5 Truths About Lying on Life Insurance Paperwork

When it comes to securing a life insurance policy, the thought of presenting your circumstances as favorably as possible can be enticing. However, the implications of providing false information on life insurance paperwork can have serious and far-reaching consequences. Here, we explore five critical truths about lying on your life insurance application that could impact both your coverage and your beneficiaries' future.

The Importance of Honesty in Life Insurance Applications

Life insurance companies operate on the principle of utmost good faith where both the insurer and the insured must provide complete and accurate information. This principle is not just an ethical standard but also a legal requirement:

- Legal Requirement: Failing to disclose accurate information can lead to legal ramifications, including policy cancellation or refusal to pay out claims.

- Moral Obligation: Insurers base their risk assessments on the truth; lying deprives them of the ability to make informed decisions.

Honesty ensures that the policy accurately reflects the risk, providing security to the beneficiaries when they need it most.

Consequences of Lying on Your Life Insurance Application

Providing false information might seem like an easy way to reduce premiums or secure coverage when it might not be possible otherwise. However, the consequences are severe:

- Policy Cancellation: If the insurer discovers any discrepancies, they have the right to cancel the policy.

- Claims Denial: Any false information can lead to claim denial, leaving your loved ones without financial support.

- Reputation: Misrepresentation can tarnish your creditworthiness and credibility with insurance providers.

⚠️ Note: The severity of consequences varies based on the extent and nature of the deception.

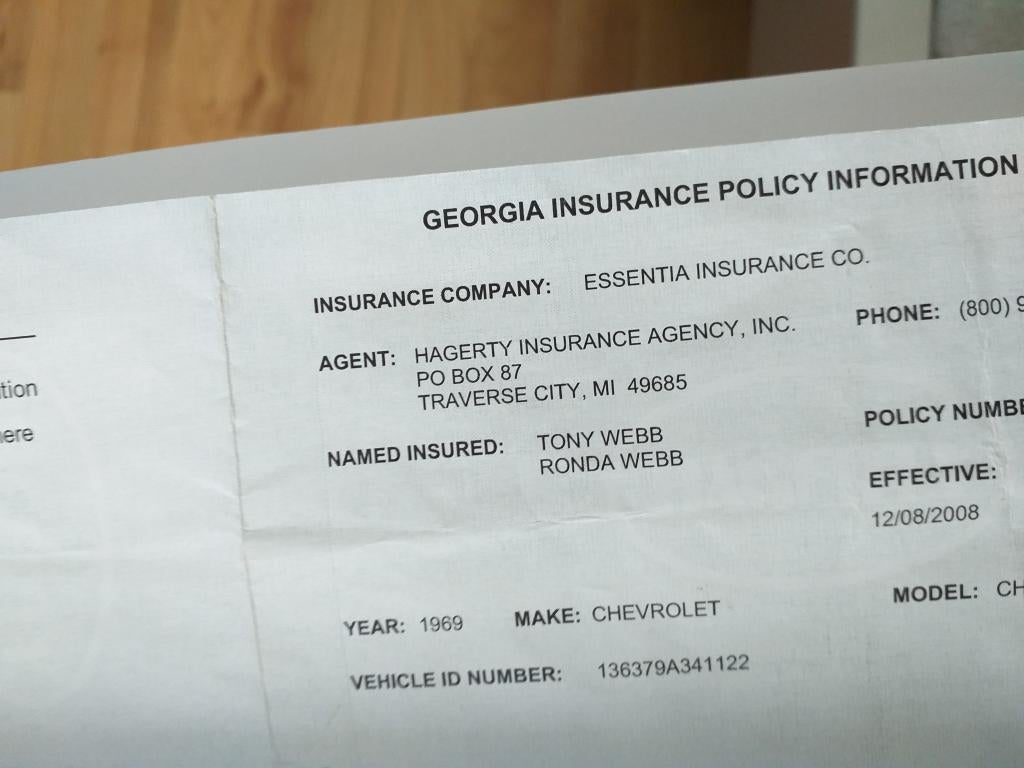

Common Lies in Life Insurance Applications

| Lie | Consequence |

|---|---|

| Hiding Medical Conditions | Increase in premiums or denied coverage |

| Falsifying Income | Policy might not cover expected needs |

| Not Disclosing Lifestyle Habits | Claims can be denied if lifestyle factors contribute to death |

