Finding Church Nonprofit Paperwork: Who Sells It?

If you're deeply committed to enhancing your church's nonprofit status and compliance, understanding where to find the right paperwork is crucial. This guide will help you navigate through the resources and outlets where you can acquire church nonprofit paperwork.

Why Church Nonprofit Paperwork Matters

Obtaining the correct nonprofit paperwork is more than just a formality; it's a foundational step in ensuring:

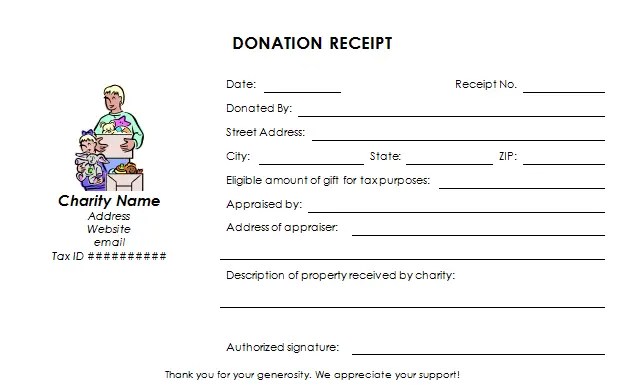

- Tax Exemption: Official documentation grants churches eligibility for tax-exempt status.

- Legal Compliance: It ensures that the church meets all federal, state, and local requirements for operation as a nonprofit entity.

- Funding and Grants: Many grants and funds are available only to registered nonprofits.

Where to Purchase Church Nonprofit Paperwork

1. Nonprofit Resource Centers

Many nonprofit resource centers offer a variety of document kits tailored for churches:

- Urban Nonprofit Legal Services provides affordable forms for initial filings and annual renewals.

- The Foundation Center - Known for its educational resources, also offers form kits for nonprofits.

📝 Note: Verify the authenticity and legitimacy of the resources before purchasing.

2. Online Platforms and Document Providers

Here are some trusted platforms where you can procure your church nonprofit paperwork:

| Platform | Notable Features |

|---|---|

| LegalZoom | User-friendly interface, offers customization, legal support available. |

| FormSwift | Specializes in form creation, e-signatures, easy document management. |

| Nonprofit Documents | Focuses on nonprofits, providing detailed guides along with forms. |

| Rocket Lawyer | Free trial access to forms, legal help, and ongoing support for startups. |

🔍 Note: Be cautious of platforms that might not offer church-specific paperwork or lack legal support.

3. Printing Services

Local printing companies can also provide nonprofit documentation:

- While not a specialized provider, they can print official forms from regulatory bodies.

- Consider local businesses that might give discounts or special rates for religious organizations.

