5 Easy Steps to Calculate Balance Sheet in Excel

Creating a balance sheet in Excel can be an empowering process for anyone who wants to gain a clearer understanding of their financial health, whether it's for a business or personal finances. Excel offers a versatile platform for this purpose, combining simplicity with functionality. Here's a detailed guide on how to calculate your balance sheet effectively using this powerful tool.

Step 1: Understand Your Assets

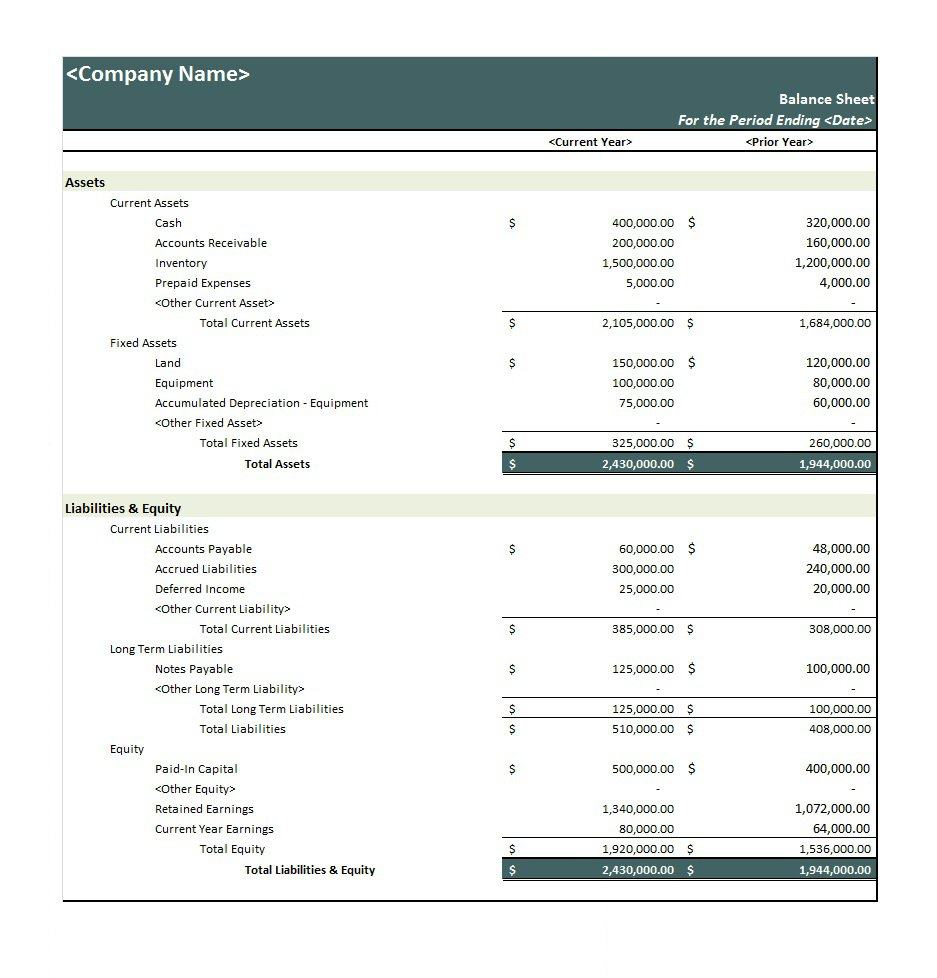

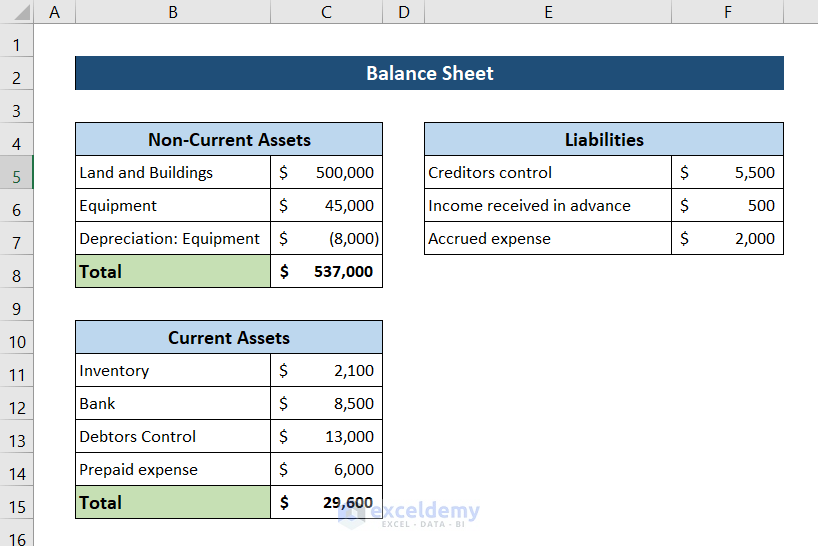

Begin by listing all your assets. These are resources with economic value owned by you or your business:

