5 Steps to Access Bankruptcy Forms Online Free

In today's digital age, accessing vital legal documents online has become essential, especially when facing financial challenges like bankruptcy. Understanding how to find and utilize free bankruptcy forms can greatly simplify the process of filing for bankruptcy. Here are five steps to access these forms online, ensuring you're equipped to navigate this legal process effectively.

Step 1: Identify the Type of Bankruptcy

Bankruptcy laws offer different chapters or types, each tailored to specific financial situations:

- Chapter 7: Known as liquidation bankruptcy, this type allows individuals or businesses to discharge their unsecured debts.

- Chapter 13: Referred to as wage earner’s plan, it permits individuals with regular income to develop a plan to repay all or part of their debts.

- Chapter 11: Primarily for businesses, this allows for reorganization to continue operations while restructuring debt.

- Chapter 12: Designed for family farmers or fishermen with regular income.

Identifying the appropriate type of bankruptcy is crucial because each has its own set of forms.

Step 2: Visit Official Websites

Once you’ve determined the bankruptcy type, the next step is to access the relevant forms. Here are reputable sources:

- The United States Courts website offers official bankruptcy forms free of charge.

- State-specific websites, especially for state-specific bankruptcy forms, which can be found by navigating through your state’s court system website.

- Legal aid organizations, which often provide access to forms and additional resources.

🔍 Note: Always ensure you're using the most recent version of forms as they can change periodically.

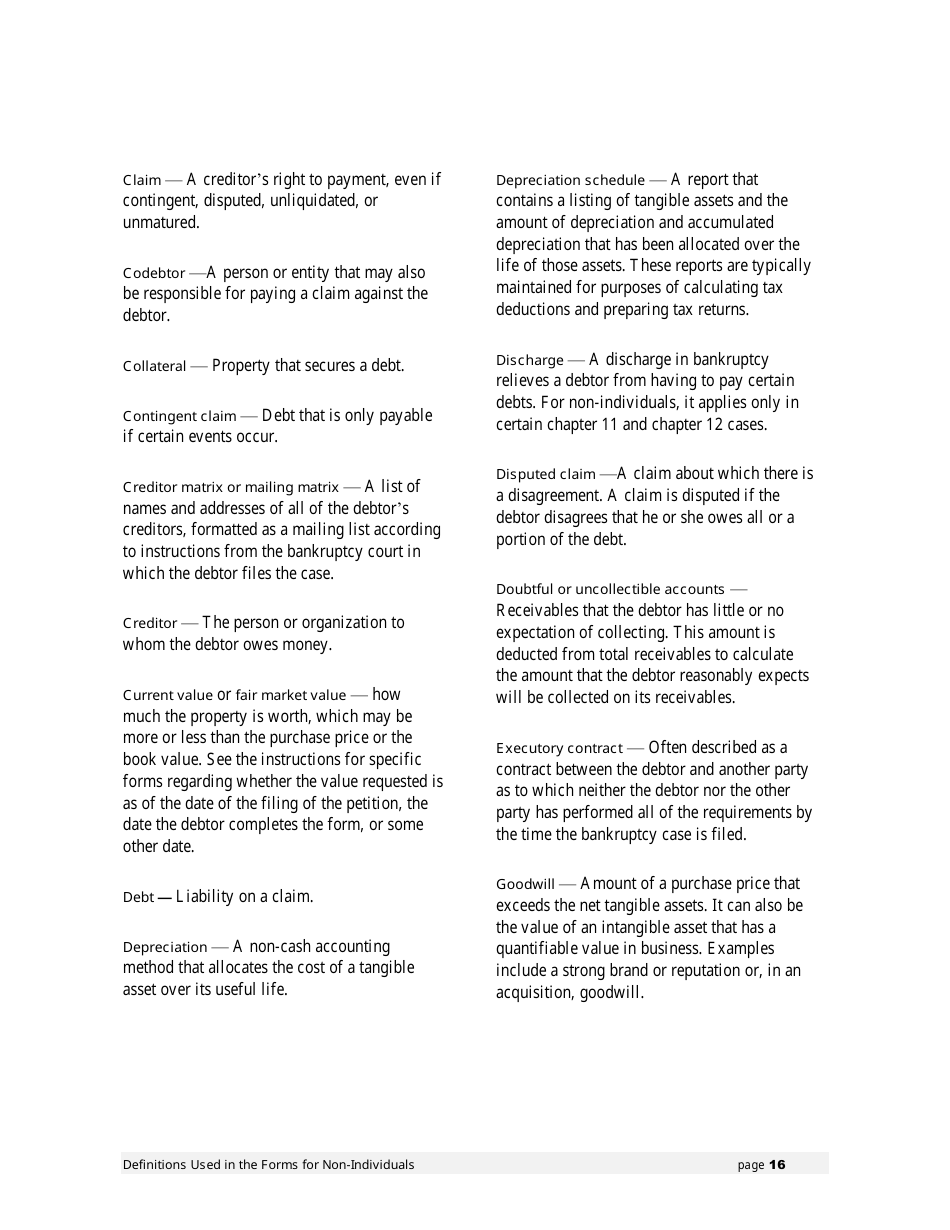

Step 3: Understand Required Forms and Schedules

Each bankruptcy chapter requires a different set of forms, but common documents include:

| Form Number | Form Name |

|---|---|

| B 101 | Voluntary Petition for Individuals Filing for Bankruptcy |

| B 106 | Schedules A/B through J |

| B 122A-1 | Statement of Current Monthly Income (Chapter 7 only) |

| B 122C-1 | Statement of Current Monthly Income (Chapter 13 only) |

Download or save these forms to fill them out later.

