Mastering Excel for Balance Sheet Management: A Simple Guide

Mastering Excel for balance sheet management can transform your approach to financial reporting and analysis. Whether you're a business owner, an accountant, or a finance student, understanding how to effectively use Excel for managing balance sheets is crucial. This guide will walk you through everything from setting up a basic balance sheet to advanced analysis techniques.

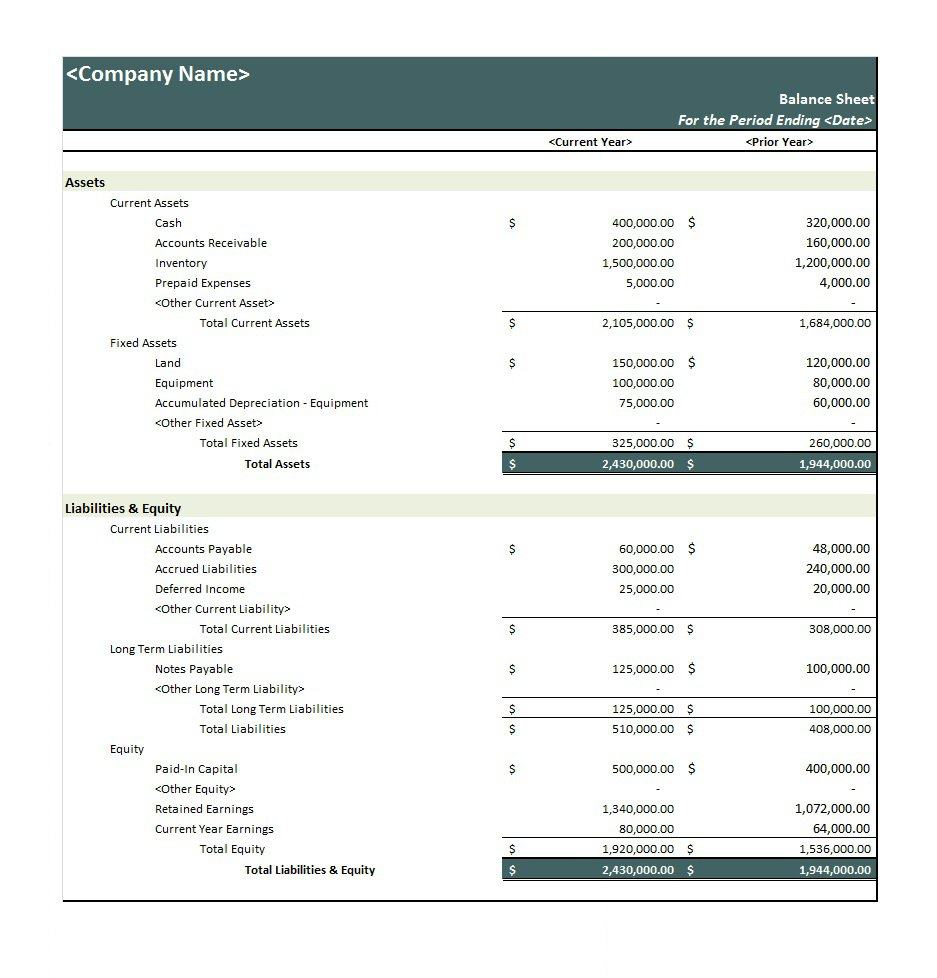

Understanding Balance Sheets

Before diving into Excel specifics, it’s essential to grasp what a balance sheet represents. A balance sheet provides a snapshot of a company’s financial health at a given point in time. It lists:

- Assets: What the company owns (cash, inventory, property, etc.)

- Liabilities: What the company owes (loans, accounts payable, etc.)

- Equity: The net worth of the company, calculated as Assets - Liabilities

Setting Up Your Excel Workbook

To manage balance sheets efficiently in Excel:

- Open Excel and create a new workbook.

-

- Assets

- Liabilities & Equity

- Summary

- Configure Your Worksheets:

- Assets Sheet: List all company assets, with columns for Account, Current Value, and Notes.

- Liabilities & Equity Sheet: Similar setup for Liabilities and Equity.

- Summary Sheet: This will be your actual balance sheet where totals from Assets and Liabilities & Equity will be brought together.

💡 Note: Ensure your workbook is well-organized to avoid errors in data entry and subsequent calculations.

Entering Data

Here’s how you can enter the data into your Excel sheets:

- Use the Grid: Excel’s grid layout is perfect for balance sheets. Each row can represent an account, with columns for descriptions, current values, and notes.

- Sum Formulas: Utilize Excel’s SUM function to total assets, liabilities, and equity sections.

- References: Link totals from the Assets and Liabilities sheets to your Summary sheet using cell references (

=‘SheetName’!A1).

Here is an example of how you can set up your formulas:

| Account | Value |

|---|---|

| Accounts Receivable | =SUM(Assets!B2:B10) |

| Inventory | =SUM(Assets!B11:B15) |

Advanced Features for Balance Sheet Management

Beyond basic setup, Excel offers features for deeper financial analysis:

- Conditional Formatting: Highlight negative values, variance between periods, or thresholds for financial ratios.

- Data Validation: Prevent erroneous data entry by setting rules on inputs.

- PivotTables: Analyze data from different angles or compare historical data.

- What-If Analysis: Use Scenario Manager to see how changes in assumptions impact the balance sheet.

- Macros: Automate repetitive tasks like formatting, data updates, or report generation.

📝 Note: Leverage Excel’s vast array of tools to not only manage but analyze financial data for strategic decision-making.

Wrapping Up

In conclusion, mastering Excel for balance sheet management empowers you with the ability to efficiently organize, analyze, and report on financial data. From setting up your workbook correctly to employing advanced features for deeper insights, Excel provides all the tools needed to ensure accuracy in financial reporting, streamline processes, and make informed decisions based on comprehensive analysis.

Can I use Excel for real-time financial data?

+

While Excel itself isn’t designed for real-time data updates, you can use add-ins or APIs to pull in real-time or near real-time data from external sources, enhancing your financial reporting.

What are common mistakes when setting up a balance sheet in Excel?

+

Common errors include misclassifying accounts, failing to account for all assets or liabilities, and incorrect cell references or formulas that can lead to calculation errors. Regular audits can help prevent these mistakes.

How can I ensure data accuracy in my Excel balance sheet?

+

To maintain accuracy, use data validation, lock cells to prevent accidental changes, implement checksums, and cross-reference figures with source documents. Regular internal audits and review processes also ensure data integrity.