Easily Locate Your 501c Number on Tax Documents

In the world of nonprofit organizations, understanding and keeping track of essential identifiers is crucial. One such important piece of information is the 501c number, which is often required for various legal, financial, and operational purposes. This comprehensive guide will walk you through the process of finding your organization's 501c number on different tax documents, ensuring you can swiftly locate and use this vital information whenever necessary.

Why Do You Need Your 501c Number?

Before delving into where and how to find your 501c number, let’s briefly explore why this number is significant:

- Filing Tax Returns: Your 501c number is necessary when filing Form 990, the annual information return required by the IRS for tax-exempt organizations.

- Grants and Funding: Many grant applications require this number to confirm your nonprofit status.

- Legal Compliance: It helps in proving your tax-exempt status during audits or legal challenges.

- Banking and Financial Transactions: Financial institutions might request your 501c number when setting up accounts or conducting transactions.

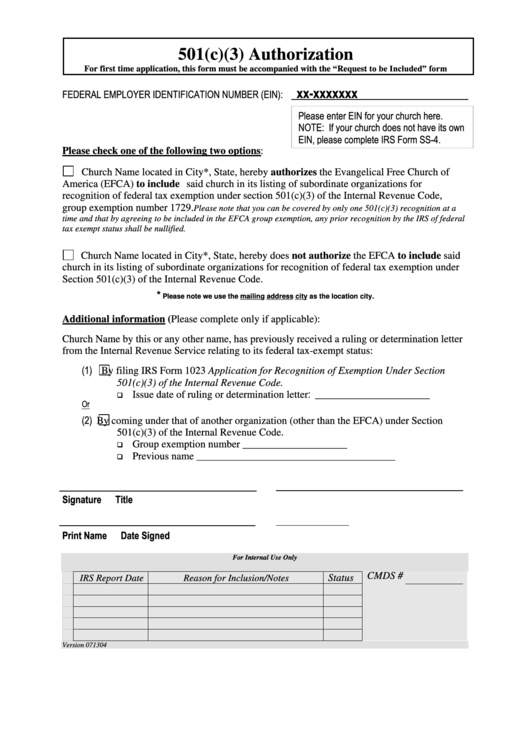

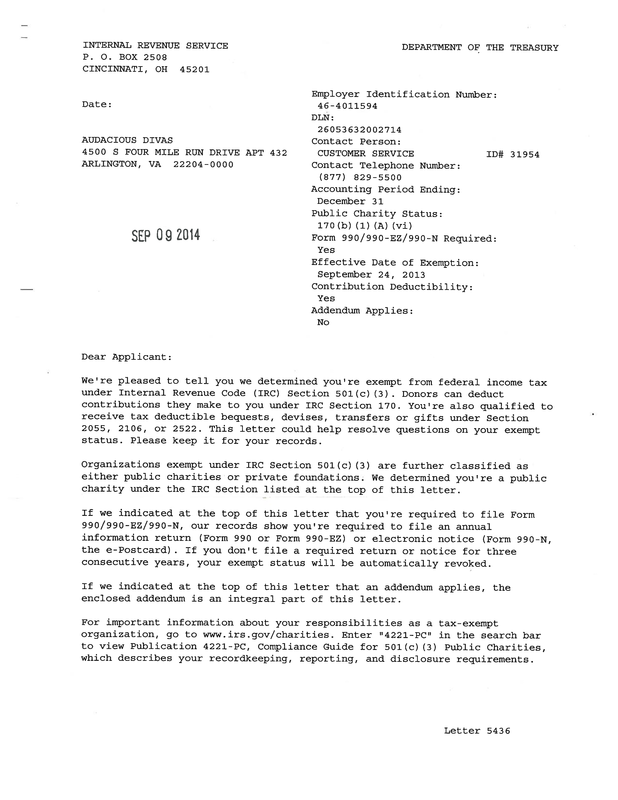

Finding Your 501c Number on the IRS Determination Letter

Your journey to find your 501c number often starts with the document that officially recognized your organization’s tax-exempt status:

- Locate Your Determination Letter: This is the letter issued by the IRS, determining your organization as a 501© entity. Look in your organization’s records, legal documents, or with the person responsible for financial and legal matters.

