What to Do with the Rest of Your Paperwork?

Whether you're reorganizing your home office, moving to a new place, or simply trying to streamline your life, managing paperwork is an essential task. But with stacks of documents, bills, and records piling up, it can quickly become overwhelming. This guide will walk you through a step-by-step process to handle your paperwork efficiently, ensuring you keep what's necessary while safely disposing of what isn't.

Understanding What to Keep

Before we dive into sorting, let’s clarify which documents you should definitely keep:

- Tax Records: Keep tax returns and supporting documents for at least 7 years. If you own a business, you might want to keep records longer.

- Contracts and Legal Documents: Retain indefinitely, or as per the terms of the contract.

- Property Records: Keep deeds, mortgage documents, and homeowner’s insurance records indefinitely.

- Medical Records: Hold onto them for as long as possible, especially records that have ongoing relevance.

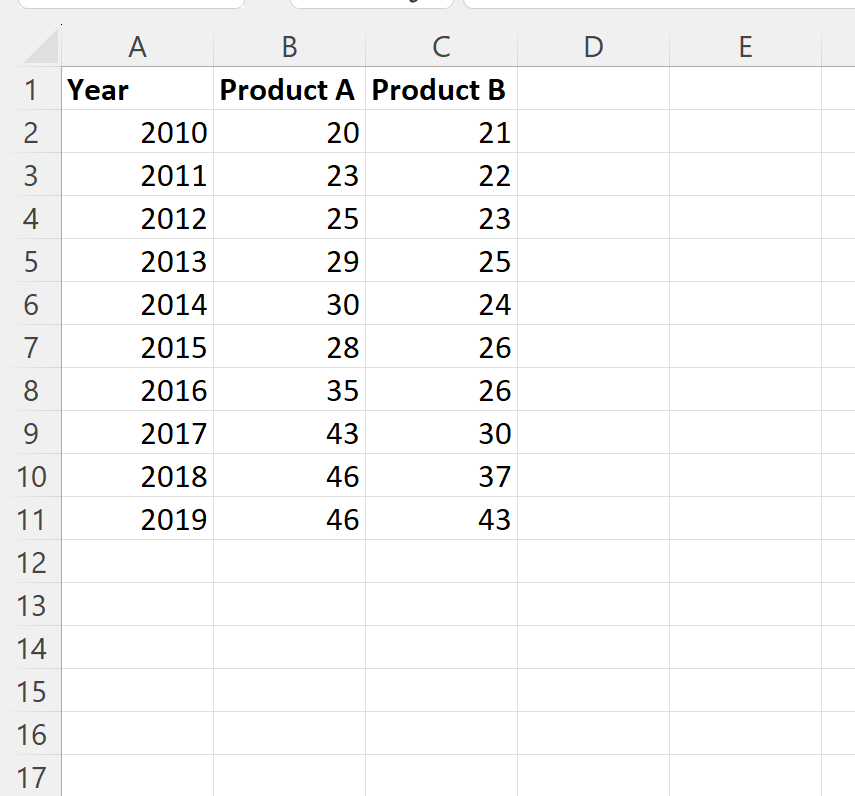

- Financial Statements: Review these annually, keeping the last 3-5 years for reference.

The Sorting Process

Now that we know what to keep, let’s organize:

Step 1: Gather Everything

Collect all your paperwork from drawers, shelves, and folders. Bring it to a designated sorting area.

Step 2: Sort into Categories

Divide the documents into categories like:

- To Keep

- To Shred

- To Scan/Digitize

- To File

Step 3: Review and File

| Category | Action |

|---|---|

| To Keep | File these securely in a designated area or safe. |

| To Shred | Shred sensitive documents to prevent identity theft. |

| To Scan/Digitize | Scan documents and store them on secure cloud or external storage. |

| To File | Organize them into a filing system for easy retrieval. |

🗂️ Note: Ensure your filing system is clearly labeled to make document retrieval straightforward.

Shredding and Digitizing

Shredding

Use a shredder or shredding service for documents with personal information. Shredding protects you from identity theft.

Digitizing

Digitizing can reduce clutter:

- Scan documents using a scanner or smartphone app.

- Organize digital files into folders.

- Back up your digital archive to avoid data loss.

💡 Note: Regularly back up your digital files to multiple secure locations to safeguard against data loss.

Creating a Paperless Future

Going paperless reduces clutter and environmental impact:

- Set up e-billing and automatic payments where possible.

- Use cloud storage solutions like Dropbox or Google Drive.

- Implement document management software for better organization.

Maintenance and Declutter

Keeping up with paperwork isn’t a one-time task:

- Monthly: Review financial statements and shred old bills.

- Quarterly: Review and purge unnecessary files.

- Annually: Do a comprehensive clean-up, including tax preparation and record archiving.

🔧 Note: Setting up a regular schedule for maintenance helps prevent paperwork from becoming unmanageable.

To wrap things up, handling your paperwork involves sorting, understanding what to keep, shredding, and possibly transitioning to a paperless system. By following these steps, you can not only reduce clutter but also ensure your important documents are secure and accessible. Remember, the key to effective paperwork management is consistency and a clear organizational strategy.

How long should I keep bank statements?

+

Financial institutions generally keep records for 7 years. It’s advisable to keep yours for at least this period to address any discrepancies.

What should I do with old medical records?

+

Keep them as long as possible, especially for chronic conditions or if they relate to ongoing medical issues. Digitizing can help manage space.

Can I store important documents in the cloud?

+

Yes, using secure cloud storage services is a good option for back-up. However, ensure you have strong passwords and consider encryption for sensitive documents.