Where To Send Ftc Credit Paperwork

In the world of federal trade regulation, one of the most confusing processes is often filing FTC credit paperwork. Knowing where to send these documents can prevent delays, ensure compliance, and help businesses and individuals address any credit-related disputes or issues. Here’s a comprehensive guide to navigating the FTC credit paperwork submission process:

Understanding FTC Credit Paperwork

Before we dive into where to send the FTC credit paperwork, it’s important to understand what these documents entail:

Credit Reports: Companies might file disputes over inaccuracies in credit reports or credit repair disputes.

Debt Collection Practices: Complaints or disputes related to aggressive or unfair debt collection practices.

Credit Repair Organizations: Individuals might file complaints if they believe a credit repair company has not delivered on its promises.

Identity Theft: Reports related to fraudulent credit activity on one’s account due to identity theft.

When filing such paperwork, proper documentation and adherence to guidelines are crucial. Here are some steps to follow:

Steps to Properly File FTC Credit Paperwork

Identify the Correct Forms:

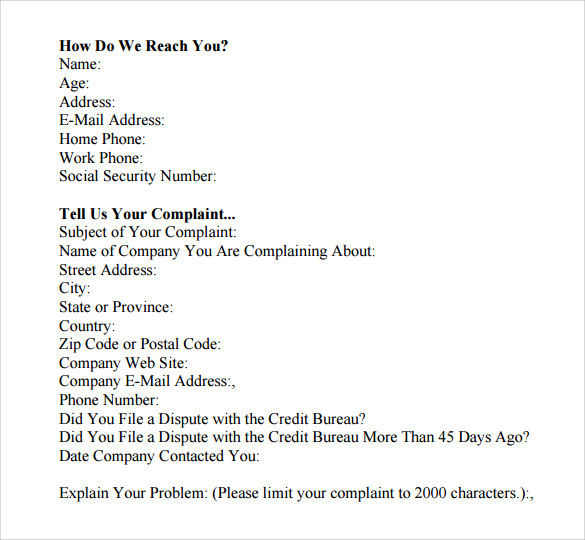

- Ensure you use the correct forms for your specific case. The FTC provides different forms for different issues like identity theft affidavits, complaint forms, etc.

Gather Necessary Documentation:

- Collect all relevant documents like credit reports, collection notices, agreements, and evidence supporting your claim or dispute.

Complete the Forms:

- Fill out the forms accurately. Any missing or incorrect information can delay the processing of your paperwork.

Where to Send FTC Credit Paperwork

The place where you need to send your FTC credit paperwork can vary depending on the type of issue:

- Identity Theft: Use the Identity Theft Report to file with the FTC. You can do this online, or if you need to submit documents, you can mail them to:

Identity Theft Clearinghouse Federal Trade Commission 600 Pennsylvania Avenue, NW Washington, DC 20580

🔍 Note: Mailing the document is not necessary if you can file it electronically. However, physical documentation might be required for severe cases.

- FCRA Disputes: For disputes under the Fair Credit Reporting Act (FCRA), you might need to send your dispute to the credit bureaus directly, but you can also inform the FTC. You can either: - Send it to the credit reporting agency or - Use the FTC's complaint assistant online or contact their Consumer Response Center at 877-FTC-HELP (877-382-4357).

- Credit Repair Organizations Act (CROA): If you're filing against a credit repair organization, submit your complaint or dispute through the FTC’s complaint assistant, or mail to:

Federal Trade Commission Consumer Response Center 600 Pennsylvania Avenue, NW Washington, DC 20580

- Debt Collection Practices: Disputes or complaints can be sent directly to the FTC:

Federal Trade Commission Consumer Response Center 600 Pennsylvania Avenue, NW Washington, DC 20580

Tips for Accurate Filing

Use Certified Mail: When mailing documents, use certified mail with return receipt requested for important documents to ensure delivery.

Keep Copies: Always keep copies of everything you submit for your records.

Track Your Complaint: Use the FTC’s complaint assistant to track the progress of your complaint if possible.

Follow Up: If you do not hear back within a reasonable time frame (30-45 days), follow up with the FTC or relevant bureau.

What to Expect After Filing

After you’ve sent or filed your FTC credit paperwork:

FTC Review: The FTC will review your complaint or dispute to determine if further action is needed.

Bureau Response: If your complaint is related to credit bureaus or a specific company, they might respond directly to you.

Investigation: In some cases, the FTC might open an investigation or work with other agencies to resolve the issue.

Feedback: Sometimes, the FTC will provide feedback or resolution options. They might advise you to contact a lawyer or provide mediation services.

In wrapping up, ensuring you send your FTC credit paperwork to the right place can significantly expedite the resolution process. By following these steps and guidelines, you’re putting yourself in the best position to deal with any credit-related disputes or issues efficiently and effectively.

💡 Note: Regularly check your credit reports and keep your documents organized to make any future filings easier.

Can I file FTC credit paperwork online?

+

Yes, the FTC provides an online complaint assistant for many types of issues, including identity theft and disputes with credit repair organizations or debt collectors.

What if I don’t receive a response after filing my paperwork?

+

If you don’t receive any feedback within 30-45 days, it’s advisable to follow up with the FTC or the respective bureau or company involved.

Do I need to send my documents by certified mail?

+

While it’s not always necessary, using certified mail can provide proof of delivery, which is beneficial in case of any disputes or follow-ups.