5 Tips to Import SEC Filing Balance Sheets into Excel

The SEC, or Securities and Exchange Commission, requires publicly traded companies to file various financial statements to keep investors informed. One of these key documents is the balance sheet, which provides a snapshot of a company's financial health at a specific point in time. Importing these balance sheets into Excel can be incredibly useful for financial analysis, comparisons, and data manipulation. Here are five detailed tips to help you import SEC filing balance sheets into Excel effectively.

1. Accessing SEC EDGAR Database

Before importing the balance sheet into Excel, you need to obtain the financial statements. The SEC’s EDGAR database is the primary resource for accessing these filings. Here’s how you can access it:

- Visit the SEC EDGAR website.

- Use the Company Search tool or the Full-Text Search to find the company’s filings.

- Look for Form 10-K or 10-Q, which typically contain comprehensive financial statements.

- Click on “Interactive Data” for XBRL-formatted documents, which are easier to import into spreadsheets.

🔍 Note: Always make sure you are accessing the most current financial reports.

2. Extracting Data from XBRL

XBRL (eXtensible Business Reporting Language) is a standard for the electronic exchange of business information, used by the SEC for financial reporting. Here are steps to extract balance sheet data:

- Download the XBRL files or use online tools like XBRL US Viewer or other parsing tools to view and extract the data.

- Open the XBRL file in your tool, and navigate to the balance sheet section.

- Copy the data directly from the interactive viewer or export it into a .csv or other easily importable format.

Using XBRL ensures that you can accurately map financial items to predefined taxonomies, reducing errors in data import.

3. Using Financial API Services

For an automated approach, consider using financial APIs like those offered by EDGAR Online, Intrinio, or Alpha Vantage:

- Sign up for an API key with a financial data provider.

- Use their API documentation to learn how to request balance sheet data for a particular company.

- Implement the API call in Excel using Power Query or VBA to fetch and organize the data directly into your spreadsheet.

4. Manual Entry and Data Cleaning

If you prefer or must manually enter the data:

- Open the PDF or HTML document of the financial statement.

- Copy and paste values into an Excel template designed for balance sheets.

- Check for consistency, ensure all units are uniform, and verify that financial periods are correct.

| Step | Description |

|---|---|

| 1 | Open Financial Statement |

| 2 | Copy Relevant Data |

| 3 | Paste into Excel Template |

| 4 | Data Validation and Cleaning |

🔥 Note: Be meticulous in data entry to avoid transcription errors which could affect your analysis.

5. Excel Features for Streamlining Import

Excel has several built-in tools that can help streamline the import process:

- Power Query: Import, transform, and load data from web pages or files directly into Excel.

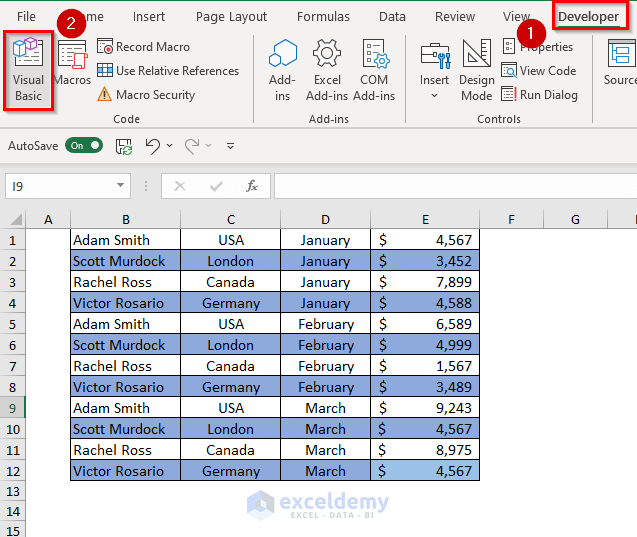

- VBA Macros: Automate repetitive tasks, like formatting and cleaning financial data upon import.

- Data Validation: Use Excel’s data validation rules to ensure data consistency and accuracy.

- Text to Columns: Convert delimited data into separate columns for easier analysis.

To summarize, importing SEC filing balance sheets into Excel can be an intricate process, but it's crucial for deep financial analysis. Whether you opt for manual entry, leverage the power of APIs, or utilize the structured data from XBRL filings, the key is in ensuring the data's accuracy and relevance. By following these tips, you'll enhance your ability to use Excel for sophisticated financial analysis, making your investment decisions or financial reporting more informed and effective.

Why should I import SEC filings into Excel?

+

Importing SEC filings into Excel allows for custom financial analysis, trend analysis, and comparison across different companies or over time, providing a flexible data manipulation environment for deeper insights.

What if the SEC filings are not in XBRL format?

+

If the SEC filings are not in XBRL format, you can still manually download the PDFs or HTML files and extract the data by copying and pasting or using OCR technology to convert images of text into editable data.

Can I automate the process of fetching SEC data into Excel?

+

Yes, you can use financial APIs or tools like Power Query in Excel to automate the process of fetching, transforming, and loading financial data directly from SEC filings.