How to Get Balance Sheet in Excel Easily

The balance sheet is a financial statement that provides a snapshot of a company's financial health at a specific point in time. It lists the company's assets, liabilities, and equity, giving stakeholders an overview of what the company owns and owes, as well as the amount invested by the shareholders. Creating a balance sheet can seem daunting, but with Microsoft Excel, this process can be streamlined and managed efficiently. In this detailed guide, we'll walk you through the steps to craft a balance sheet in Excel, including formatting tips for presentation and potential automation techniques.

Setting Up Your Excel Document

Begin by opening Microsoft Excel on your computer:

- Open a new workbook.

- Save the document with a descriptive name like “Company Balance Sheet_2023.”

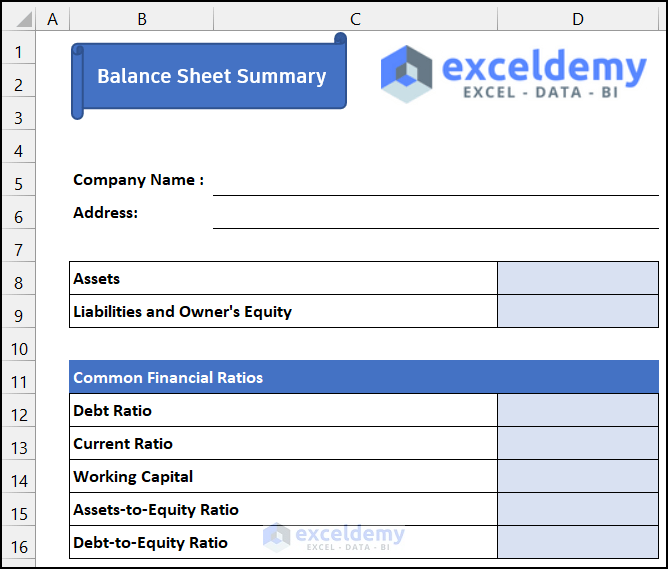

Planning Your Layout

Before you start entering data, consider how you want your balance sheet to look:

- Header Information: Include the company name, the fiscal year, or the date for which the balance sheet is created.

- Section Headers: Plan for “Assets,” “Liabilities,” and “Equity” sections with subheadings for current and non-current items.

- Formatting: Think about using different colors for different sections, bold fonts for headers, and alignment for better readability.

Entering Data

Now, start populating your balance sheet:

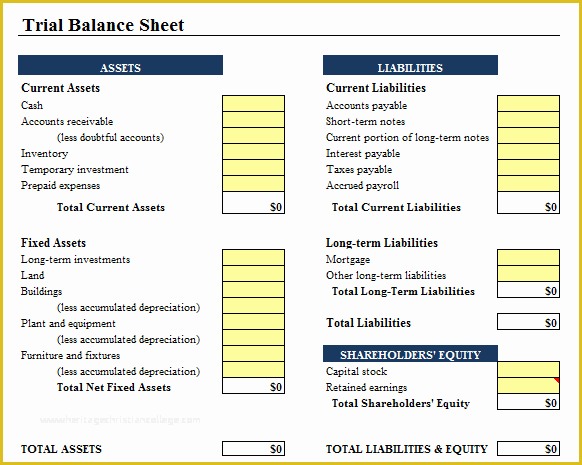

Assets

Assets are resources the company owns or controls that provide future economic benefits:

- Current Assets: List items like Cash, Accounts Receivable, Inventory, Prepaid Expenses, etc.

