5 Essential Documents to Close on Your Home

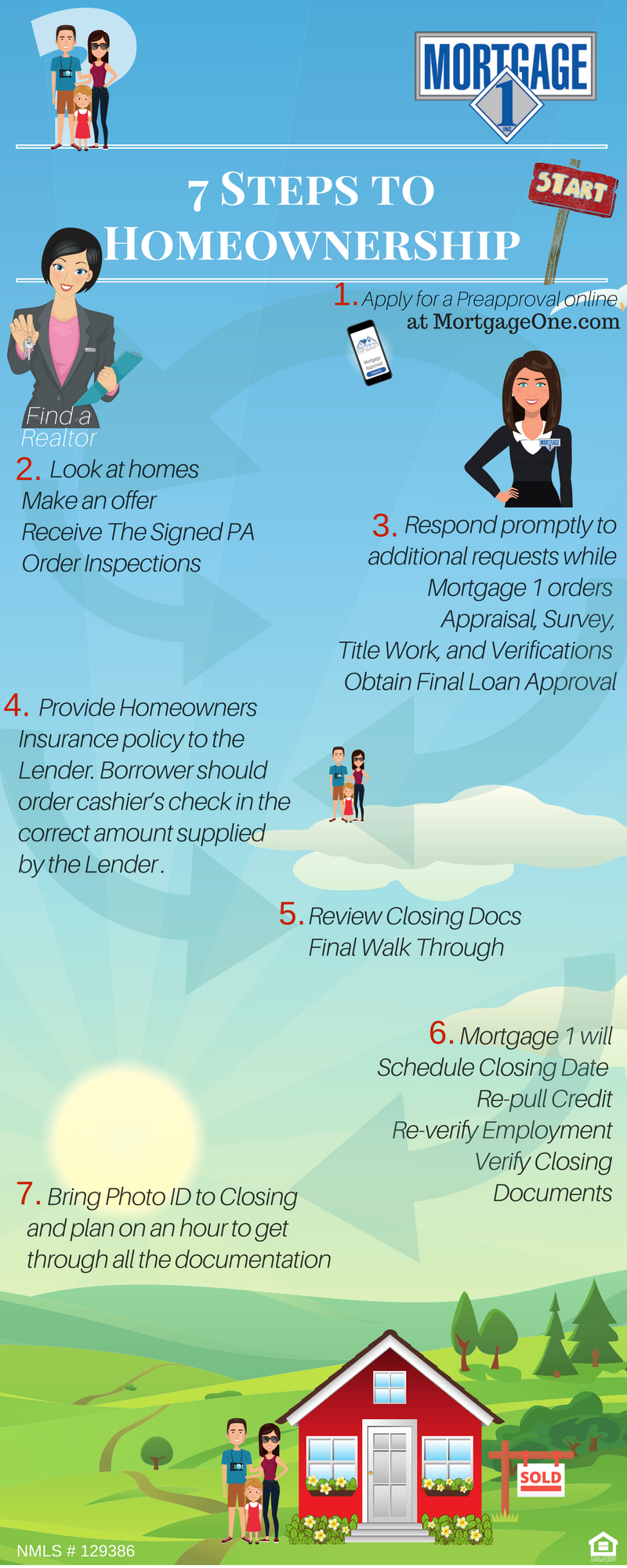

If you're in the process of purchasing a home, understanding the key documents involved in the closing process is crucial. Closing on a house involves a multitude of legal papers that can be daunting at first glance. However, these documents are fundamental to ensuring that the transfer of property is executed smoothly, legally, and in accordance with all parties' interests. Here's a guide to the five essential documents you'll encounter at the closing table.

