How Long to Keep Chapter 13 Paperwork After Discharge

Receiving a discharge from a Chapter 13 bankruptcy can feel like a major milestone, signaling the end of a long journey toward financial recovery. However, the responsibilities that come with managing your finances post-discharge are not completely over. One key aspect involves deciding how long to keep your Chapter 13 paperwork, a topic that deserves careful consideration for future financial stability and legal compliance.

Why Keeping Chapter 13 Paperwork Matters

Chapter 13 bankruptcy, often referred to as a wage earner’s plan, allows individuals with regular income to restructure their debts over a period of three to five years. The paperwork associated with this process is not only voluminous but also critical for various reasons:

- Legal Compliance: Some of the documents related to your bankruptcy must be kept for legal purposes, especially in case of any future disputes or inquiries.

- Future Financial Transactions: Banks, lenders, and creditors might request information related to your bankruptcy when considering you for loans, lines of credit, or even rental applications.

- Historical Reference: Personal records can help you track your financial journey and provide peace of mind, knowing that everything is properly archived.

How Long Should You Keep the Paperwork?

The consensus among legal professionals and financial advisors is that you should retain your Chapter 13 paperwork for at least seven years after your discharge. Here’s why:

- Tax Records: The IRS requires you to keep tax records for three years from the date you filed your tax return or two years from the date you paid the tax, whichever is later. However, since bankruptcy impacts your tax returns, keeping documents related to it alongside tax documents is a wise practice.

- Lender Requests: When seeking new credit or significant loans, lenders might ask for bankruptcy records up to seven years after discharge to assess your financial stability and repayment history.

- Federal Guidelines: While federal law does not explicitly state a minimum retention period for bankruptcy records, a seven-year retention aligns with other federal record-keeping requirements like tax documentation.

📝 Note: Always consult with a bankruptcy attorney for advice specific to your case, as legal requirements might vary by jurisdiction or individual circumstance.

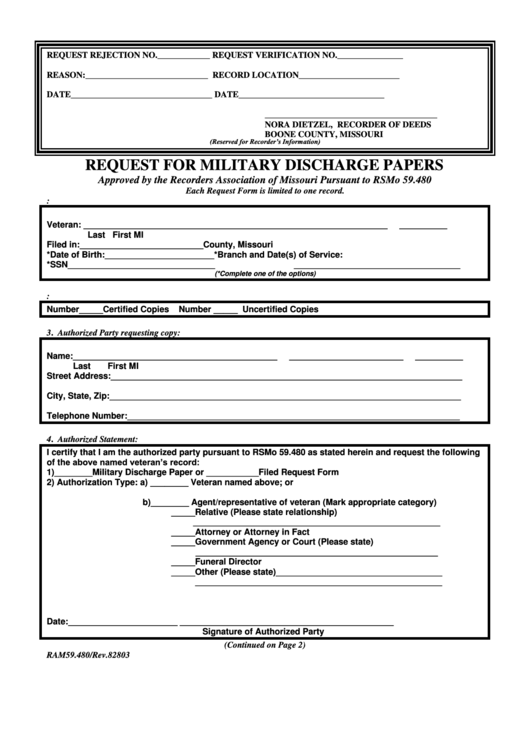

Key Documents to Keep

Here’s a list of essential documents you should keep:

| Document | Importance |

|---|---|

| Order of Discharge | Official proof that your bankruptcy case was successfully closed. |

| Repayment Plan | Outlines the payment schedule and amount, essential for financial tracking. |

| Court Filings | These include petitions, schedules, and statements of financial affairs. |

| Credit Counseling Certificates | Evidence of required pre-bankruptcy and pre-discharge credit counseling. |

| Trustee Statements | Payments made through the trustee provide a record of compliance with the court-approved plan. |

Proper Storage of Paperwork

Ensuring that your Chapter 13 paperwork is properly stored is crucial for preservation and future access:

- Physical Storage: Use a fireproof safe or lockbox, and keep these documents in a dry, cool, and secure location like a home office or a safety deposit box.

- Digital Storage: Scan and save digital copies on a secure cloud storage service or external hard drive, with proper encryption for sensitive data.

- Backups: Create multiple backups of your digital documents to prevent data loss due to hardware failure, cyber threats, or accidental deletion.

📌 Note: Ensure that the storage method you choose protects your personal information from unauthorized access.

Wrapping up, managing your Chapter 13 paperwork post-discharge is an essential part of maintaining financial order. By keeping documents for at least seven years, you ensure compliance with legal requirements and provide a robust history of your financial journey. Remember to secure your documents both physically and digitally to safeguard your privacy and ensure access to critical information when necessary.

Can I shred all my Chapter 13 bankruptcy paperwork after seven years?

+

Generally, yes, you can shred most of your Chapter 13 documents after seven years. However, consider keeping the discharge order and any records that might be needed for extremely long-term purposes like tax or legal disputes.

What happens if I lose important Chapter 13 documents?

+

Losing key documents might require you to contact the bankruptcy court or your bankruptcy attorney for replacements. Some documents like the discharge order can be reissued, though it might involve some paperwork and cost.

Is it mandatory to keep all documents in paper format?

+

No, it’s not mandatory. Many documents can be stored digitally, especially when backed up securely. However, for legal and financial audits, you should be prepared to provide originals or certified copies if requested.