Which Deed Paperwork Should You Use? Simple Guide.

If you're in the process of buying, selling, or transferring property, understanding the different types of deed paperwork can be a bit overwhelming. The choice of deed can significantly impact the rights and responsibilities associated with the property. This guide will walk you through the most common types of deeds, helping you determine which one is appropriate for your situation.

Types of Deeds

- General Warranty Deed

- Special Warranty Deed

- Quitclaim Deed

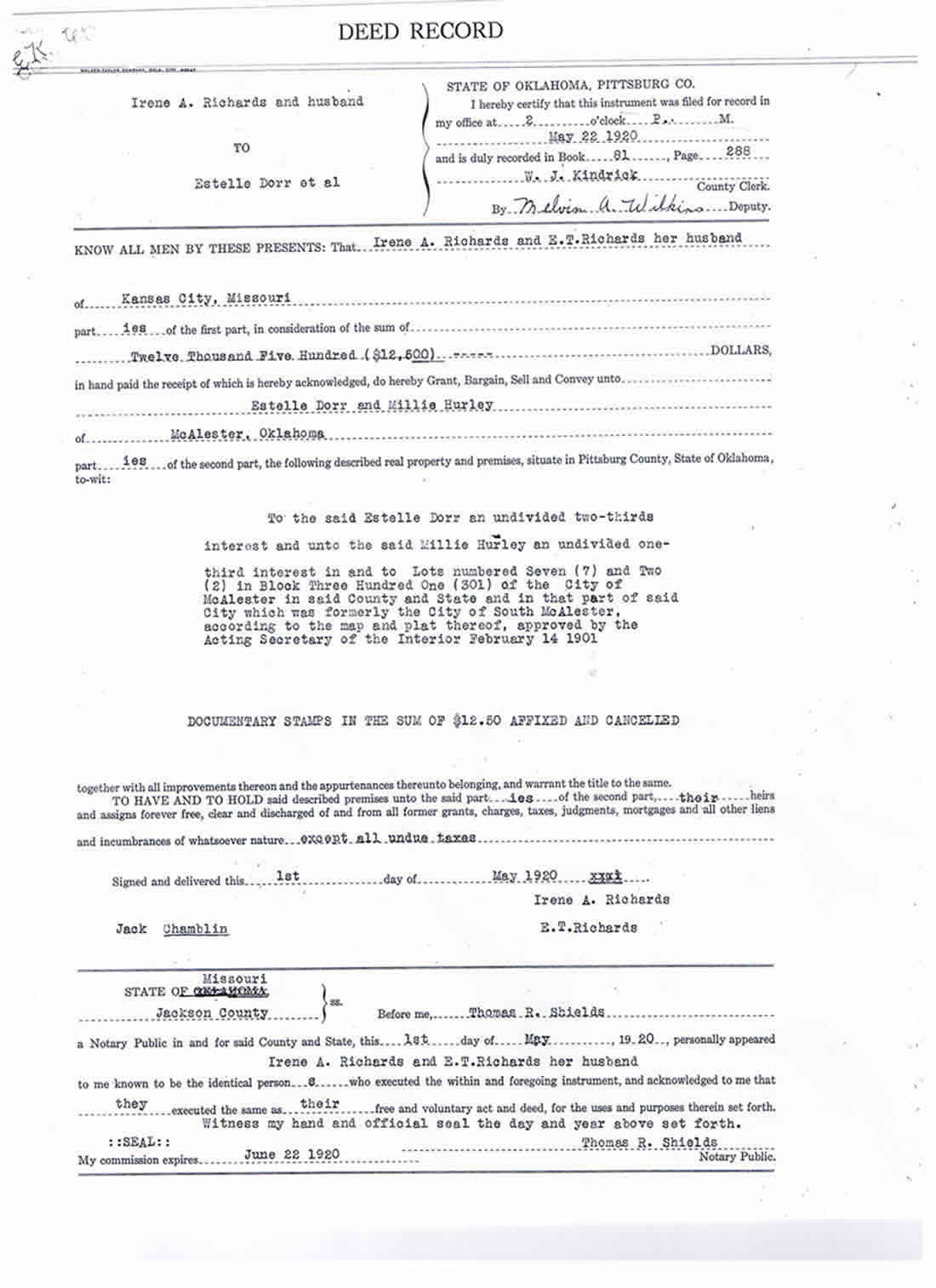

- Bargain and Sale Deed

General Warranty Deed

A General Warranty Deed is often considered the “gold standard” of deeds. Here’s what you need to know:

- Full Coverage: The grantor (seller) promises to defend the title against anyone who might challenge it, not just during their ownership but all the way back to its origin.

- Covenants: It includes six covenants or promises:

- Covenant of Seisin: Ensures the grantor has the legal right to convey the title.

- Covenant Against Encumbrances: The property is free from liens or encumbrances except as noted in the deed.

- Covenant of Quiet Enjoyment: Guarantees that the buyer will not be disturbed in their use of the property.

- Covenant of Further Assurance: The grantor will do whatever else is necessary to ensure the title is good.

- Covenant of Warranty Forever: The grantor will permanently defend the title against all claims.

- Covenant to Defend Title: Promises to legally protect against any title claims.

- Usage: Typically used in standard home sales where the seller wants to provide the most assurance about the title.

🔑 Note: General Warranty Deeds offer the highest protection for the buyer because of the extensive warranties provided by the seller.

Special Warranty Deed

A Special Warranty Deed offers less protection than a General Warranty Deed. Here are its key features:

- Limited Warranty: The grantor only guarantees that no title defects occurred during their ownership.

- No Claims from Past: Unlike a General Warranty, it does not assure against issues that might have arisen before the grantor owned the property.

- Usage: Common in foreclosure sales or when banks or estate executors sell property, as they can only guarantee what happened during their ownership.

