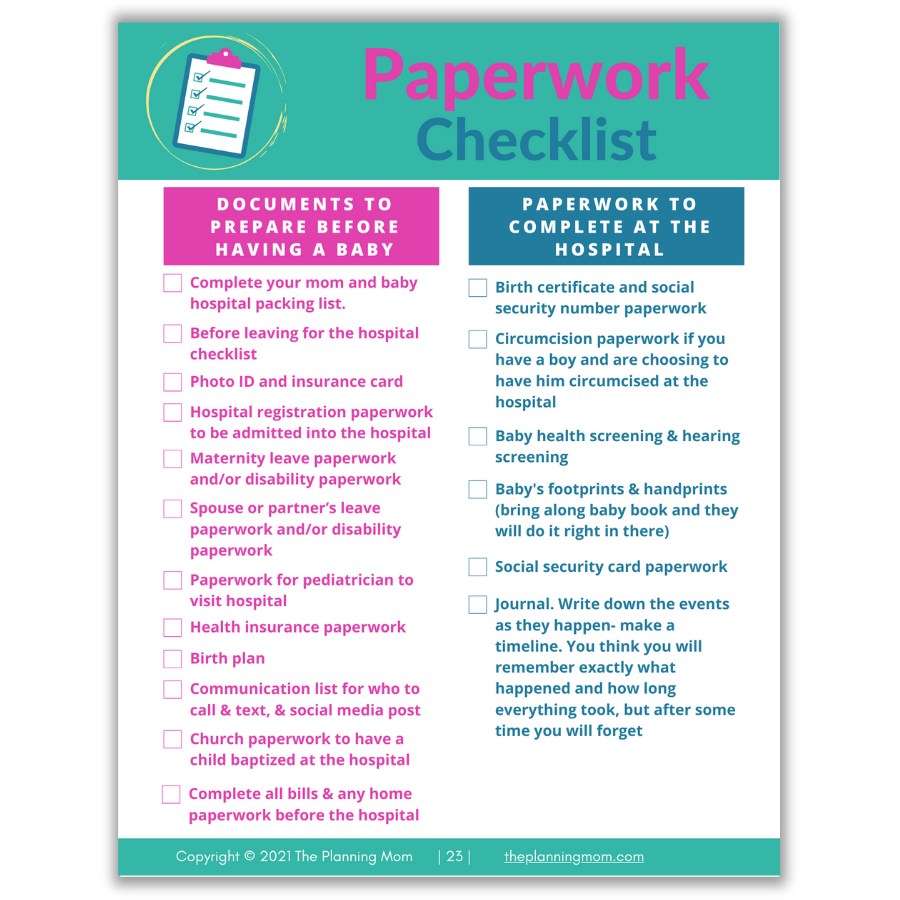

5 Ways to Claim Old PPI Without Paperwork

Claiming old Payment Protection Insurance (PPI) can be a daunting task, especially when you no longer have the paperwork to back up your claims. However, with the right approach, you can still access your PPI refunds, even without physical documents. Here are five effective methods to pursue your PPI without the hassle of paperwork:

1. Contact Your Original Lender

Your first line of action should be reaching out directly to the financial institution or credit card provider where you took out the loan or credit agreement associated with the PPI. Here's what you can do:

- Identify Your Lender: Track down the original lender from statements, online banking history, or even old address books where their contact details might still be listed.

- Call or Visit: Call the customer service number or visit a branch if possible. Explain your situation and your intent to claim back any PPI.

- Verify Account Details: Have as much information as you can provide to verify your account. This might include your name, date of birth, account numbers, or the approximate time you took out the loan or credit card.

🔍 Note: Even if you haven't kept any paperwork, your lender might have records of your historical transactions which could include details about your PPI policies.