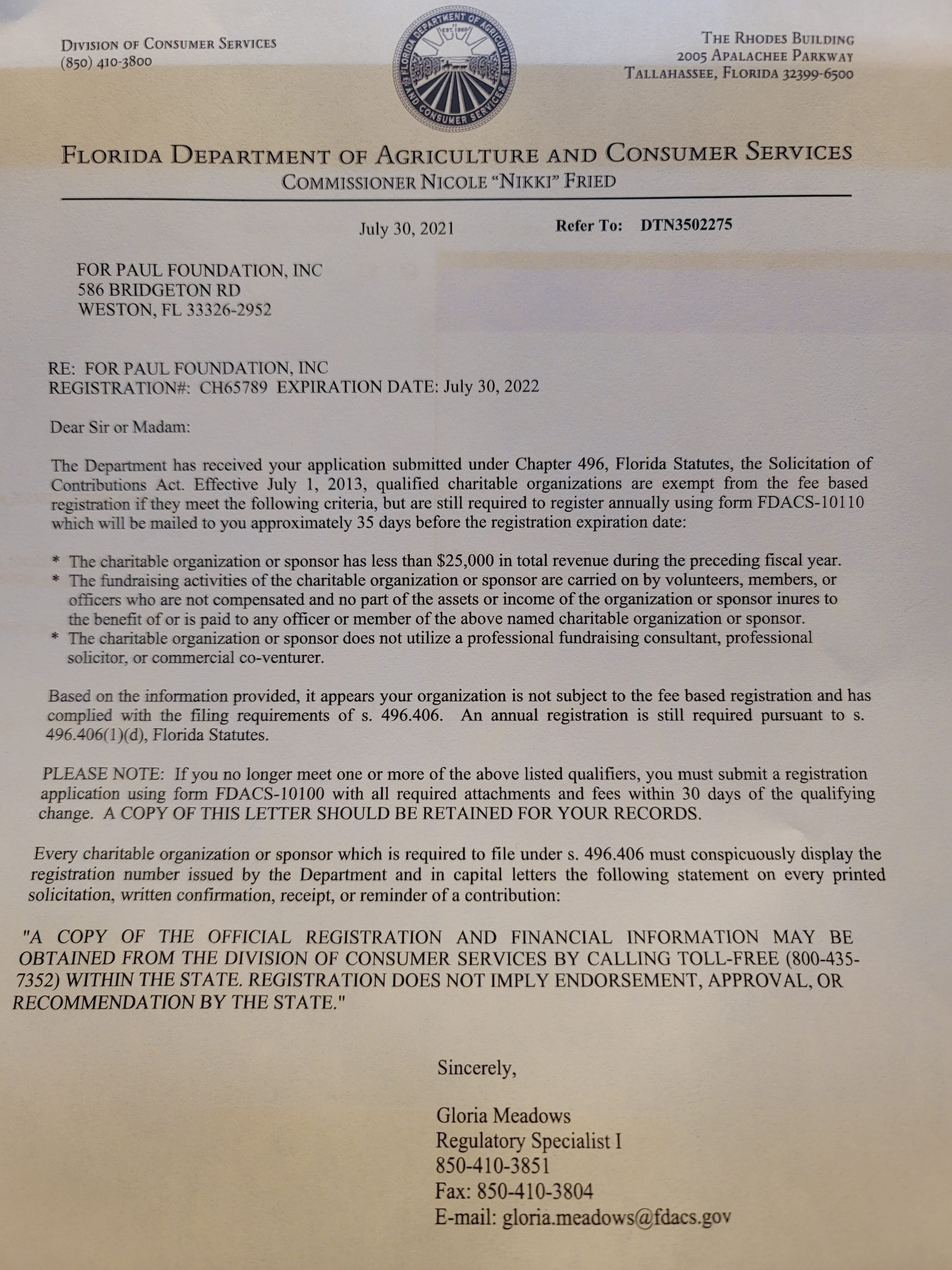

4. Government Resources and Forms

Direct government resources:

- Visit the IRS website for Form 1023 and other essential forms needed for nonprofit status.

- State Attorney General’s office websites often provide forms for registration and annual reports.