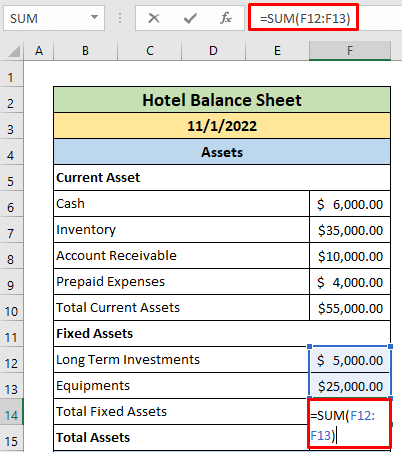

- Current Assets: Items that can be converted into cash within a year like cash, inventory, accounts receivable.

- Fixed Assets: Long-term investments like property, plant, and equipment, which typically aren’t quickly turned into cash.

- Other Assets: This might include intangibles like patents or copyrights, or investments that don’t fall neatly into the previous categories.

Organize your assets in a column under “Assets” in your Excel sheet, breaking them down further if necessary.

🔍 Note: For a business, distinguish between current and non-current assets for better financial management.

Step 2: List Your Liabilities

Next, list your liabilities. These are your financial obligations:

- Current Liabilities: Debts due within one year, such as accounts payable, short-term loans.

- Long-term Liabilities: Debts due beyond one year, like mortgages or long-term loans.

In your Excel, create a “Liabilities” column next to your assets to input these values. This visual representation helps in understanding your financial leverage.

Step 3: Calculate Equity

Equity is the difference between your assets and liabilities:

- If you are creating a personal balance sheet, this might simply be your net worth.

- For businesses, include retained earnings, owner’s equity, or stockholder’s equity.

Formulate the equity in your Excel sheet by using the formula:

=SUM(Assets) - SUM(Liabilities)

This provides a clear snapshot of your financial health or the business’s equity position.

💡 Note: Equity can also be used to determine how much your company or personal assets are worth after subtracting all liabilities.

Step 4: Formulate Balance Sheet Ratios

Excel can help calculate key financial ratios:

| Ratio | Formula |

|---|---|

| Current Ratio | Current Assets / Current Liabilities |

| Debt to Equity Ratio | Total Liabilities / Equity |

| Return on Equity | Net Income / Equity |

These ratios can give insights into liquidity, solvency, and profitability, helping you or your business make informed financial decisions.

Step 5: Summarize and Review

Summarize your balance sheet by totaling all your columns to ensure they balance:

- The equation should be: Total Assets = Total Liabilities + Equity

- Review the figures to identify discrepancies or areas that need attention.

- Consider using Excel’s chart functions to visually represent your financial data for better analysis.

🔔 Note: Regularly updating your balance sheet can help in forecasting future financial needs or adjustments.

In summary, calculating a balance sheet in Excel involves understanding and listing your assets, liabilities, and calculating equity, along with formulating key financial ratios. This process not only helps in understanding your current financial situation but also aids in planning future financial strategies. By organizing and analyzing financial data in Excel, you can make informed decisions that drive growth and stability.

Why is it important to use Excel for a balance sheet?

+

Excel provides a structured, manageable environment where financial data can be easily entered, organized, updated, and analyzed with built-in functions and formulas. It’s also widely recognized, making sharing financial reports straightforward.

Can I use Excel for a balance sheet if I’m not a business owner?

+

Absolutely! Excel is versatile enough for personal finance management, helping individuals track their net worth, manage debts, and plan investments.

How often should I update my balance sheet?

+

For businesses, quarterly updates or end-of-period financial statements are common. For personal use, updating annually or semi-annually can help keep a pulse on your financial health.

What if my balance sheet doesn’t balance?

+

Check for errors in data entry, review your calculations for assets, liabilities, and equity, and ensure all entries are properly categorized. Common mistakes include incorrect valuation or misclassification of items.