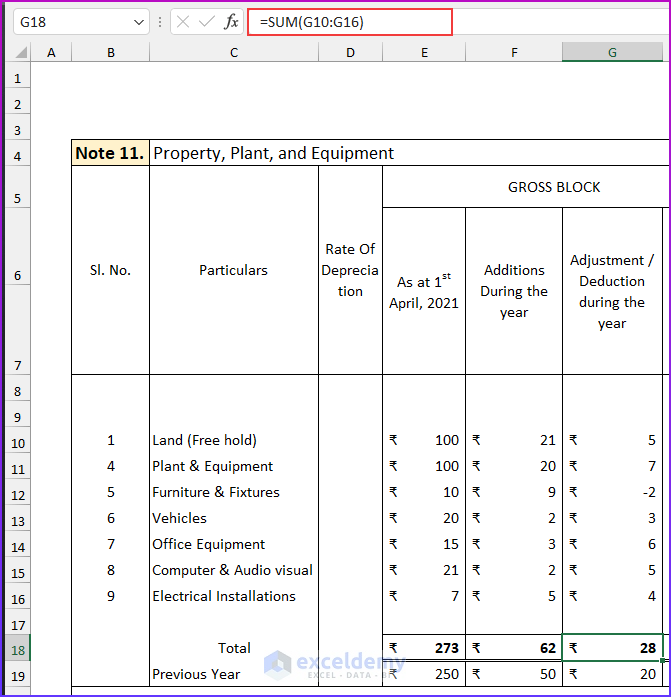

- Non-Current Assets: Include Long-Term Investments, Property, Plant, and Equipment (net of depreciation), Intangible Assets, etc.

Here’s how you might format your asset section:

| Assets | Current Assets | Amount |

|---|---|---|

| Cash | X,XXX.XX</td> </tr> <tr> <td>Accounts Receivable</td> <td></td> <td>X,XXX.XX | |

| Inventory | X,XXX.XX</td> </tr> <tr> <th colspan="2">Non-Current Assets</th> </tr> <tr> <td>Property, Plant, and Equipment</td> <td></td> <td>X,XXX.XX |

💡 Note: Use formulas to automatically calculate totals for each section. For example, in cell C5, you might type =SUM(C2:C4) to sum up all current assets.

Liabilities and Equity

Liabilities represent obligations, while equity indicates ownership interest:

- Current Liabilities: Include Accounts Payable, Accrued Expenses, Short-term Loans, etc.

- Non-Current Liabilities: Long-term Loans, Deferred Revenue, etc.

- Equity: Common Stock, Retained Earnings, Additional Paid-in Capital.

Summarizing and Balancing

Balance sheets must adhere to the fundamental accounting equation:

- Assets = Liabilities + Equity

Ensure your Excel sheet is set up to auto-calculate this equation:

- In cell C7, type =B1+B2 where B1 represents the total assets and B2 represents the total liabilities and equity to confirm the balance.

Formatting for Presentation

Make your balance sheet visually appealing:

- Use colors to differentiate between different sections; for example, blue for assets, red for liabilities, and green for equity.

- Apply borders for clarity.

- Consider conditional formatting to highlight cells with specific conditions, like negative values.

- Align text appropriately; right-align numbers, center headers.

