3 Ways to Fill Out Oregon PERS Paperwork Easily

One of the most crucial steps in managing your retirement benefits in Oregon is filling out the Oregon Public Employees Retirement System (PERS) paperwork correctly. Whether you're just starting your career, nearing retirement, or transitioning between different roles in public service, understanding how to navigate PERS paperwork can save you time, reduce stress, and ensure that you receive the benefits you've worked for. Here are three straightforward strategies to fill out your Oregon PERS paperwork efficiently.

1. Gather All Necessary Documents in Advance

Before you even start filling out the paperwork, it’s essential to have all your documents ready:

- Your employment history records, including dates of employment and any breaks in service.

- Information on previous retirement contributions or purchases.

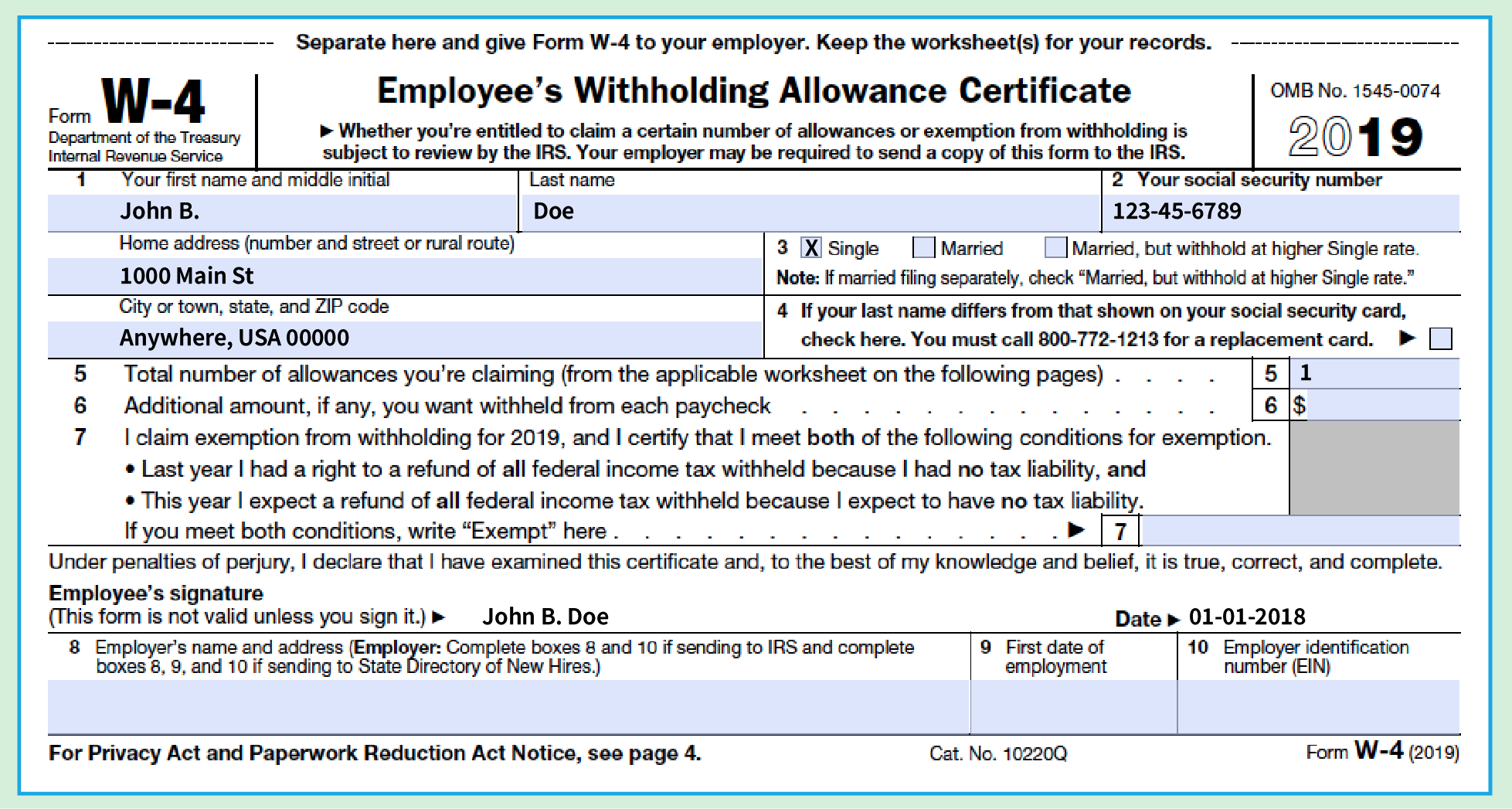

- Social Security numbers for you and, if applicable, for your beneficiary or survivors.

- Details of your marital status and any divorce documents that might impact your benefits.

- Information about any deferred compensation plans or other retirement accounts you might have.

🏆 Note: Having all the documents at hand will streamline the process, making it much easier to avoid delays caused by missing information.

2. Understand Your Options

Oregon PERS provides several options for retirement benefits:

- Full retirement - based on full years of service.

- Early retirement - with a possible reduction in benefits.

- Service retirement - for employees who meet specific service and age requirements.

- Disability retirement - if your ability to work has been compromised by disability.

Each option has its implications on your monthly benefits:

| Retirement Type | Age Requirement | Service Requirement | Benefit Adjustments |

|---|---|---|---|

| Full | 65 years or older | Varies | Full benefit amount |

| Early | 55 years or older | 25 years of service | Reduced by 4% per year under 65 |

| Service | 50-54 years with 30 years service | 30 years | 100% benefit until age 62, then reduced |

| Disability | Any age | 5 years | Based on service credit |

💼 Note: Make sure to review these options with your financial advisor or a PERS representative to understand the long-term implications for your financial situation.

3. Use Resources and Online Tools

Leveraging resources can greatly simplify the process:

- PERS Website - It provides comprehensive information, including forms, instructions, and benefit calculators.

- Workshops and Seminars - PERS often offers educational sessions for members to understand their benefits better.

- Employer’s HR Department - They can provide tailored guidance on how to complete the forms.

- Online Communities - Engaging with others who have completed the process can provide practical tips and insights.

📖 Note: Utilize these resources not only to fill out your paperwork but also to stay updated on any changes to PERS policy or benefits.

In summary, managing your Oregon PERS paperwork doesn't have to be an overwhelming task. By gathering necessary documents, understanding your options, and utilizing the available resources, you can navigate the process efficiently. Ensuring you've filled out everything correctly will lead to a smoother transition into retirement or your next career step, providing peace of mind knowing your retirement benefits are secure.

What if I’m missing some documents when filling out PERS paperwork?

+

If you’re missing some documents, you can submit what you have, and continue to gather the remaining documents. PERS will typically allow you to provide missing information later, though this might delay the processing of your application. Contact PERS directly for guidance.

Can I change my retirement option after I’ve submitted my paperwork?

+

Yes, you can change your retirement option, but it usually requires PERS to approve the change, and there might be a waiting period before the new option takes effect. Contact PERS for specific rules regarding changing your election.

How do I know which retirement option is best for me?

+

Each individual’s situation is unique. Factors like your health, expected longevity, financial situation, and retirement goals should be considered. Consulting with a financial advisor or a PERS representative can provide personalized advice on the best retirement option for your circumstances.