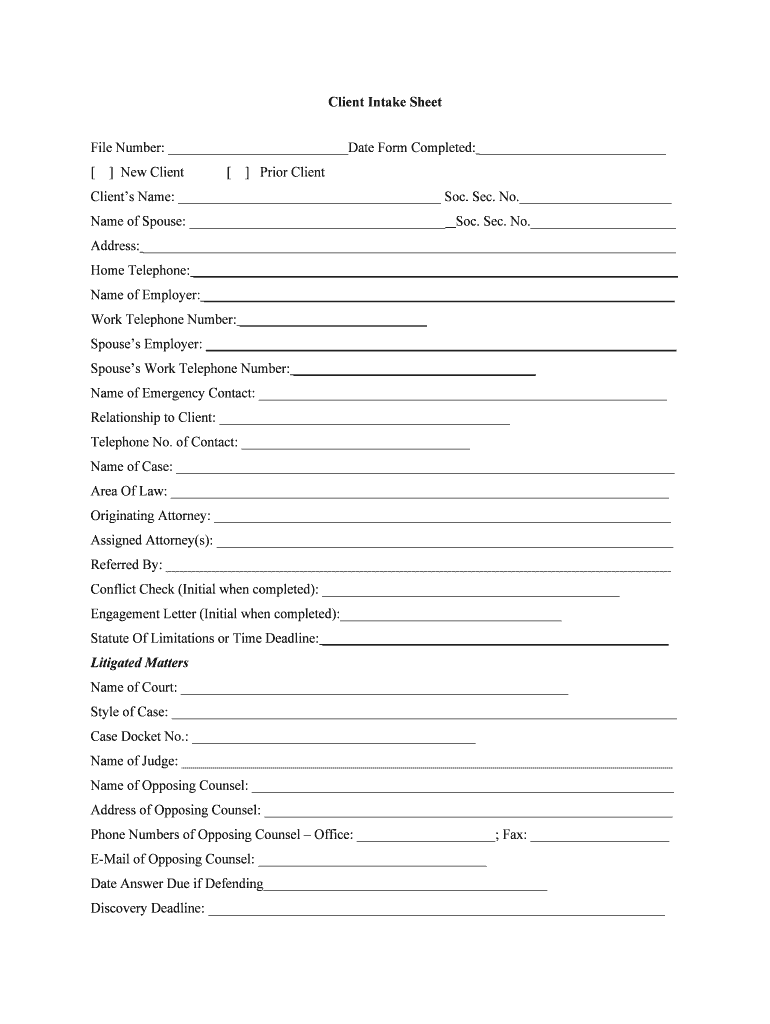

Step 4: Download, Fill, and Save

Filling out these forms is a meticulous process:

- Download each required form from the official websites mentioned above.

- Fill them out accurately. It’s critical to provide truthful information as inaccuracies can lead to case dismissal.

- Save a digital copy for your records. Consider using software or services that allow you to save partially completed forms for future updates.

📋 Note: Filling out these forms correctly often requires a basic understanding of legal terms and processes.

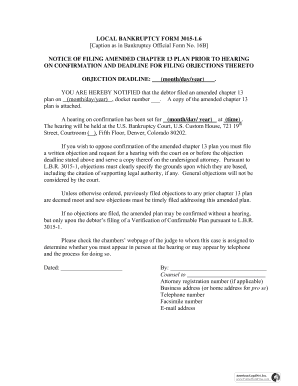

Step 5: Review, Sign, and File

After filling out the forms:

- Double-check all entries for accuracy and completeness.

- Sign the forms where required, understanding that electronic signatures are generally accepted but verify this with your court.

- File the forms with the appropriate court, either electronically through the court’s electronic case filing (ECF) system, by mail, or in-person.

To summarize, accessing and filing bankruptcy forms involves understanding the appropriate type, sourcing the forms from reliable websites, recognizing required documents, carefully filling them out, and finally filing them. The process is daunting but manageable with the right preparation.

Can I file for bankruptcy without a lawyer?

+

Yes, you can file for bankruptcy without a lawyer, known as filing “pro se.” However, the process is complex, and hiring a bankruptcy attorney can prevent errors that could negatively impact your case.

How often can I file for bankruptcy?

+

The frequency of filing for bankruptcy is limited by law. For Chapter 7, you must wait at least 8 years between filings. For Chapter 13, the waiting period is 6 years from a previous Chapter 7 filing.

What happens if I miss an asset or debt on my bankruptcy forms?

+

Failing to disclose all assets or debts can lead to severe consequences, including the dismissal of your case or denial of discharge. It’s vital to be thorough and honest in your forms.