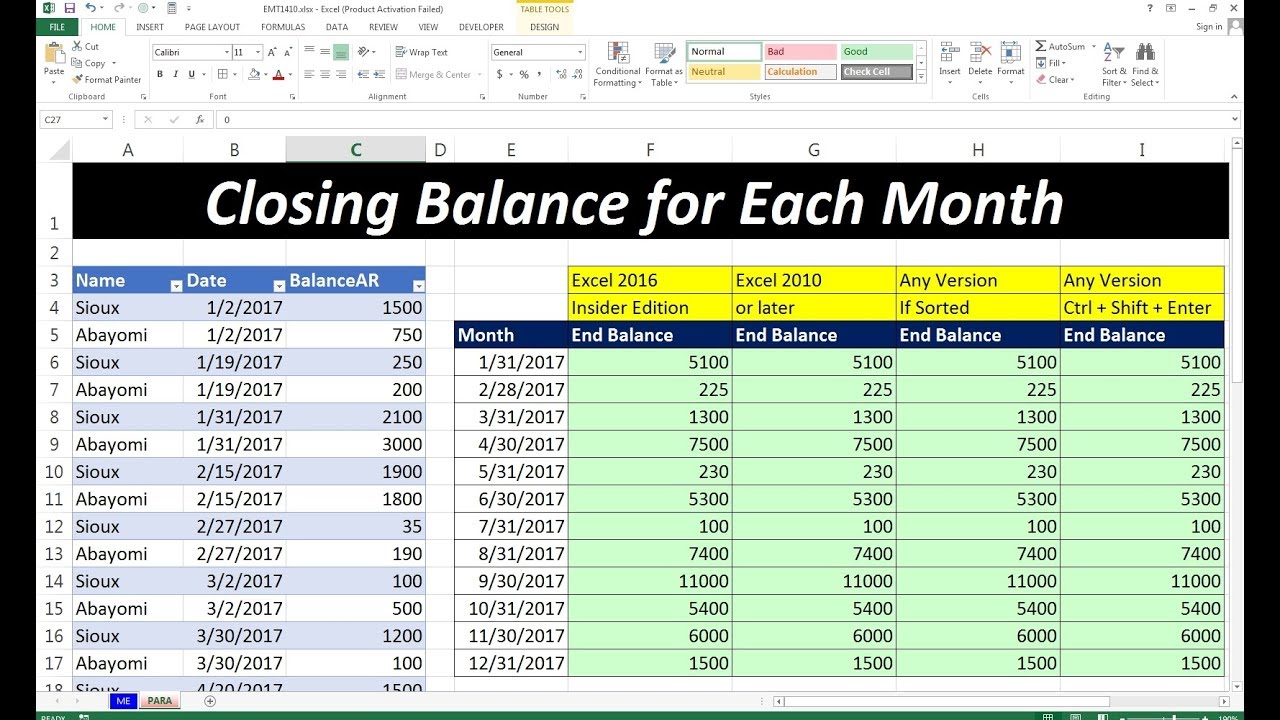

Automation and Advanced Features

Excel allows for advanced features:

- Macros: Record a macro for repetitive tasks like formatting or updating data from another source.

- Data Validation: Set up data validation rules to prevent incorrect entries, enhancing data integrity.

- Dynamic Charts: Incorporate charts that update automatically with your balance sheet.

Troubleshooting Common Issues

Here are some common problems and their solutions:

- Missing Data: Double-check your data sources to ensure all entries are recorded.

- Formula Errors: Ensure all formulas are correctly referencing the right cells.

- Formatting Issues: Use the format painter or directly adjust cell styles to maintain consistency.

In wrapping up, creating a balance sheet in Excel might initially seem like a complex task, but with a methodical approach, you can manage it efficiently. By setting up your workbook with clear sections for assets, liabilities, and equity, using formulas for automatic calculations, and applying appropriate formatting, you ensure accuracy and readability. Remember, Excel’s tools like macros and dynamic charts not only make your balance sheet more professional but also save time and reduce errors. Always verify your work by ensuring that the equation Assets = Liabilities + Equity holds true, which signifies a balanced sheet.

By following this guide, you’re well on your way to producing a professional-grade balance sheet that not only fulfills accounting requirements but also presents the financial health of your business in a visually appealing and informative manner.

Why is it important to balance the balance sheet?

+

Balancing the balance sheet ensures that the company’s accounting equation holds true, which is crucial for financial accuracy and demonstrating the company’s solvency. It also provides stakeholders with confidence in the financial reporting process.

