DIY Guide to 501c3 Paperwork: Simplified Steps

Starting a nonprofit organization is an exciting yet challenging endeavor. The critical step of obtaining the 501(c)(3) status from the IRS can seem daunting, but with the right preparation, it can be managed effectively. This guide will walk you through the simplified steps for managing the 501(c)(3) paperwork.

Understanding the Basics of 501©(3) Status

The 501©(3) status is granted to nonprofit organizations by the IRS, providing them with federal tax exemption. This status allows donors to claim tax deductions for their contributions, thereby incentivizing donations. Here’s what you need to know:

- Purpose: Your organization must operate for charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, or preventing cruelty to children or animals.

- Public Benefit: Your activities should benefit the public rather than individual members or private shareholders.

Step 1: Form Your Organization

Before diving into the IRS paperwork, you need to formally create your nonprofit:

- Choose a Name: Ensure it’s unique and not used by any other organization in your state.

- Incorporate: File Articles of Incorporation with your state to become a legal entity.

- Draft Bylaws: These rules govern the internal management of your organization.

- Select Board Members: These individuals will oversee your organization’s operations.

⚠️ Note: State laws can differ significantly regarding the legal formation of nonprofits. Make sure to check your state’s specific requirements.

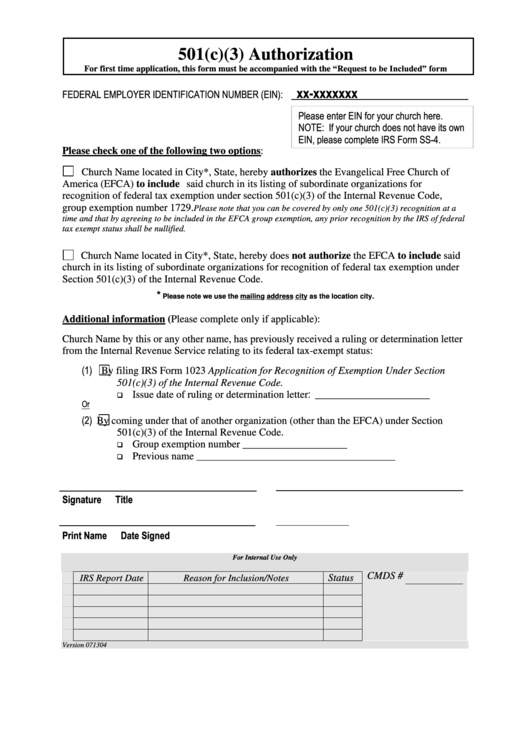

Step 2: Secure an Employer Identification Number (EIN)

An EIN is necessary for tax purposes and to apply for tax-exempt status:

- Apply for an EIN online through the IRS website, which is immediate and free of charge.

- Keep the confirmation letter as you will need to include this EIN in your Form 1023 application.

Step 3: Prepare Your Documents

Before filing with the IRS, ensure you have the following:

- Articles of Incorporation or other formation documents.

- Bylaws: Your organization’s rules.

- Conflict of Interest Policy: To prevent personal benefits to insiders.

- Financial Statements: If your organization has been operating, provide a balance sheet or similar.

- Narrative Description: A detailed description of your past, present, and planned activities.

Step 4: Complete IRS Form 1023

Form 1023 is the application for recognition of exemption under section 501©(3) of the Internal Revenue Code. Here’s how to fill it out:

- Part I: Provide organizational information like name, address, EIN, and incorporation date.

- Part II: Describe your organization’s structure, governance, and compensation policies.

- Part III: Detail your past, current, and planned activities, including how they benefit the public.

- Part IV: List your financial data, including revenues, expenses, and assets.

- Schedules: Include additional information requested in specific schedules.

ℹ️ Note: There is also a Form 1023-EZ for smaller organizations with annual gross receipts of less than 50,000 and assets under 250,000.

Step 5: Submit Your Application

After compiling all documents:

- File Electronically: Submit Form 1023 via pay.gov for faster processing.

- User Fee: Pay the appropriate user fee based on your organization’s size.

- Track Status: Use the IRS’s online tool to check your application status.

Step 6: Post-Approval

Upon approval, you’ll receive a determination letter from the IRS:

- Public Disclosure: Make your exemption application available for public inspection.

- Annual Filings: File Form 990, 990-EZ, or 990-N annually.

- Ongoing Compliance: Adhere to nonprofit laws and maintain your status.

Navigating the process of obtaining 501(c)(3) status requires meticulous preparation and adherence to IRS guidelines. By following these simplified steps, your organization can set up the foundation for a successful nonprofit venture. Remember, achieving this status not only provides tax benefits but also establishes credibility with donors and the community. Keep your operations transparent and in line with your stated mission to maintain this important recognition.

What happens if my 501©(3) application is rejected?

+

If your application is rejected, the IRS will provide a detailed explanation. You can address the issues raised, make necessary amendments, and resubmit your application.

How long does the IRS take to process a 501©(3) application?

+

The standard processing time can vary, but you might expect a wait of 3 to 6 months if filing Form 1023-EZ, and up to a year or more for Form 1023, depending on complexity.

Can a for-profit business apply for 501©(3) status?

+

No, a for-profit business cannot apply for 501©(3) status. However, for-profit companies can establish or sponsor a nonprofit affiliate or foundation to conduct charitable activities.