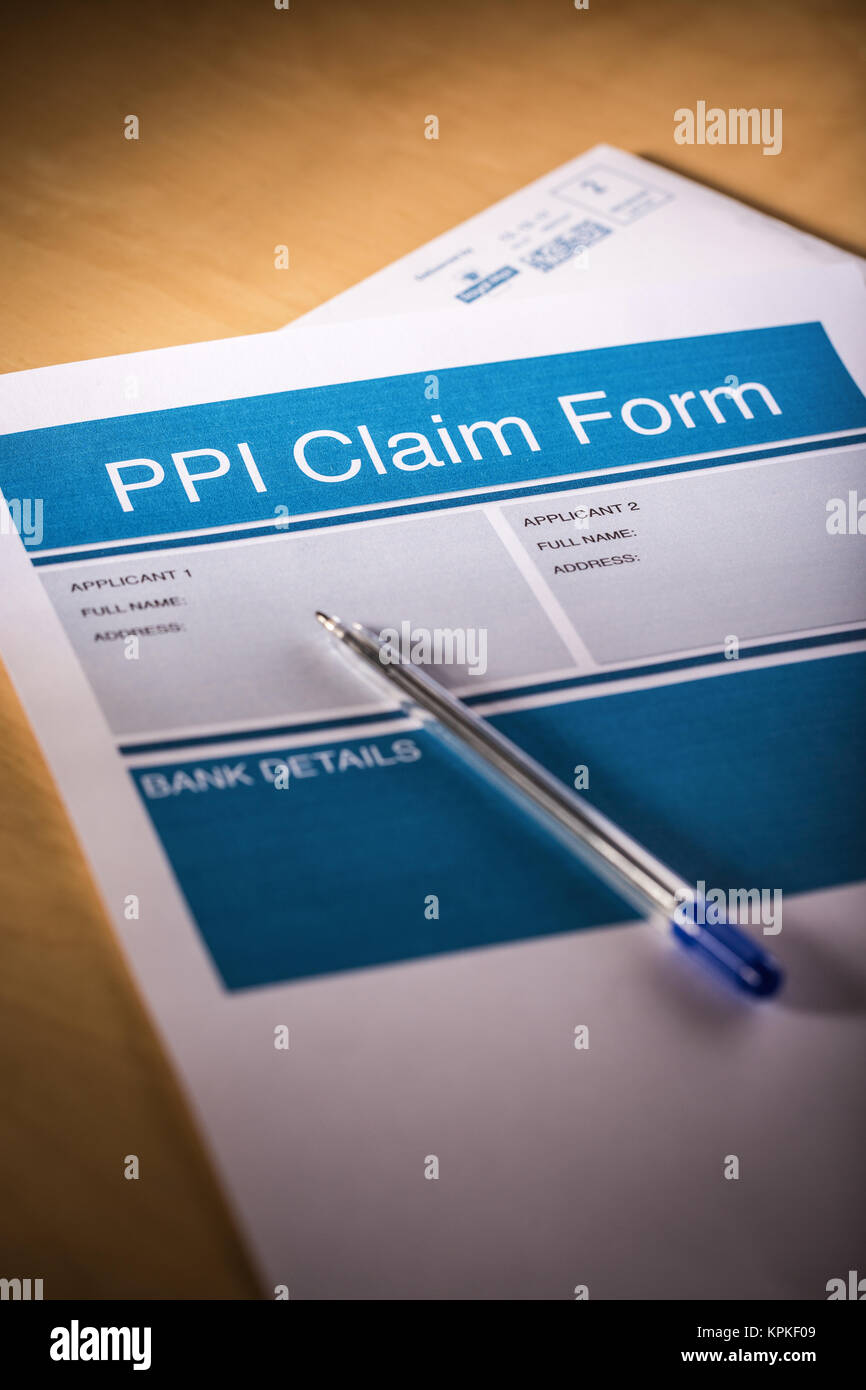

2. Use PPI Claim Companies

If you're not comfortable navigating the claims process alone or if you're having difficulty reaching your lender, consider employing the services of a PPI claims management company. Here are the steps:

- Choose a Reputable Company: Research and select a company with a good track record. Look for reviews and client testimonials.

- Provide Information: They'll ask for basic details like your name, contact information, and any recollection of loans or credit agreements you've had.

- Fees and Charges: Be aware that these companies will charge a fee, often a percentage of the refund if successful.

3. Utilize Financial Ombudsman Services

If your claim has been rejected or you're not satisfied with the lender's response, you can escalate the issue to the Financial Ombudsman Service:

- Submit a Complaint: Describe your situation, including what you've tried and why you believe you're entitled to a PPI refund.

- Provide Evidence: Even without physical documents, provide details like dates, approximate amounts, or names of the lenders involved.

- Mediation and Decision: The Ombudsman will mediate between you and the lender, potentially leading to a decision in your favor.

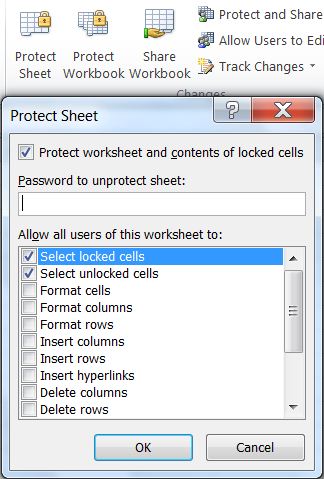

4. Online PPI Claim Tools

Some websites offer tools or guides to help you claim your PPI online. These platforms can streamline the process:

- Find a Reliable Tool: Use tools provided by consumer protection organizations or legal aid sites known for their integrity.

- Enter Your Information: Input your details, recalling as much as you can about your past financial agreements.

- Generate a Claim: These tools can help draft a formal letter of claim for you to send to the lender.

5. Seek Legal Advice

As a last resort, if your claim has been repeatedly denied or if the process is too complex, seeking legal advice might be necessary:

- Find a Solicitor: Look for one specializing in financial mis-selling or PPI claims.

- Discuss Your Case: Explain your situation, providing as much detail as possible. This might help in finding alternative evidence or strategies to claim your PPI.

- Legal Fees: Be prepared for legal fees if you proceed with a claim through a solicitor, though often these can be on a 'no win, no fee' basis.

🚨 Note: While seeking legal advice can be costly, it might be your best option if the amount of PPI you are entitled to is significant.

To summarize, claiming back PPI without physical documents is not impossible. By reaching out directly to your lender, engaging claim companies, using the Financial Ombudsman, employing online tools, or seeking legal assistance, you can navigate the process. Remember, the key is persistence and patience, as each approach might take time to yield results. With these methods, you stand a good chance of retrieving what might rightfully be yours, even if the paperwork has been long lost or destroyed.

Can I still claim PPI if the lender has gone out of business?

+

Yes, you can. If the lender or credit provider has gone out of business, you might still be able to claim PPI through the Financial Services Compensation Scheme (FSCS) or by contacting any administrators or new owners of the business.

How long does a PPI claim take?

+

The duration can vary significantly. Some claims can be resolved within weeks, while others might take months, especially if they go to the Financial Ombudsman or through legal channels.

What if I can’t remember the details of my loan or credit agreement?

+

If you can’t remember exact details, approximate dates or periods can still help. Many lenders keep records that can trace back to your transactions, which might include PPI details.

Are there any deadlines for claiming PPI?

+

Yes, there are time limits. The deadline for claims was August 29, 2019, but there might be exceptions if you can prove specific reasons for a delay in making a claim.