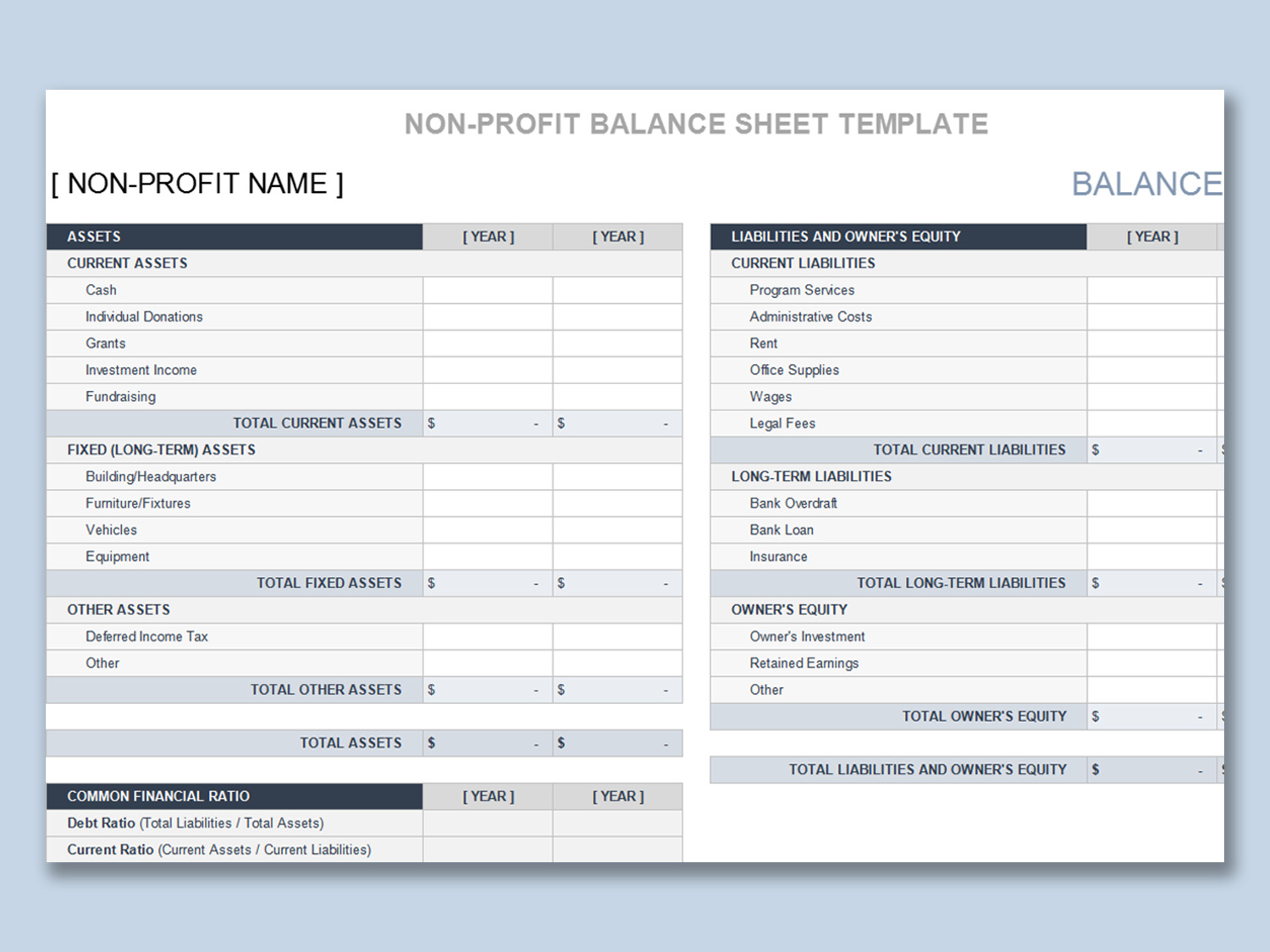

Can I use Excel templates for balance sheets?

+

Yes, Microsoft Excel provides several templates for balance sheets that you can customize to fit your company’s specific needs. These templates often come pre-formatted and with basic formulas already in place.

How often should a balance sheet be updated?

+

A balance sheet should be updated at least annually for financial reporting. However, for internal management purposes, monthly or quarterly updates are common to monitor financial health closely.

What if my balance sheet doesn’t balance?

+

If your balance sheet doesn’t balance, check for:

- Incorrect entries or missing data.

- Errors in formulas or cell references.

- Ensure that the accounting equation is correctly represented.

Can Excel handle complex balance sheets for large corporations?

+

Yes, Excel can manage complex balance sheets, especially when integrated with advanced features like macros, pivot tables, and data analysis tools. However, for very large organizations with thousands of transactions, specialized accounting software might be more suitable.