Steps to Obtain the Correct Paperwork

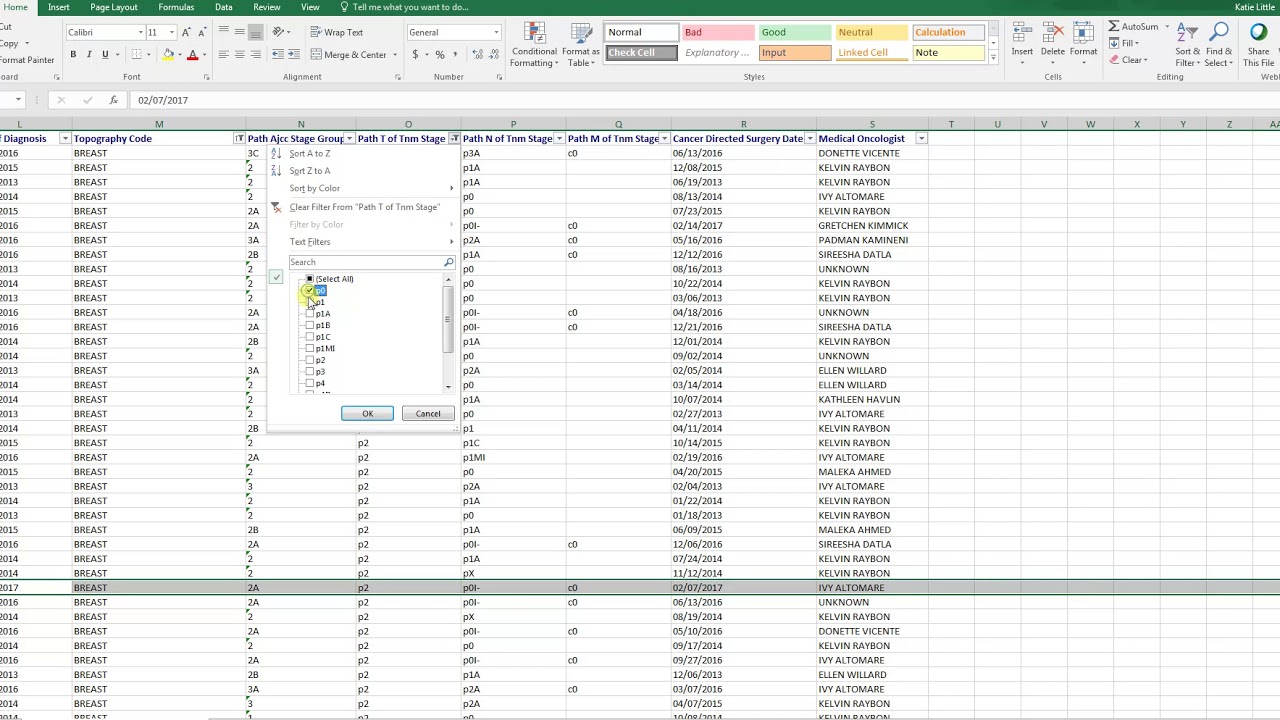

- Determine Your State’s Requirements: Research the specific nonprofit regulations in your state.