- Search for Key Information: The determination letter will include several critical details:

- Employer Identification Number (EIN): Not to be confused with your 501c number, but often mentioned.

- 501c Number: This number is typically found within the body of the letter, usually near the approval paragraph.

Checking Your Form 990 or 990-EZ

Another common place where you might find your 501c number is on your organization’s tax returns:

- Access the Latest Filed Form: You’ll need to have access to the most recent Form 990 or Form 990-EZ.

- Look for Part I: This section of the form often contains details about the organization, including:

- Employer Identification Number (EIN)

- Group Exemption Number, if applicable (similar to a 501c number)

- Ensure to Verify: If you find something that looks like a 501c number, double-check with other documents or the IRS website to confirm its accuracy.

💡 Note: While the EIN and Group Exemption Number are different from the 501c number, understanding their distinction can help avoid confusion when searching for your organization's 501c number.

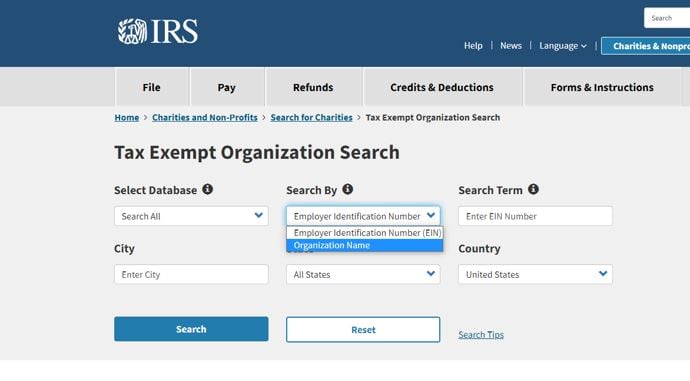

Locating the Number Through the IRS Website

The IRS website provides a valuable resource for nonprofit organizations:

- Use the Tax Exempt Organization Search (TEOS): Visit IRS’s Tax Exempt Organization Search.

- Enter your organization’s EIN or legal name to locate its public records.

- Verify the Details: In the search results, you’ll find information like the organization’s name, EIN, and its tax-exempt status under 501©(number). This might not explicitly list the 501c number, but it confirms your exemption status.

Additional Resources and Steps

If you still cannot locate your 501c number through these primary sources, consider the following alternatives:

- Contacting the IRS: If your organization has lost its determination letter, contact the IRS directly. They can provide a replacement or confirm your status.

- Reviewing Correspondence: Any correspondence from the IRS regarding your exemption status might include or reference your 501c number.

- State Registration: While state registrations might not provide the exact 501c number, they will confirm your nonprofit status, which can be useful when contacting the IRS or updating your records.

After exploring these steps, you should have successfully located your organization's 501c number, a key piece of information for maintaining compliance, securing funding, and managing organizational activities. Remember, this number is not just a bureaucratic detail but a confirmation of your organization's commitment to fulfilling its mission within the legal framework provided.

As we've navigated through the various documents and resources where you can find your 501c number, keep in mind that maintaining accurate records and being aware of your organization's legal identifiers are vital for its smooth operation. By knowing where to look, you can quickly access this critical information, ensuring that your organization remains compliant and eligible for the benefits that come with 501(c) status.

Is the EIN the same as the 501c number?

+

No, the Employer Identification Number (EIN) is different from your 501c number. The EIN is a unique 9-digit number issued by the IRS to identify your organization for tax purposes, while the 501c number confirms your tax-exempt status under a specific section of the tax code.

Can I lose my 501c status if I can’t find my 501c number?

+

Not directly, but failing to maintain records or misrepresenting your tax-exempt status can lead to issues. If you’ve lost the number, contact the IRS to clarify your status and update your records.

What should I do if I’ve lost all documents?

+

Contact the IRS directly. They can issue a replacement determination letter or provide information on your organization’s tax-exempt status. Also, review any past correspondence or consult with your legal or financial advisors.