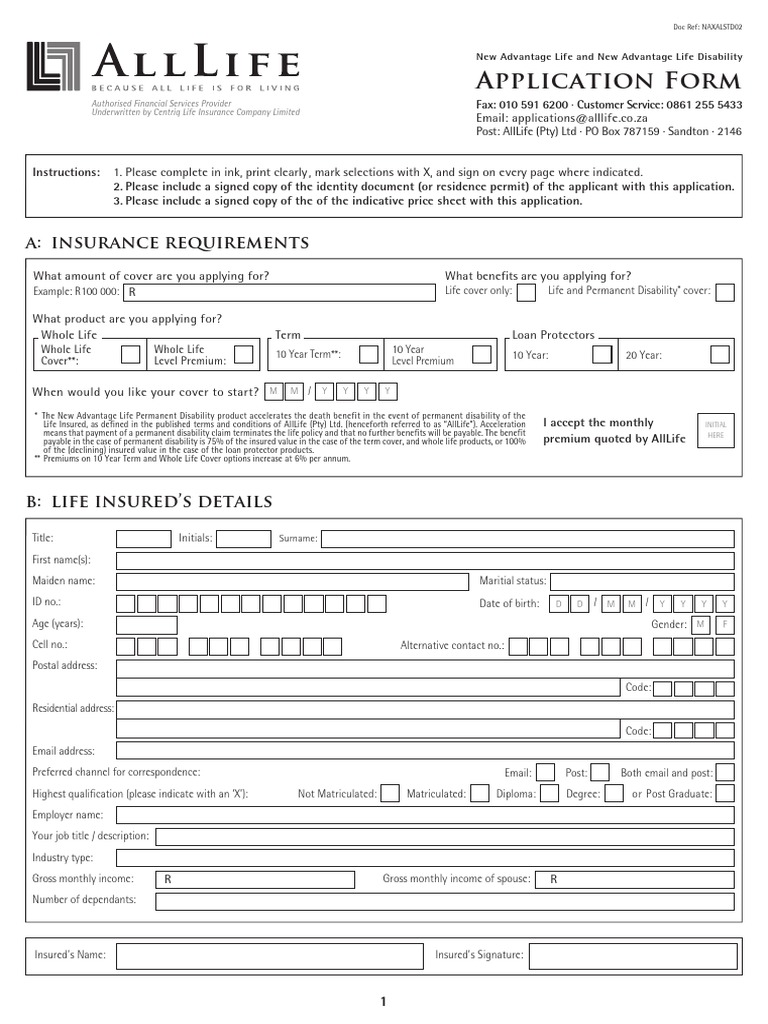

How Insurers Detect Lies

Life insurance companies employ various methods to uncover the truth:

- Medical Exams: Thorough examinations can reveal hidden medical conditions.

- Questionnaire: Detailed questions aimed at establishing risk profiles.

- Third-party Verification: Information from doctors, employers, or credit reports.

These measures ensure that the policy accurately reflects the risk profile of the applicant.

Steps to Take if You’ve Misrepresented Information

If you’ve lied or provided incomplete information on your life insurance application:

- Correct the Information: Contact your insurance provider to update your records.

- Assess the Impact: Understand how this misrepresentation might affect your coverage or premiums.

- Legal Consultation: If significant issues arise, consider legal advice.

Recognizing the mistake and taking prompt action can sometimes mitigate the consequences, though it won’t always guarantee the policy’s survival.

In life insurance applications, honesty is more than a legal requirement; it's an ethical responsibility that affects the policy's integrity and the support system for your beneficiaries. The financial security you seek through life insurance is based on the foundation of accurate information, ensuring that when the time comes, your loved ones receive the benefits you intended for them.

Can I lie about my age on a life insurance application?

+

No, lying about your age is considered misrepresentation and can lead to policy cancellation or denied claims. Age is a critical factor in determining life expectancy and premiums.

What happens if my insurer finds out I lied after my death?

+

If discovered posthumously, the insurance company may refuse to pay out the claim, leaving your beneficiaries without financial support.

Is it ever okay to withhold information on a life insurance form?

+

No, it is crucial to provide complete and accurate information to ensure your policy remains valid and your beneficiaries receive the coverage you intended.

Can I change my policy if I’ve given false information?

+

Yes, you can correct the information, but this might lead to changes in premiums or even policy cancellation. Early and honest communication with your insurer is key.

What if the insurance company misinterprets the information I’ve given?

+

Insurers are generally thorough, but if there is a misunderstanding, you have the right to clarify or correct the information. Document all communications regarding your policy to ensure clarity.