Finding Marital Trust Paperwork: Essential Tips

Marriage isn't just about love and partnership; it's also about the legal formalities that come with it. One such formality is the trust paperwork, which plays a crucial role in estate planning and financial security for couples. For those navigating the intricate world of marital assets and legal documents, understanding where and how to locate these essential papers is indispensable. This post will guide you through the steps to find marital trust paperwork, ensuring you're well-prepared for financial and estate planning.

The Importance of Marital Trusts

Before diving into where to find the paperwork, it's important to understand why trust documents are so significant:

- Estate Planning: Trusts help manage and distribute assets after one's demise, avoiding probate and potentially lowering estate taxes.

- Asset Protection: Marital trusts can safeguard assets from creditors and legal disputes.

- Provision for Spouse: Ensures surviving spouses have financial security by setting aside funds or property for their benefit.

Where to Begin Your Search

Looking for marital trust paperwork can feel daunting. Here's where to start:

1. Review Your Safe or Lockbox

- Check your personal safe or any secure lockbox for legal documents.

- Trust deeds or relevant estate planning documents might be kept in a safety deposit box at a bank or in a home safe.

2. Consult Your Attorney

- If you worked with an estate planning attorney or a lawyer to establish the trust, contact them. They would have copies of the documents you need.

3. Look Through Your Home Filing System

- Check your home filing system for folders labeled "legal", "trust", or "estate planning".

4. Contact Financial and Insurance Companies

- Your financial advisors, investment managers, or insurance agents might have details or copies of trust-related documents. They may also be involved in managing trust assets.

🛡️ Note: Ensure you have legal authorization or documentation proving your right to access these trust documents when contacting professionals.

Types of Marital Trusts

Understanding the various types of marital trusts can aid in identifying the relevant paperwork:

Simple Trust

- Income is distributed to the surviving spouse, and the remaining assets go to the beneficiaries after their passing.

QTIP Trust

- Qualifies for the marital deduction to minimize estate taxes, giving the surviving spouse an income interest while controlling asset distribution.

Credit Shelter Trust

- Optimizes estate tax exemptions by moving assets to a trust up to the amount of the exemption, benefiting the surviving spouse with income without increasing their taxable estate.

What to Do if You Can't Find the Documents

If you've searched everywhere but can't find the trust documents:

Check for Digital Records

- Many people store documents digitally, on a computer, or in cloud storage like Dropbox, Google Drive, or iCloud.

Recreate the Documents

- If all else fails, you might need to recreate the trust agreement with the help of your attorney. You'll need to provide any available information about the trust's creation and its terms.

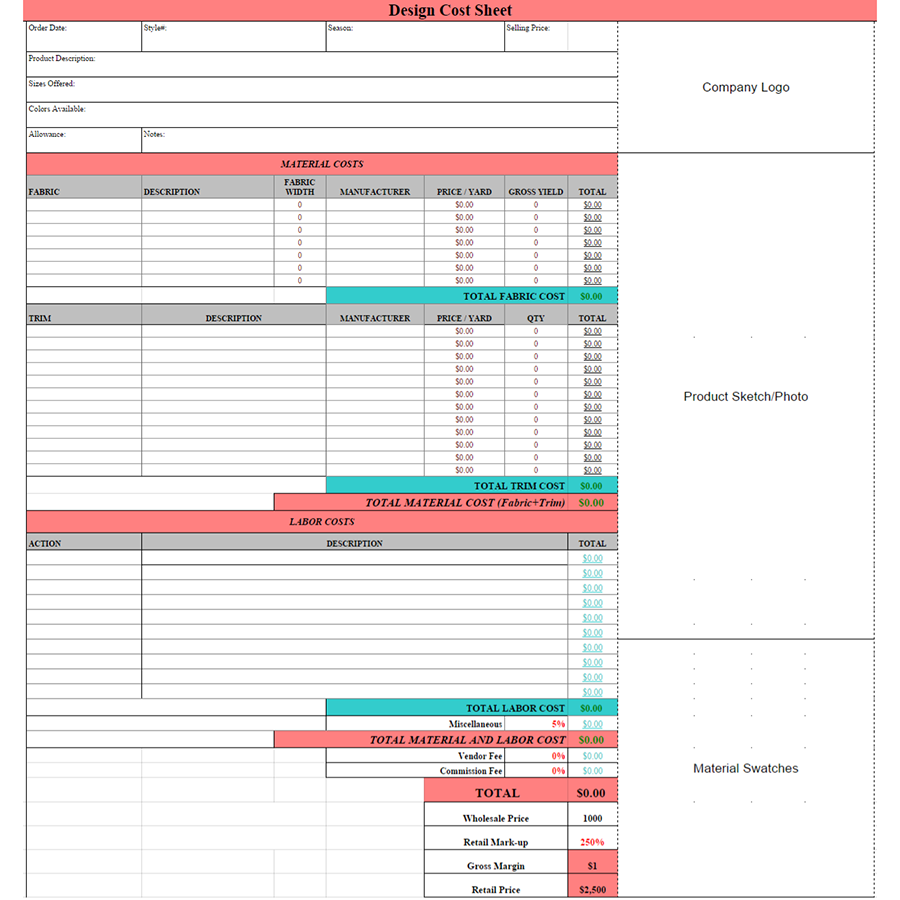

Here's a simple table to help you identify and understand different types of marital trusts:

| Type of Trust | Purpose | Benefit for Surviving Spouse |

|---|---|---|

| Simple Trust | Provides income to spouse, assets to heirs | Income distribution, assets to heirs after death |

| QTIP Trust | Estate tax planning, control over distribution | Income interest, no control over asset distribution |

| Credit Shelter Trust | Maximize estate tax exemptions | Income benefit, not increase taxable estate |

📍 Note: Creating new trust documents involves fees, so it's best to first exhaust all efforts to locate the original documents.

Wrapping Up

Finding marital trust paperwork is not just about locating physical or digital documents; it's about ensuring that your financial and estate planning remains intact. Whether you're looking for these documents during your lifetime for amendments or after a spouse's passing to execute their wishes, these steps will guide you through the search process. Remember, the trust paperwork contains critical legal and financial information, and keeping track of them can save time, legal fees, and potential disputes down the line.

Why is trust paperwork essential in marriage?

+

Trust paperwork is essential in marriage because it outlines how assets will be managed and distributed after one spouse passes away, potentially minimizing estate taxes, avoiding probate, and providing for the surviving spouse.

Can a trust be changed after it’s created?

+Yes, most trusts can be amended or revoked during the lifetime of the grantor. This process usually involves consulting with an attorney and drafting an amendment or restatement to the trust agreement.

What if I lose my trust paperwork?

+If you’ve lost your trust documents, you should attempt to locate them by checking with your attorney, financial advisors, or safe deposit boxes. If all efforts fail, you might need to recreate the trust with the help of your attorney using any available information.

Is it necessary to have an attorney create a marital trust?

+While it’s possible to create basic trust documents using software or online tools, involving an attorney provides tailored legal advice, ensures compliance with state laws, and minimizes the risk of errors in complex estate planning.

How does a marital trust benefit estate tax planning?

+Marital trusts like the QTIP Trust or Credit Shelter Trust can leverage estate tax exemptions, reducing the taxable estate of the first spouse to die and providing income to the surviving spouse, while assets are preserved for other beneficiaries without increasing estate tax liability.