write “Liabilities”

- List:

- Current Liabilities (like accounts payable, short-term loans)

- Long-term Liabilities (like mortgages, long-term debt)

- Total Liabilities

- In cell A17, write “Equity”

- List:

- Equity components like Owner’s Equity, Retained Earnings

- Total Equity

Calculate totals using the SUM function:

- Total Assets = SUM(B2:B5)

- Total Liabilities = SUM(B10:B12)

- Total Equity = SUM(B18:B20)

5. Formatting for Clarity

Ensure your balance sheet is easily readable:

- Merge cells to create headers (e.g., merge A1:A5 for “Assets”).

- Use borders, bold or italic text for emphasis.

- Align your figures to the right.

| Section | Example |

|---|---|

| Assets | Cash, Inventory |

| Liabilities | Accounts Payable |

| Equity | Owner’s Equity |

After completing these steps, you will have a basic balance sheet that not only summarizes financial positions but can be updated and modified to reflect ongoing changes in the company's financial status.

Finally, using this straightforward approach to creating a balance sheet in Excel can benefit you in several ways:

- Provides immediate insight into a company’s financial health.

- Allows for easy updates to reflect changes in financial figures.

- Fosters better understanding of financial terms through practical application.

What is the difference between current and long-term assets?

+

Current assets are those that can be converted into cash within a year (e.g., cash, accounts receivable), whereas long-term assets (e.g., property, plant, and equipment) are not expected to be liquidated or converted within that timeframe.

How do I know what should be included under equity?

+

Equity typically includes the owner’s investment in the business, retained earnings, and other forms of capital contributed by shareholders.

Can I use this simple balance sheet for tax purposes?

+

A balance sheet can provide valuable information for tax purposes, but you might need to make adjustments or use specialized software for tax reporting.