How Long to Keep Paperwork for Your Old House?

When it comes to managing your records for a home you've sold or are no longer living in, knowing how long to keep paperwork can be quite perplexing. This guide will walk you through the various types of documents you should retain and for how long, ensuring you're complying with legal standards and safeguarding your financial interests.

Understanding the Basics of Home Paperwork

The paperwork associated with selling or owning a home isn't just about having a cluttered filing cabinet. It's crucial for legal, tax, and historical purposes. Here's what you need to know:

- Why Keep Documents? Keeping records ensures you have proof for transactions, tax benefits, property ownership, and in case of disputes or audits.

- Types of Documents: From closing documents to repair receipts, various records are pertinent to keep.

Duration for Keeping Different Types of Documents

Closing Documents

Documents from the home sale or purchase, like:

- Settlement Statement (HUD-1)

- Deed

- Loan documentation

- Appraisal

These documents should be retained indefinitely. They prove ownership, taxes paid, and any capital gains or losses.

📝 Note: Don't forget to store these documents in a fireproof safe or digitize them for added security.

Tax Records

Tax records, especially those related to home transactions:

- Mortgage interest statements (Form 1098)

- Property tax bills

- Improvement receipts

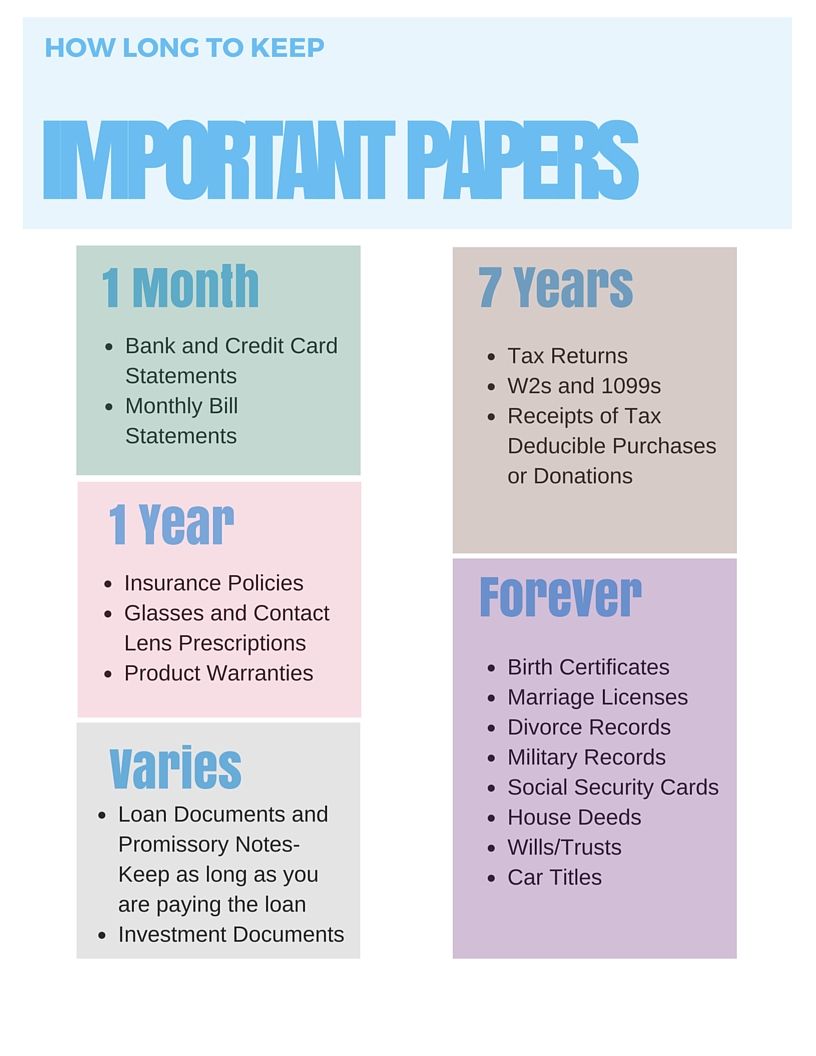

These records should be kept for at least 7 years. However, if you're looking for tax benefits related to the home, retain these for longer.

Home Improvement Records

Keeping records of improvements:

- Receipts

- Contracts with builders

- Paid invoices

The IRS allows you to add the costs of these improvements to your home's basis. Retain these records for as long as you own the property, plus 7 years after you sell it.

Utilities and Maintenance Records

Here's what to keep:

- Utility bills for the first and last month at the property

- Major repair receipts

While most people retain utility bills for only a year, the first and last month's bills are useful for proving occupancy and utility costs. Keep these records for at least 3 years.

Insurance Documents

Insurance policies and related paperwork:

- Policy documents

- Claims filed

- Payment receipts

You should keep these records for the duration of your homeownership plus 7 years for potential future claims or audits.

📌 Note: Always review your insurance policy to understand the retention period they might require for filing claims.

Miscellaneous Records

Including but not limited to:

- Warranties for appliances or home systems

- Pest control records

- Homeowners association documents

Keep warranties for as long as they are valid, and other miscellaneous records for at least 3 to 5 years post-sale.

Organizing and Storing Your Documents

Having a system for organizing and storing your paperwork can make life much easier:

Digitization

Scanning documents can save space and make them more accessible. Here are steps to digitize:

- Use a high-quality scanner or a mobile scanning app

- Organize digitally with folders and descriptive file names

- Back up digital files on external drives, cloud storage, or both

Physical Storage

For those who prefer paper, consider:

- Fireproof safe

- Binders with dividers for each document type

- Clearly labeled boxes or file cabinets

When to Toss Out Old Paperwork

It's tempting to keep everything, but not all documents are needed indefinitely:

- Get rid of monthly utility bills after one year, except for the first and last month of occupancy.

- Discard old repair receipts once the warranty has expired or after 5 years, whichever is longer.

- After 7 years, it's generally safe to shred most of your financial records if you aren't expecting an audit or lawsuit.

❗ Note: Before disposing of any document, make sure it's no longer relevant or required for legal or tax purposes.

The process of managing your old house paperwork requires diligence, organization, and knowledge of retention periods. Retaining the right documents for the appropriate duration ensures you're covered for legal, tax, and personal interests. Remember:

- Permanently retain closing documents.

- Keep tax records for at least 7 years.

- Retain home improvement records for the life of the property ownership plus 7 years.

- Organize, digitize, or store documents securely.

By following these guidelines, you'll navigate the complexities of home record-keeping with confidence, ensuring you're prepared for any future needs without holding onto unnecessary clutter.

How long should I keep my closing documents?

+

Keep closing documents indefinitely as they are crucial for proving ownership and tax benefits related to the sale of your property.

Is it necessary to keep utility bills?

+

Retain the first and last month’s utility bills for at least 3 years to establish occupancy and utility costs. Monthly utility bills can be discarded after one year.

Can I digitize all my home-related paperwork?

+Yes, digitizing documents not only saves space but also makes them easily accessible. Ensure you keep backups in secure, reliable storage like external drives or cloud services.

How do I safely dispose of old paperwork?

+Shredding documents containing sensitive information is advisable. Regularly evaluate which documents are no longer necessary to keep.