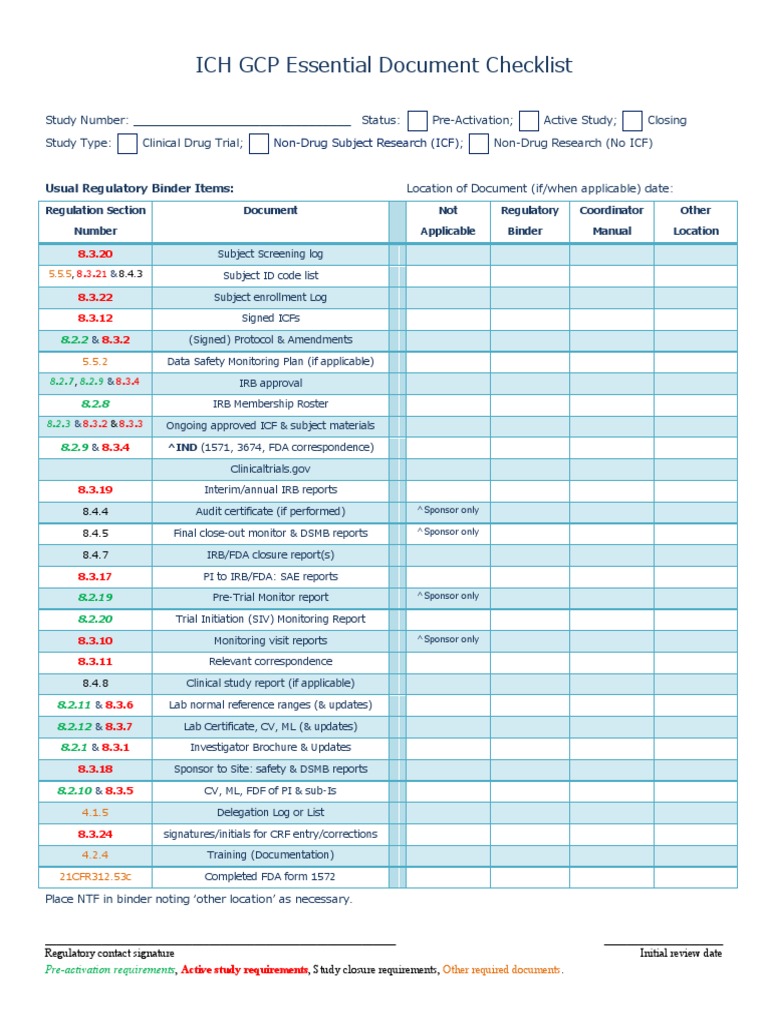

The Closing Disclosure (CD)

The Closing Disclosure is one of the most vital documents you’ll receive before you close on your home. Issued by your lender, it details every aspect of your loan:

- Loan terms: Interest rate, monthly payment, and any prepayment penalties.

- Loan costs: Points, application fees, underwriting fees, etc.

- Other Costs: Homeowner’s insurance, property taxes, prepaid interest.

- Cash to close: A summary of the total amount due from or to the buyer at closing.

💡 Note: The Closing Disclosure must be provided to the borrower at least three business days before closing, allowing time to review and understand the document.

The Promissory Note

The promissory note is a promise to repay the loan and includes:

- Amount of the loan.

- Interest rate.

- How payments are structured (monthly, bi-weekly).

- Penalties for late payments or defaults.

Mortgage or Deed of Trust

This document serves as security for the loan, giving the lender the right to take possession of the property if you fail to repay. Here’s what you’ll find in it:

- Legal description of the property.

- Your obligation to make property insurance payments.

- Any special clauses like escrow requirements.

- Provisions for foreclosure in case of default.

The Deed

The deed is a critical document that transfers ownership from the seller to the buyer. This includes:

- The names of both parties involved.

- Detailed property description.

- The type of ownership (e.g., joint tenancy, tenants in common).

- The legal instrument used to transfer the property.

🔍 Note: Ensure that the deed is correctly filled out and recorded by the local authorities to reflect the change in ownership.

The Title Insurance Policy

This insurance policy protects the buyer and lender against future claims or legal fees from property disputes:

- Owner’s title policy to the buyer.

- Lender’s title policy to the mortgage lender.

- Details on what is covered in the event of a title dispute.

In addition to these five, you might encounter other documents like the Affidavit of Title, which you would need to sign to affirm that there are no liens or encumbrances on the property that you haven't disclosed.

📝 Note: Understanding all the documents involved in closing on a home is essential, but don't hesitate to ask for clarifications or to seek the advice of a real estate attorney.

As the closing date approaches, preparation is key. Review these documents thoroughly, ask questions, and ensure you're comfortable with all terms. By doing so, you safeguard your investment and secure your peace of mind in what is likely one of the largest transactions of your life. Remember, this final step isn't just about signing papers; it's the culmination of your journey towards owning your dream home, ensuring all legal, financial, and property rights are securely transferred.

What happens if I find errors in the Closing Disclosure?

+

If you find errors, contact your lender immediately. Under the TRID rule, you have three business days to review the Closing Disclosure. If there are significant errors, the lender must provide a corrected document and reschedule the closing if necessary.

Do I need an attorney at closing?

+

While not always required, having an attorney review the documents can provide legal protection and peace of mind. Some states mandate an attorney’s presence at closing.

Can I back out of the purchase after signing all documents?

+

Once all documents are signed and funds have exchanged hands, it becomes legally complex and potentially costly to back out. It’s crucial to be certain of your decision before signing.

What are the consequences of not getting title insurance?

+

Without title insurance, you might face financial loss from undiscovered liens or title disputes. It’s generally advisable for protection against potential future claims on the property.

Is it possible to negotiate the terms outlined in the Closing Disclosure?

+

Most terms like interest rates and loan amounts are typically set, but you might negotiate some fees or ask for credits or adjustments to address any discrepancies or issues you find with the document.