5 Steps to Format a Balance Sheet in Excel

Introduction to Balance Sheet Formatting in Excel

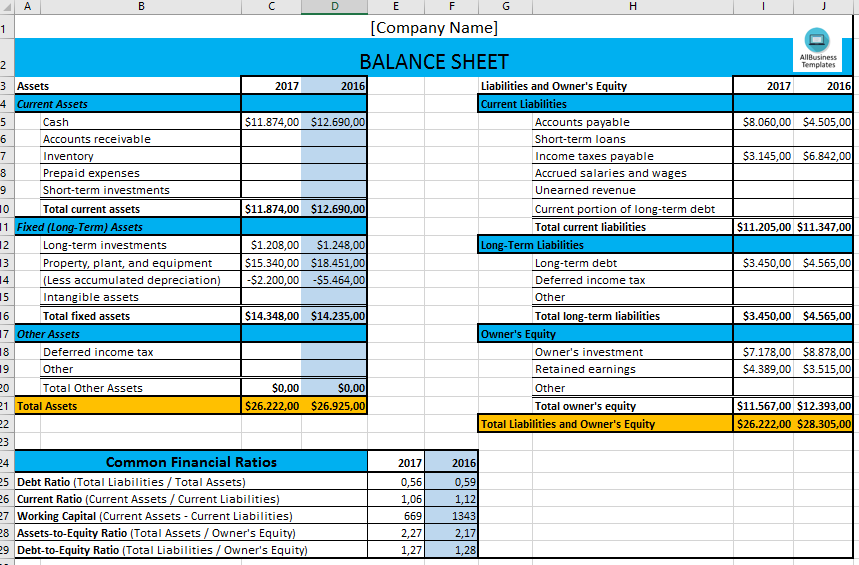

A balance sheet is a critical financial statement that provides a snapshot of a company's financial health at a specific point in time. It shows what the company owns (assets), what it owes (liabilities), and the shareholders' equity. In Excel, formatting this document not only makes it visually appealing but also enhances its readability and analytical value. Here are the essential steps to format a balance sheet effectively in Excel:

Step 1: Setting Up Your Excel Worksheet

Before diving into the numbers, setting up your Excel worksheet correctly is crucial for clarity and efficiency:

- Name your Columns: Clearly label your columns. Common labels might include 'Assets,' 'Liabilities,' 'Equity,' 'Total,' and 'Date'.

- Format for Readability: Adjust row heights and column widths to make the data easier to read. Use a font size that's legible, like 12-point, and consider bolding column headers for emphasis.

- Highlight Important Areas: Use borders or shading to separate sections. For example, use a thicker border around the total asset, liability, and equity sections to distinguish them from individual items.

💡 Note: Proper initial formatting reduces the risk of errors as you fill in financial data.

Step 2: Inputting the Data

Once your sheet is set up, it’s time to enter your financial data:

- Assets: Begin by listing all assets, starting with current assets like cash, accounts receivable, inventory, and then non-current assets like property, plant, and equipment.

- Liabilities: Follow with liabilities, separating current liabilities (those due within one year) from long-term liabilities.

- Equity: Input equity items like share capital, retained earnings, and any reserves or other equity accounts.

| Assets | Liabilities | Equity |

|---|---|---|

| Cash | Accounts Payable | Share Capital |

| Accounts Receivable | Short-term Debt | Retained Earnings |

| Inventory | Long-term Debt | Other Reserves |

🧾 Note: Accuracy in data entry is paramount. Double-check figures to ensure the balance sheet's integrity.

Step 3: Formulas and Calculations

Excel’s power lies in its ability to perform automatic calculations. Here’s how you can utilize this:

- Subtotals and Totals: Use the SUM function to calculate subtotals for current assets, fixed assets, current liabilities, long-term liabilities, and equity. For example, for total assets, you might use =SUM(Current Assets range) + SUM(Non-current Assets range).

- Balance Check: Ensure that total assets equal total liabilities plus equity. A formula like

=IF(A34 = B34 + C34, "Balanced", "Check Balance")can provide an instant check.

⚠️ Note: Never manually enter subtotals or totals; use formulas to avoid human error.

Step 4: Formatting for Clarity and Analysis

Formatting goes beyond mere aesthetics; it enhances the document’s utility for analysis:

- Conditional Formatting: Use conditional formatting to highlight positive/negative values, percentages, or to show trends in financial health.

- Data Visualization: Insert charts or graphs to visually represent data like asset composition or the company's debt structure.

- Cell Styles: Apply Excel's pre-set cell styles to quickly format different financial elements consistently, or customize your own for specific needs.

🔍 Note: Use formatting tools to make your balance sheet not only informative but also insightful for financial analysis.

Step 5: Review and Final Touches

With your balance sheet now fully formatted, take time for a final review:

- Ensure Accuracy: Check all formulas to make sure they are calculating correctly. Use Excel's "Trace Precedents" and "Trace Dependents" to verify data flow.

- Protect your Sheet: Protect your sheet to prevent accidental changes once the balance sheet is finalized. Use Excel’s worksheet protection feature.

- Add Notes or Assumptions: Include any notes or assumptions used in the preparation of the balance sheet. This could be in a separate section or as comments in cells.

📝 Note: Adding comments or notes for significant figures or unusual financial events can provide context for future readers or yourself.

To summarize, formatting a balance sheet in Excel involves structuring the sheet, entering data accurately, automating calculations with formulas, enhancing readability and analysis through formatting, and ensuring the document's integrity through review and protection. A well-formatted balance sheet not only looks professional but also provides valuable insights into the company's financial health, aiding in strategic decision-making.

Why is formatting important in a balance sheet?

+

Formatting in Excel enhances readability, making it easier for stakeholders to quickly understand financial data. Proper formatting also aids in data analysis, highlighting trends, and potential issues or errors.

Can I use Excel’s templates for balance sheets?

+

Yes, Excel provides templates that can be a good starting point. However, customization according to your business needs often yields a more accurate and tailored document.

How often should a balance sheet be updated?

+

A balance sheet should ideally be prepared at least quarterly for internal use, with a formal one typically generated annually for reporting purposes. Depending on the company’s size, industry, and financial situation, more frequent updates might be necessary.