5 Ways to Forecast Balance Sheets in Excel Easily

Understanding how to project your company's financial health through its balance sheet is an essential skill for any business owner or financial analyst. Excel offers a versatile platform to forecast balance sheets, combining ease of use with powerful data analysis capabilities. Here are five efficient methods to streamline this process:

1. Using Excel’s Built-In Functions

Excel is equipped with numerous financial functions that can significantly simplify the forecasting process:

- NPER: To calculate the number of periods for an investment based on periodic payments and interest rates.

- SLN: Straight-Line Depreciation helps in forecasting asset values over time.

- DB: This function provides declining balance depreciation, which is useful for quickly calculating asset values.

📌 Note: Familiarity with these functions allows for quick and accurate balance sheet projections.

2. The Percentage of Sales Method

This technique involves projecting future balance sheet items based on their historical relationship with sales:

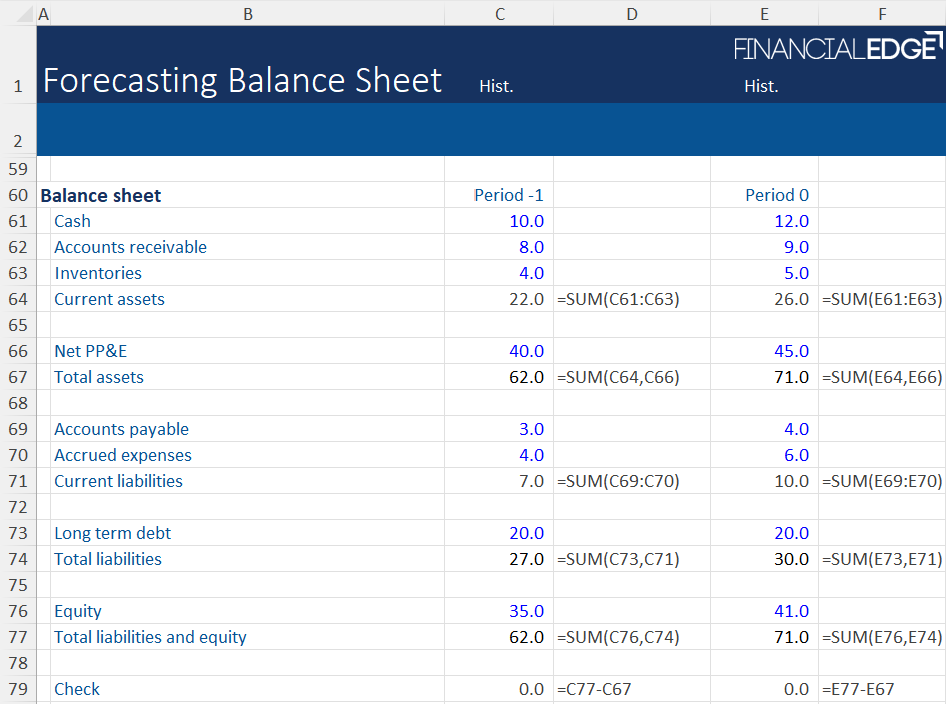

- Collect historical data of sales and related balance sheet accounts.

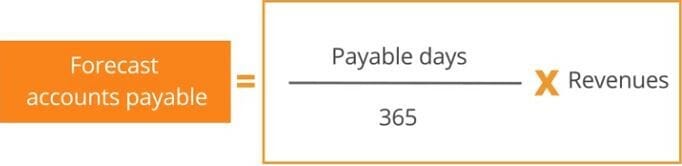

- Calculate the percentage of sales for each account (e.g., Accounts Receivable, Inventory).

- Project future sales and apply these percentages to estimate future values.

This approach assumes that balance sheet items will grow at the same rate as sales, making it straightforward for businesses with predictable growth patterns.

3. Cash Flow Forecast Integration

Linking cash flow projections with your balance sheet forecast provides a more comprehensive financial picture:

- Create a cash flow statement using Excel, focusing on cash from operations, investing, and financing.

- Feed these cash flows into your balance sheet to adjust cash balances and related accounts like accounts payable or receivable.

- This integration allows you to see how cash movements affect your company’s liquidity and solvency.

💡 Note: For more detailed analysis, incorporate different cash flow scenarios based on various business outcomes.

4. Scenario Analysis and Sensitivity Tables

Excel’s ability to model multiple scenarios can be harnessed for balance sheet forecasting:

- Create different scenarios (Optimistic, Pessimistic, Expected) with varying assumptions about sales, expenses, and capital expenditures.

- Use Excel’s Data Table feature to generate sensitivity tables, which show how changes in key variables (like growth rate, interest rates) affect the balance sheet.

- This method helps in understanding the impact of economic changes or strategic decisions on your financial position.

Having these scenarios readily available enables better preparation for different financial environments.

5. Leveraging Macros and VBA

Automating repetitive tasks in balance sheet forecasting can be achieved through Excel’s Visual Basic for Applications (VBA):

- Write macros to automate calculations, data input, or even entire forecasting models.

- VBA can also be used to integrate data from various sources, format reports automatically, or adjust forecasting models based on new data.

🚀 Note: Investing time in learning VBA can drastically reduce the time spent on regular forecasting tasks.

Key Points to Remember

When forecasting balance sheets in Excel:

- Ensure data integrity by double-checking input and formula accuracy.

- Regularly update your forecast with actuals to refine future projections.

- Keep your Excel model clean and organized for easier maintenance and updates.

- Be cautious with assumptions and consider worst-case scenarios to prepare for all possibilities.

Wrapping up, understanding how to effectively forecast balance sheets in Excel can give businesses a strategic advantage. With tools ranging from simple built-in functions to complex macro programming, Excel provides the flexibility needed to model your company's financial future with precision. Keep your Excel models regularly updated and consider a range of scenarios to ensure your business is ready for any financial challenge or opportunity that comes its way.

What are the advantages of forecasting balance sheets in Excel?

+

Excel allows for the customization of financial models, easy update with new data, integration with other financial tools, and scenario analysis, which are crucial for strategic planning and decision-making.

How can I ensure the accuracy of my financial forecasts in Excel?

+

Regularly compare your projections with actual financial data, use reliable data sources, validate formulas and inputs, and consider sensitivity analyses to understand the impact of variables on your forecast.

Is Excel suitable for large-scale financial forecasting?

+

Yes, with proper structuring and automation, Excel can handle large-scale forecasting. However, for very complex models, specialized financial software might be considered for better performance and scalability.