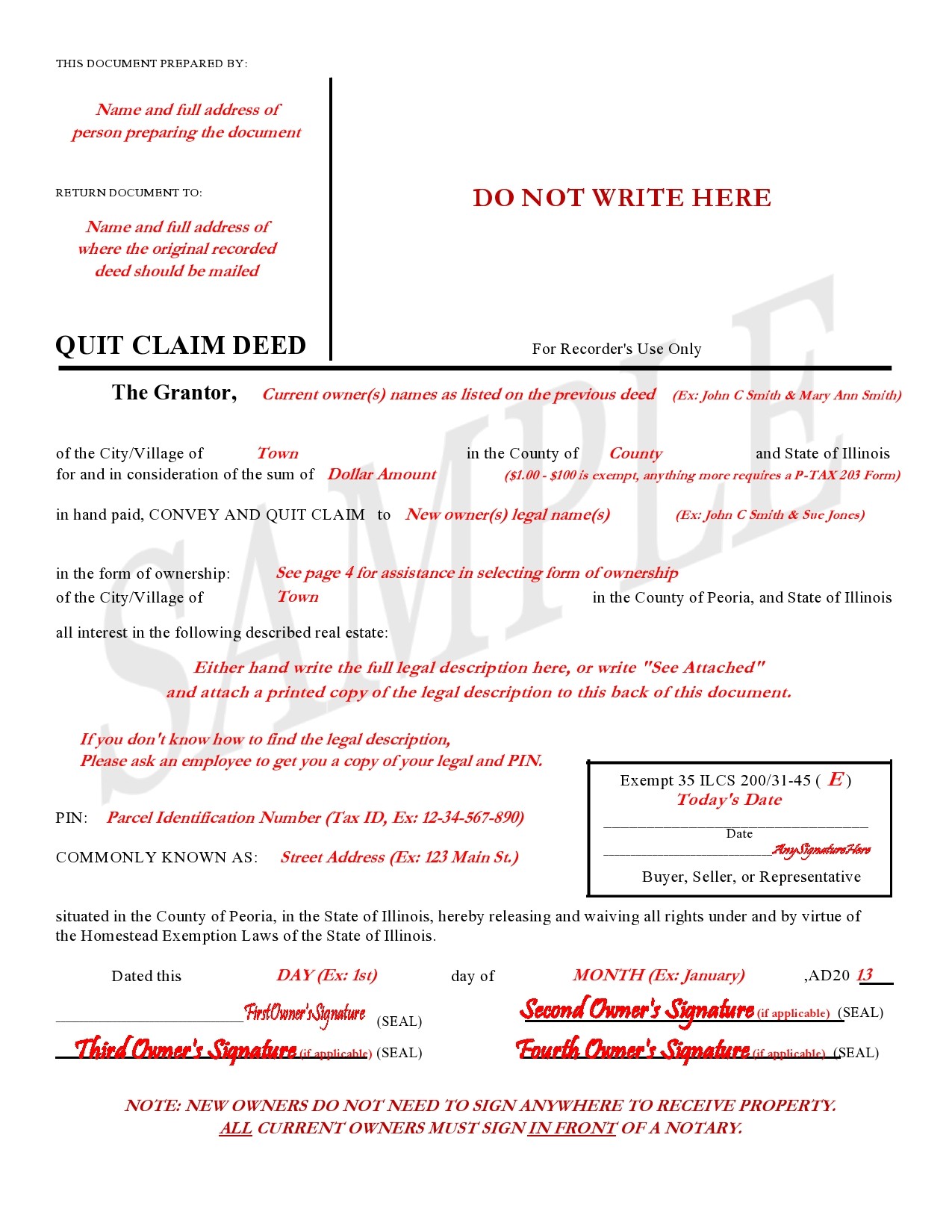

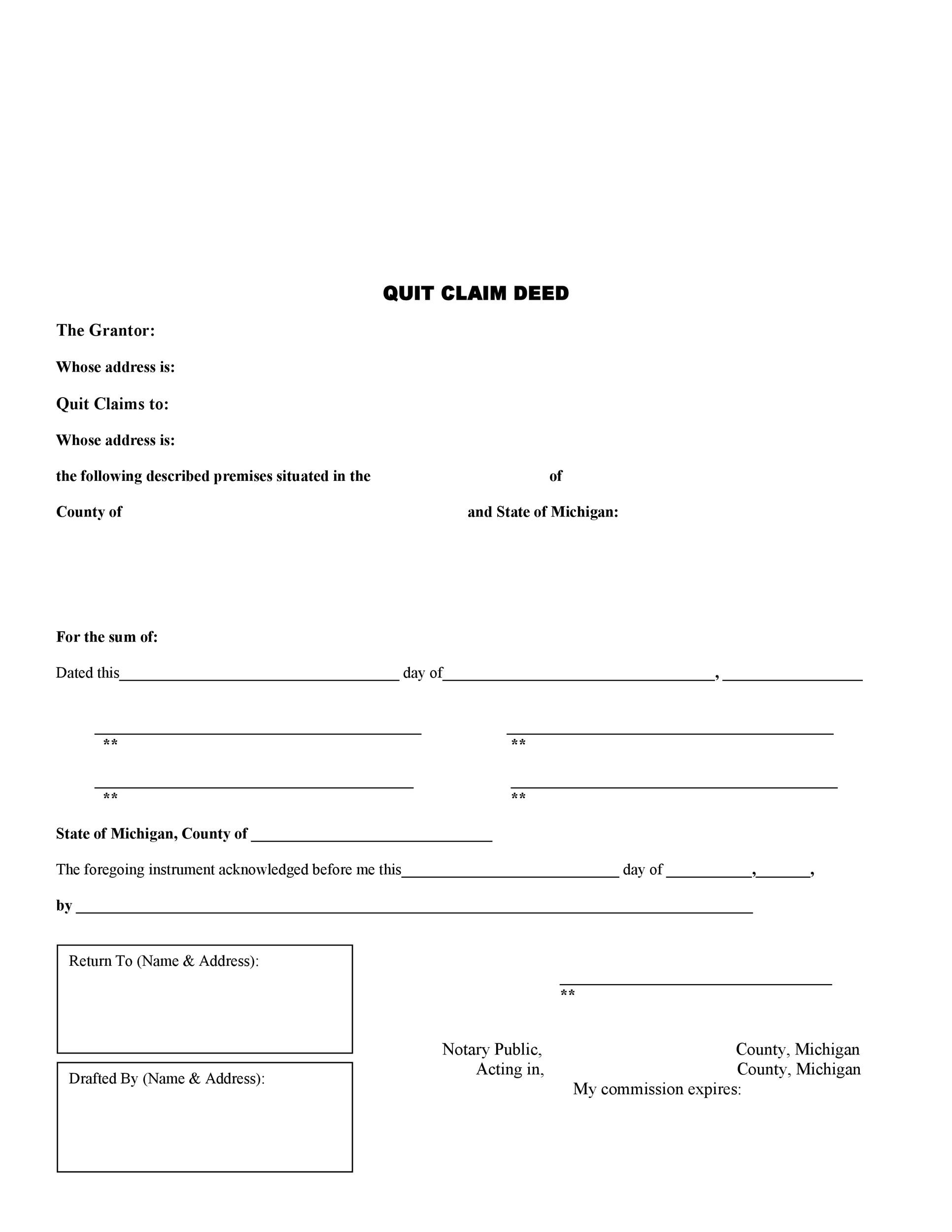

Quitclaim Deed

A Quitclaim Deed is the simplest form of deed and provides the least protection:

- No Warranty: It does not guarantee that the grantor actually owns or has the right to transfer the property.

- Transfer Only: It only conveys whatever interest, if any, the grantor has in the property.

- Usage: Used for transferring property between family members, adding or removing a name from a title, or resolving boundary disputes.

⚠️ Note: With a Quitclaim Deed, buyers assume all risks associated with the property’s title.

Bargain and Sale Deed

A Bargain and Sale Deed is similar to a Quitclaim Deed but with some variations:

- Implied Warranty: While there’s no explicit warranty, there’s an implication that the grantor held title.

- No Claim to Warranties: Like a Quitclaim, it provides minimal protection regarding the condition of the title.