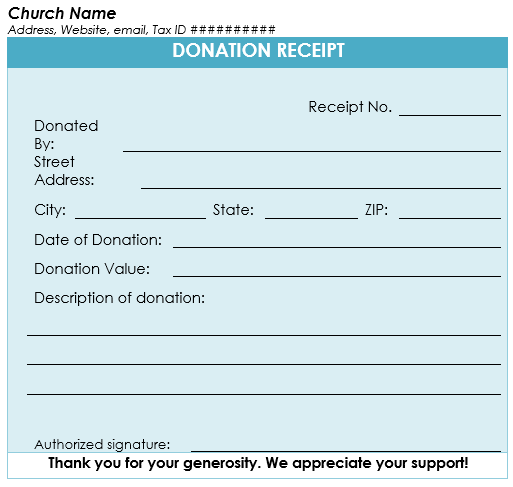

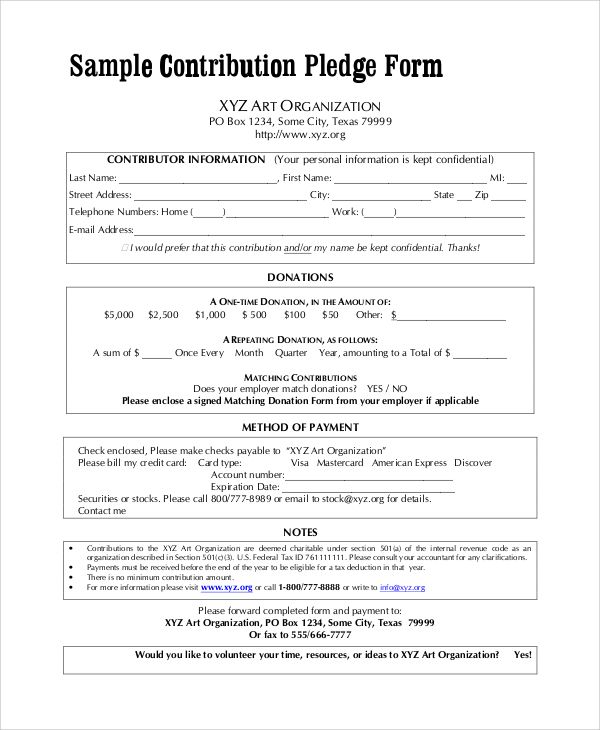

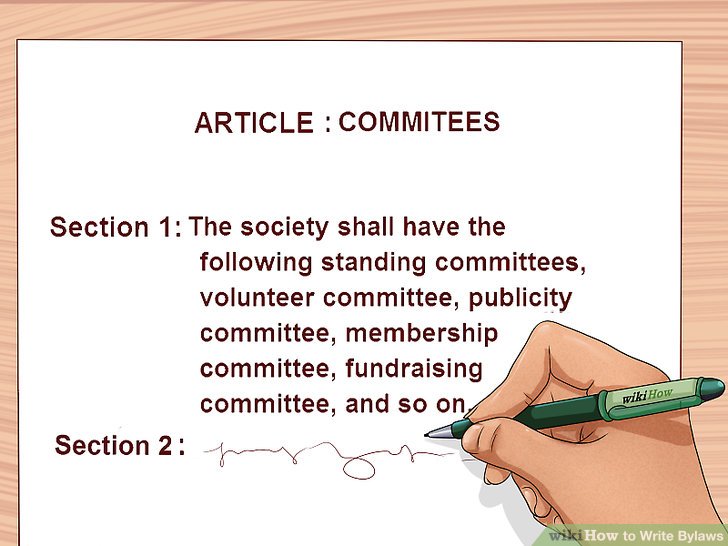

- Gather Essential Documents: Collect necessary organizational documents like articles of incorporation, bylaws, etc.

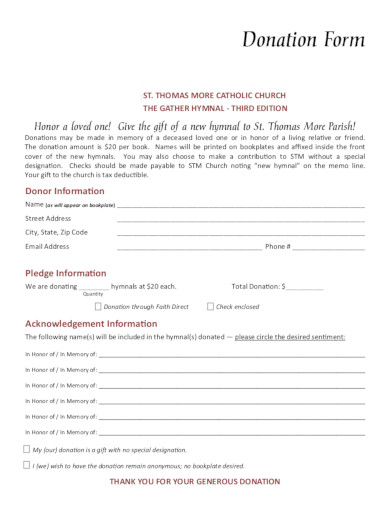

- Purchase or Download Forms: Use the sources mentioned above to acquire the forms.

- Complete and File: Fill out the forms accurately and file them with the appropriate agencies.

- Monitor Status: Keep track of application status and be prepared for any follow-up requests.

Embarking on this journey to obtain church nonprofit paperwork ensures your religious organization is well-grounded in compliance and legal recognition. Whether you opt for digital platforms, specialized providers, or local services, remember the importance of authenticity and proper documentation. This not only facilitates the smooth operation of your church but also paves the way for financial support, tax benefits, and community outreach.

What is the purpose of getting nonprofit paperwork for a church?

+

Nonprofit paperwork is essential for a church to achieve legal recognition as a tax-exempt entity, enabling it to receive donations, grants, and operate without certain financial obligations.

Can we just use any generic nonprofit forms for church incorporation?

+

While some forms might be similar, it’s important to use forms tailored to churches to ensure all specific requirements are met for both federal and state recognition.

What if we can’t afford the legal fees associated with getting church nonprofit paperwork?

+

Look for nonprofit resource centers or legal aid societies that offer free or low-cost services for churches and religious organizations.