5 Tips on IRA Paperwork at 21

Embarking on the journey of setting up an Individual Retirement Account (IRA) at the age of 21 can be a pivotal step towards securing your financial future. IRAs are powerful retirement saving tools because they offer tax advantages that can compound over time, making it an ideal time to start. However, managing IRA paperwork can seem daunting if you're new to financial investments. Here are five essential tips to help you navigate the IRA paperwork with ease.

1. Understand the Basics of Different IRAs

Before you delve into the paperwork, it’s crucial to understand the different types of IRAs:

- Traditional IRA: Contributions are often tax-deductible, and earnings grow tax-deferred until withdrawal.

- Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals are tax-free.

- SEP-IRA: Typically used by self-employed individuals or small business owners for tax-deductible contributions.

- SIMPLE IRA: Designed for small businesses, allowing both employer and employee contributions.

Each IRA type has its own paperwork and rules regarding contributions, withdrawals, and tax implications. Knowing which IRA suits your situation best will streamline your paperwork process.

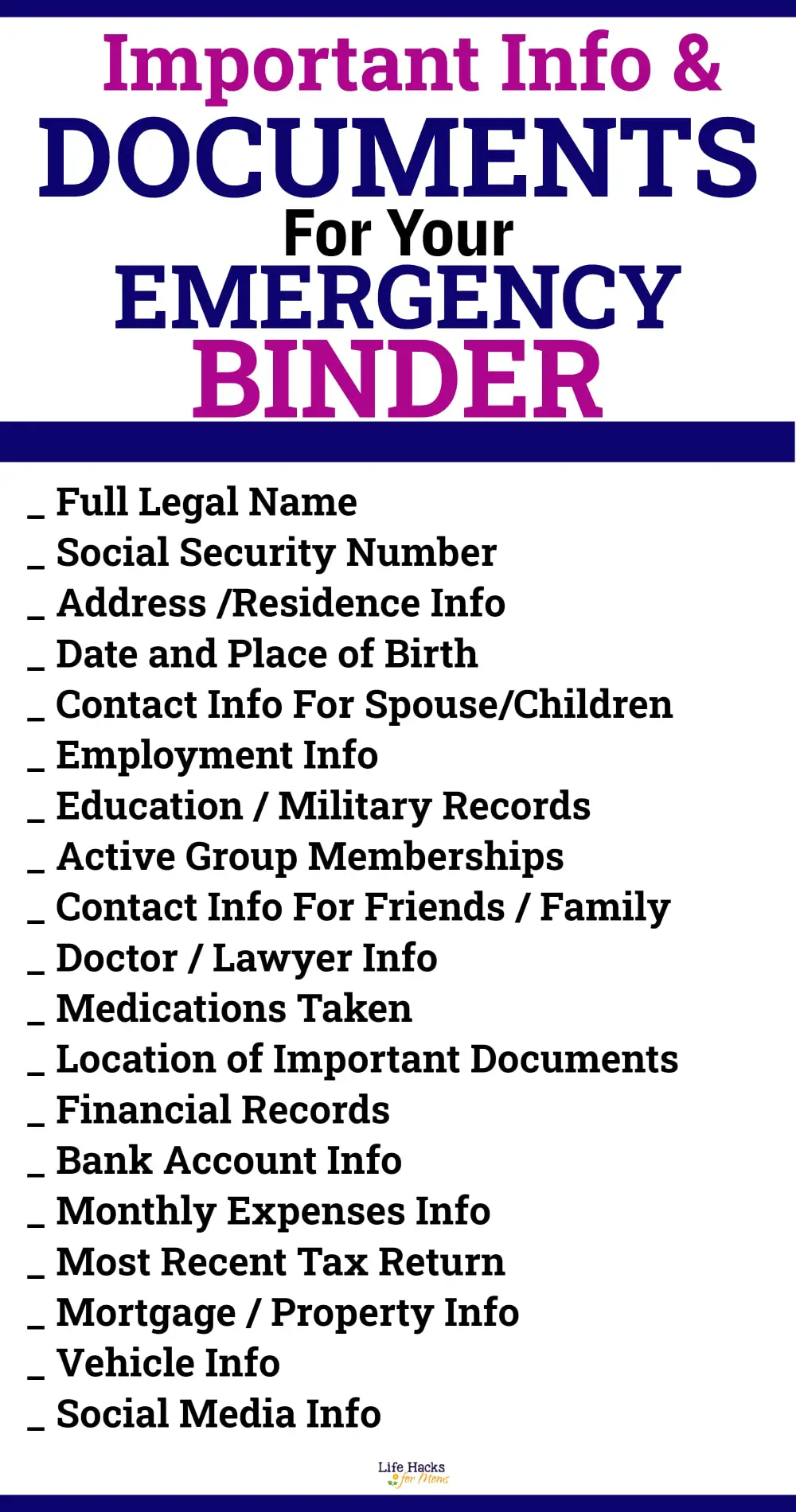

2. Gather Required Documents

Completing your IRA paperwork requires specific documents:

- A valid ID like a driver's license or passport.

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Details of any existing IRA accounts if you're rolling over funds.

- Beneficiary designations.

- If applicable, a notarized signature or power of attorney documentation.

🔔 Note: Make sure all documents are current to avoid delays in your account setup.

3. Fill Out Forms Accurately

Filling out IRA forms with accuracy is critical:

- Account Application: This includes your personal information, beneficiary details, and investment choices.

- Contribution Form: Specify how much you're contributing and which year these contributions are for.

- Beneficiary Designation: Indicate who will receive your IRA assets upon your passing.

- Disclosure Statement: Agree to the terms of the account, including fees and investment options.

- Transfer/Rollover Request: If moving funds from another retirement account.

👁️ Note: Mistakes in these forms can lead to account setup delays or compliance issues. Double-check all entries.

4. Understand the Deadlines

IRAs have specific deadlines:

- Contributions for a given tax year can generally be made until the tax filing deadline of the following year, typically April 15th.

- Rollovers need to be completed within 60 days to avoid penalties.

- Required Minimum Distributions (RMDs) for Traditional IRAs start at age 72.

| IRA Type | Key Deadlines |

|---|---|

| Traditional and Roth IRAs | Contributions by April 15, rollovers within 60 days. |

| SEP-IRA | Contributions due by tax filing deadline + extension (October 15). |

| SIMPLE IRA | Contributions due by tax filing deadline, RMDs like Traditional IRAs. |

⏳ Note: Late contributions or missed deadlines can result in fines or tax complications.

5. Keep Records and Seek Help

Organize your IRA paperwork:

- Keep copies of all completed forms.

- Maintain records of your contributions, investments, and any transactions.

- If unsure, consult with a financial advisor or tax professional. They can provide personalized advice and ensure you meet all regulatory requirements.

The process of setting up an IRA involves meticulous attention to detail. Understanding your IRA options, gathering the right documents, accurately completing forms, respecting deadlines, and keeping organized records will ensure your paperwork is processed smoothly. This proactive approach at age 21 sets the foundation for a financially secure retirement. By following these tips, you're not just managing paperwork; you're making informed decisions about your financial future.

What documents do I need to open an IRA at 21?

+

You’ll need a valid ID, your Social Security number or ITIN, details of any existing IRA accounts for rollovers, and beneficiary designations.

Can I contribute to multiple IRAs?

+

Yes, but your total contributions across all your IRAs cannot exceed the annual limit (6,000 in 2022 or 7,000 if you’re over 50).

How long does it take to set up an IRA?

+

It depends on the institution, but usually, once your paperwork is processed and any funds are transferred, you can expect your account to be set up within a few business days.