5 Ways to Calculate Loan EMI in Excel

In today's financial landscape, understanding how to calculate the Equated Monthly Installment (EMI) of a loan is crucial for personal finance management. Whether you're looking to buy a new home, a car, or planning to take an educational loan, knowing your monthly obligations can help in better financial planning. Excel, being one of the most versatile tools available for financial calculations, can greatly assist in this process. In this post, we'll explore five different methods to calculate EMI in Excel, each tailored to different levels of complexity and requirements.

Method 1: Using the PMT Function

The PMT function in Excel is a straightforward way to compute the EMI for a fixed interest rate loan. Here's how you can use it:

- Open Microsoft Excel and select a cell where you want the EMI result to appear.

- Enter the formula: =PMT(rate, nper, pv)

- rate: The interest rate for the loan, divided by 12 for monthly payments.

- nper: The total number of payments for the loan term.

- pv: The present value, or the principal loan amount.

- For example, if you have a loan of $100,000 at an annual interest rate of 8% for 30 years, your formula would look like: =PMT(8%/12, 30*12, 100000)

💡 Note: The PMT function assumes the payments are made at the end of the period.

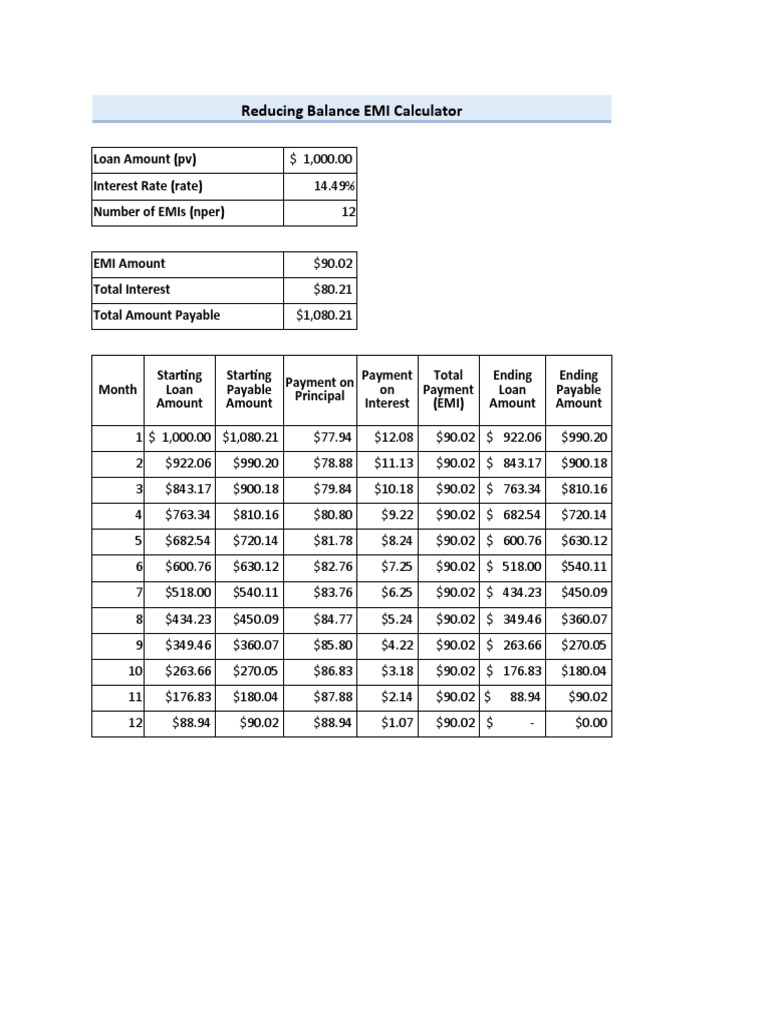

Method 2: Loan Amortization Schedule

Creating a loan amortization schedule not only gives you the EMI but also shows how much goes towards interest and principal over time:

- Set up your Excel sheet with columns for Period, Beginning Balance, Payment, Principal, Interest, and Ending Balance.

- In the first row, enter the initial values like:

Period 1 Beginning Balance Loan Amount (PV) Payment =PMT(rate, nper, pv) Interest =Beginning Balance * (Rate/12) Principal =Payment - Interest Ending Balance =Beginning Balance - Principal

- Extend these formulas down the column to cover the entire loan term.

Method 3: Using Goal Seek for Variable Rates

When you're dealing with fluctuating interest rates, you can use Excel's Goal Seek function to adjust your EMI dynamically:

- Enter the expected EMI in a cell.

- Set up your PMT formula, but make 'rate' variable by linking it to another cell.

- Use Goal Seek:

- Go to Data > What-If Analysis > Goal Seek.

- Set the 'Set cell' as your EMI cell, 'To value' as the known EMI, and 'By changing cell' as the cell with the interest rate.

- Excel will find the interest rate that corresponds with your desired EMI.

Method 4: Calculating EMI with Prepayments

Not all loans follow a simple amortization schedule due to prepayments. Here's how you can handle these scenarios:

- Use an amortization schedule as described in Method 2.

- Create additional columns for Prepayments and Adjusted Principal Payment.

- Adjust the Ending Balance formula to account for prepayments:

- Adjusted Principal Payment = Principal + Prepayment

- Adjusted Ending Balance = Beginning Balance - Adjusted Principal Payment

Method 5: Using Solver for Complex Scenarios

Excel's Solver can handle more intricate loan scenarios where you might need to optimize multiple variables:

- Set up your loan scenario in Excel, including your loan terms and constraints.

- Go to Data > Solver.

- Define your target cell (like EMI or total interest paid) and what you want to achieve (minimize or maximize).

- Set your variable cells (could be the interest rate or loan term) and specify constraints (e.g., EMI should not exceed your monthly budget).

- Run Solver to find the optimal solution.

After exploring these methods for calculating EMI in Excel, you'll appreciate the flexibility and insight Excel can provide into your loan repayments. Each method has its place depending on your specific financial situation and the level of detail you're comfortable with.

What does EMI stand for?

+

EMI stands for Equated Monthly Installment. It refers to the fixed payment amount made by a borrower to a lender at a specific date each calendar month.

Can EMI calculations change?

+

Yes, EMI can change due to several reasons like changes in interest rates, loan term extension or prepayments made by the borrower.

Is it better to pay more than the EMI?

+

Paying more than the EMI can help you pay off the loan faster, reduce the total interest paid, and increase your equity in the financed asset.

How does prepayment affect EMI?

+

Prepayment can either reduce the EMI amount or shorten the loan term, or both, depending on how the prepayment is applied to the loan.

Can Excel be used for other types of financial calculations?

+

Yes, Excel is widely used for various financial calculations including budgeting, investment analysis, depreciation schedules, and forecasting.