- Usage: Often used in tax sales, foreclosure auctions, or when an executor is settling an estate.

To wrap up, understanding the different types of deeds is crucial when dealing with real estate transactions. Each type of deed offers varying degrees of protection and legal assurances:

- The General Warranty Deed provides the strongest protection for the buyer.

- The Special Warranty Deed offers protection only during the period of the grantor's ownership.

- Quitclaim Deeds are best for transfers where title issues aren't a significant concern.

- Bargain and Sale Deeds are for when parties are aware of potential title issues but still want to proceed.

The choice of which deed to use should align with the transaction's nature, the level of trust between parties, and the degree of protection desired. Always consult with a real estate attorney to ensure you select the right deed for your specific needs.

What is the difference between a Warranty Deed and a Quitclaim Deed?

+

A Warranty Deed (specifically a General Warranty Deed) guarantees that the seller owns the property free and clear of liens, claims, and encumbrances, and will defend the title against any claims. In contrast, a Quitclaim Deed transfers any interest the grantor has without any warranties, offering no guarantees about the status of the title.

Can I change my mind after signing a Quitclaim Deed?

+

Once a Quitclaim Deed is recorded, it’s legally binding. However, if all parties agree, you might be able to reverse the transaction, but this would typically require drafting a new deed to undo the transfer.

When should I use a Bargain and Sale Deed?

+

This type of deed is commonly used in situations where the seller might not have full knowledge of the title’s history, like in foreclosure or estate sales, or when there’s a transfer of property without a full price, but some assurance on the title is still desired.